In June, the ECB announced a liquidity boost and introduced a negative deposit rate. Although it will take some time before the macro economic implications are seen, the debate about broad-based QE has already returned.

From a market perspective, the monetary easing has supported performance in peripheral markets and led to lower money market fixings, but the expected steepening of yields curves and higher break-even inflation have not been seen.

This could reflect that the potential and actual liquidity boosts remain unknown as it depends on future net lending and demand for liquidity for months ahead. However, the first net lending figures suggest a large possible amount of liquidity and continuing the trend results in a potential liquidity boost around EUR1tn.

The declining benchmark for negative net lenders means the ECB provides liquidity to banks, which need to adjust their balance sheets. Entering the TLTRO with a large negative benchmark and/or the possibility to expand lending results in the most available liquidity.

The penalties attached to the TLTROs are limited and banks can use the funding for government bond carry trades for two years. This should be positive for the willingness to take on the TLTRO, but negative for credit creation.

In this paper, we revisit the announced easing measures and their dynamics. It answers the questions ‘what’ and ‘how’ and with sterilised examples we show the prospects for banks with positive and negative net lending developments.

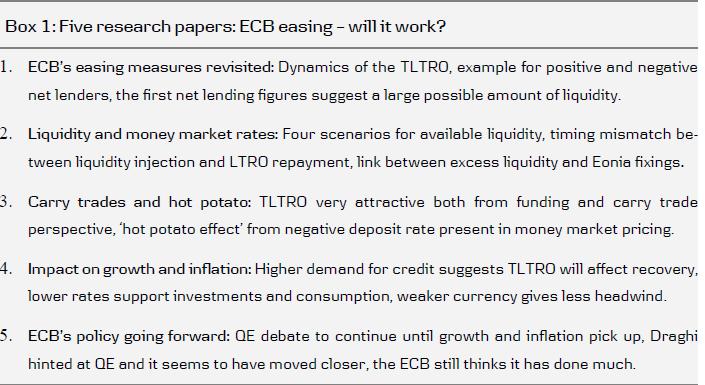

In four upcoming papers, we analyse the impact on money market rates, the potential for carry trades, support for activity and inflation and implications for the ECB (see Box 1). We also provide charts with ‘what to watch’ going forward.

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD stays firm amid BoE, Fed commentary and US data

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.