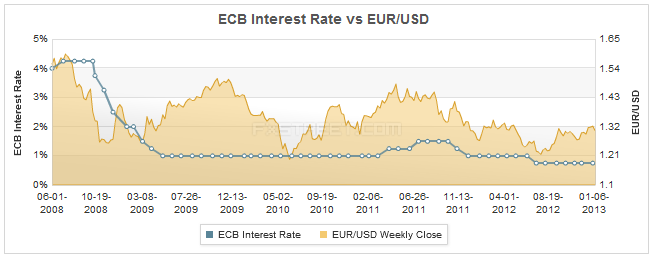

The general expectation for ECB's January monetary policy meeting is that of no change. Despite the fact that the central bank signalized its readiness to perform further rate cuts, "they know as well as everyone else in the market that we can’t carry on with such low interest rates for ever," as Steve Ruffley suggests. Other contributors point out that the OMT program has brought relief to the markets, that peripheral countries' bond yields have dropped and that "fundamentals are showing signs of stabilization in major countries like France and Germany," in the words of Richard C. Lee, and that all of these factors significantly reduce the need for a cut.

Only Yohay Elam sees a "50/50 chance that the ECB will cut the main interest rate from 0.75% to 0.50%," while Alberto Muñoz considers such an action possible in the first quarter of 2013. None of the experts believe however that the ECB would be willing to push the deposit rate into negative territory (an option considered by the Governing Council last month) "as the fragile confidence in the EU will likely be hammered with such move," Valeria Bednarik emphasizes.

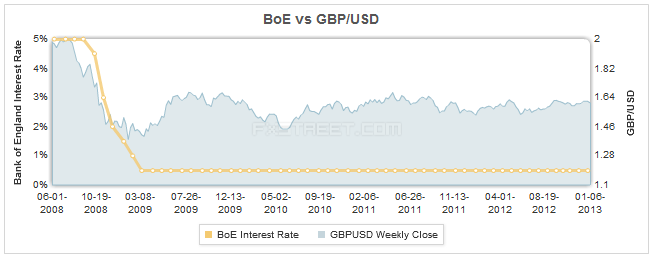

As far as the Bank of England is concerned, the economists agree that its next monetary policy meeting will be uneventful. Nevertheless, they offer some predictions for the upcoming months and years. The majority believe that the central bank will continue evaluating the impact of the Funding for Lending scheme and that it will first announce further QE rather than another rate cut if inflation starts to pose a problem.

An interest rate hike on the other hand "still looks a long way off," as Alberto Munoz stresses, adding that market consensus points to very remote dates such as January 2017 for the first rise and September 2018 for the second. Several of the other analysts polled for the forecast report point however to an earlier date, such as the beginning of 2015. We should bear in mind however, as Richar C.Lee puts it, that "a long term outlook is always subject to change, especially with rather mixed economic signals that are surfacing in the UK."

The BoE and the ECB will announce their monetary policy decisions on January 10 at 12 and 12:45 GMT respectively. Below you will find full commentaries of the contributing economists.

Richard C. Lee - Forex Analyst at FXstreet.com:

ECB:

ECB:"European Central Bank policymakers are unlikely at this point to cut rates on the simple fact that fundamentals are showing signs of stabilization in major countries like France and Germany. However, if anything were to happen, we would have to wait till at least March. With that said, it’s unlikely that the ECB will elect to cut rates in to negative territory. Bond yields of troubled periphery nations are already falling, reducing the necessity of any aggressive monetary measures in the near term."

BoE:

"A long term outlook is always subject to change, especially with rather mixed economic signals that are surfacing in the UK. Although it is always a likelihood that rates will be reduced in the future, at this point, it’s not likely as the Bank of England will still be scrutinizing the results from their Funding for Lending program and will resort to additional asset purchases before applying rate reductions."

Yohay Elam - Analyst at Forex Crunch:

ECB:

ECB:"There is more than 50/50 chance that the ECB will cut the main interest rate from 0.75% to 0.50%. With PMIs pointing to more weakness in manufacturing and with a weak holiday season, the ground is ready for the ECB to act. In addition, inflation is almost at the 2% target, and is forecast to slide. Mario Draghi will probably refrain from pushing the deposit rate into negative territory and leave this policy option to a future deterioration. It's important to note that bond yields of Spain and Italy are significantly lower now. The negative rate ammunition could be kept dry for another round of the crisis. If the ECB does announce a negative deposit rate, this would be another step in the 'currency wars' and the euro could tumble down."

BoE:

"The BoE isn't likely to cut the interest rate in the near future nor in the second half of 2014. When Carney takes control in mid 2013, we could see a more hawkish approach, especially if inflation picks up once again. A rate hike could be seen in early 2014. For the upcoming meeting, no change in policy is expected. The economic situation in the UK isn't good, with a danger of a "triple dip" recession. However, not all data is bad, and the BOE could wait for another month before announcing new QE."

Steve Ruffley - Owner of Tradermaker.com:

ECB:

ECB:"Although the ECB continue to hint at further reductions in the key interest rate they know as well as everyone else in the market that we can’t carry on with such low interest rates for ever. Inflation in Europe is above target both the CPI and PPI figures continue to indicate that inflation is far from being under control. With this in mind I feel it is very unlikely that anything will happen in the January meeting and there will be no change to the interest rate. The low interest rates over the last few years to an extent has had the desired effect of helping people via lower mortgage repayments and lower debt costs. This has increased spending power but has certainly not let to the much needed growth the economy is currently looking for.

Although there is some semblance of stability in the US and the Euro Zone there are still more risk on the down side. We have seen a strong end to the year with regards to NFP figures, but as I predicted in previous reports we dipped below the key 1400 support mark in the S&P and looks like there is more downside pressure to come. I think that the ECB will stand firm and I certainly don’t see the ECB cutting the deposit rate into negative territory and time soon. Although the ECB have good intentions they are a long way from being the ‘united nations’ of Europe, for me they have build their house on sand and low interest rates are not the answer to the underlying problems in Europe. Interest rates will rise and I feel it will happen a lot sooner than people may want to realise."

BoE:

"As with the ECB the BOE are in the same situation with regards to interest rates and the inter bank rate. The UK seems to be faring better than the Euro Zone on its road to recovery and although there is still plenty of hard times ahead I feel the worst of it is over. We are a nation of survivors, and unlike countries like Spain and Portugal we have seen many ups and downs in our economy and always come out the other side not always stronger but certainly wiser. I would think that with Meryvn King due step aside in the in the not too distant future that nothing too radical with happen with regards to interest rates or the inter bank lending rate. I very much doubt that it will get into negative territory and think if that was to happen that would not the BOE have certainly admitted defeat! However stranger things have happened. I think we have seen an end to cuts but still remain confident rates will not rise until at the very least 2015 but more realistic the 3rd quarter of 2014. The problem therein lies that when rates inevitably do go up how quickly and how high will they go?"

Clemente De Lucia - Economist at BNP Paribas:

ECB:

ECB:"The success of the OMT has reduced the need of an interest rate cut. The ECB Governing Council seems in a wait and see mood. Our call, therefore, is for a status quo at next week ECB meeting. However, should the economic environment deteriorate significantly, the ECB might decide to cut the refi rate by another 25bp, easing funding conditions for banks that are having trouble raising market funds.

A cut in the deposit facility rate (DFR, currently at 0%) is less likely. Although cutting DFR would have a bigger impact on market rates, a negative DFR could fuel tensions in the banking sector, posing a threat to the profitability of banks, among other factors. In all likelihood, the ECB does not want to increase costs for the banking sector, particularly for banks mainly from the core countries (and Germany, in particular), which by far have been the biggest users of the deposit facility. In addition a negative interest rate on the deposit facility might trigger early repayments of the two special 3-year LTROs (in Q1 2013 banks have this opportunity), reducing, consequently, the excess liquidity in the money market. A sharp reduction in excess liquidity might tighten money market conditions (the Eonia could increase), something that the Eurozone does not need at all. "

Ilian Yotov - FX Strategist and Founder at AllThingsForex:

ECB:

ECB:"As the euro-area heads into 2013 with chronic contraction in its manufacturing and services sectors, the question remains just how long can the European Central Bank afford to wait until it resorts to additional monetary policy easing, including another rate cut. With euro-zone growth still nowhere to be seen, the central bank could see time running out, especially if the EU debt crisis flares up again. Although January may not be the month when we witness a 25 bps rate cut, ECB policy makers will probably face such decision sometime in the first quarter of 2013. The euro would feel pressure if the market continues to price in more easing by the ECB and if risk aversion and political uncertainty rise ahead of the February election in Italy, while at the same time the U.S. heads for another debt ceiling showdown. "

BoE:

"The minutes of the Bank of England's last meeting confirmed that policy makers were not in a hurry to do more quantitative easing. This is why the central bank will be likely to keep the size of its Asset Purchase Program unchanged in January, while also maintaining the benchmark interest rate at the record low 0.50%. On the other hand, we should not completely discount the possibility of another 50 billion pounds expansion of the bank's Asset Purchase Program in upcoming months, especially if the economy takes a turn for the worse in Q1 2013. As long as the Bank of England continues to sit on the QE sidelines, the GBP should remain as a viable alternative to other currencies whose central banks go full speed ahead with more easing."

Adam Narczewski - Financial Analyst at X-Trade Brokers, XTB:

ECB:

ECB:"The upcoming ECB meeting should not bring any spectacular changes. Global sentiment recently has improved and the fiscal cliff issue in the U.S was partially solved. I believe Mario Draghi will keep some bullets to shoot when the situation worsens. Reducing the depositary rate would be one of those bullets but I do not expect it will happen on the next meeting. The ECB had already made some strong declarations so I believe they will wait with another interest rate cut ( I give it a 25% chance that the ECB will reduce the main interest rate on the upcoming meeting). Despite all that, Mario used to surprise investors often times during his press conference, so we have to be prepared for everything."

BoE:

"The Bank of England has little room to perform any actions at this moment. What can be more important for the markets is the upcoming change of Governor (in a couple of months). Interest rates could be lowered in the future, but I believe the BoE would act sooner than the second half of 2014. At the same time, the earliest interest rate increase should not happen sooner than the second half of 2015."

Alberto Muñoz - Forex Analyst at FXstreet.com:

ECB:

ECB:"The European Central Bank considered a rate cut before the end of the year so it's likely that Mario Draghi will cut rates during the first quarter of 2013, though the improvement in the situation of peripheral countries will probably delay the decision until March. It would be a surprise for me a rate cut now that Spain and Italy risk premiums have improved dramatically reducing the chances of Spain asking for bailout in the short term.

Regarding cutting deposit rates into negative territory, I think it's an extreme measure so unless credit conditions get worse I don't think the ECB will take such a measure. In fact Mario Draghi said last month that the ECB council "has touched upon the complexities that such a measure would involve and possible unintended consequences, but we didn't elaborate any further" which indicates that cutting deposit rates in the short term is not an option."

BoE:

"Money markets are currently pricing a rate rise to 0.75% in January 2017 and 1% by September 2018 as inflationary pressures has significantly reduced during 2012 (CPI is now at 2.6%, down from 3.5% on March). Therefore I wouldn't expect a rate cut in the short term (would be negative to contain inflation) while rate rise still looks a long way off. In fact, if inflation becomes a problem, the Bank of England could unwind its £375bn QE programme selling the bonds it bought to cool the economy before even thinking of turning to rate rises."

Valeria Bednarik - Chief Analyst with FXstreet.com:

ECB:

ECB:"Although the ECB has hinted a probable rate cut, chances of some action this January meeting seem pretty limited, as per latest economic developments: the market feels a clear relief since the OTM announcement, as despite the facilities had not been required yet, yields of peripheral countries had fall. On the other hand, I believe that cutting the deposit rate into negative territory is out of the table at the time being, as the fragile confidence in the EU will likely be hammered with such move. I would expect a relatively optimistic speech from Mario Draghi, to be the most notable factor of the upcoming meeting, giving a temporal boost to Euro across the board."

BoE:

"With rates at record lows, and facilities programs in full mode, I don't see how the BOE may think on a rate cut this 2014, moreover, considering Mark Carney will be the head of the bank by the second half of this year. Besides, if they actually need to cut rates at a certain point in the future, that would mean the economic situation deteriorated even further, which means then, a rate hike will take more than a year to occur afterwards. The picture therefore seems quite unlikely. For upcoming January meeting, I'm expecting as usual a non event, and the central bank leaving its economic policy unchanged."

Recommended Content

Editors’ Picks

AUD/USD pressured as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.