Outlook:

Nobody wants to think about the puzzle that is the J apanese economy, despite long-standing warnings that if we don't learn from Japan, we will be doomed to repeat its performance. The issue today is the unemployment rate at 3%, the best since 1995) but household spending down 0.5% y/y. Granted, household spending is up 2.5% m/m and retail sales 1.4% m/m, so it's only when you look at the year-over-year that the aberration appears.

Japanese households are not increasing spending to the extent predicted by full employment and expected or desired by the government. Blame the consumption tax, maybe, or demographics (older people yearn for fewer material goods). Blame houses so tiny you can't cram any more Stuff into them (this wouldn't bother American households). But the real blame lies in persistent and long-lasting fear that low growth and deflation are the destiny. Central bankers, according to the FT last week, fear a "low growth rut" unless government step up fiscal spending. But Japan has periodically stepped up fiscal spending—the famous paving over river bottoms—without getting lasting momentum. Expectations for yet another Abenomics plan later in September, presumably along with some BoJ actions, are not really cause for joy and hope. The implication is that the carry trade can go on forever.

Note that we also have selective data at work in the analysis of the UK post-Brexit. Is lending up or down and is confidence up or down? It depends on which data you look at.

Back on the Fed beat, Bloomberg reports "Fed funds futures ended Monday indicating a 36 percent chance that the Fed will raise rates in September, up from 24 percent a week earlier." Vice Chair Fischer gets some of the credit and he seems to be the PR man of the moment, speaking with Bloomberg yesterday and again this morning. He told Bloomberg TV that the dollar can't be blamed for the productivity bust and he doesn't believe "one and done," either. "We can choose the pace, but we choose the pace on the basis of data that's coming in."

Fischer says we are very close to full employment. Worries about productivity are real but not controllable by policy makers. He expects a surge in productivity due to "remarkable" advances in technology. Fischer also agreed Friday's payrolls will be key to the Sept decision making. Bloomberg currently has an estimate of 180,000 for Aug (after a weird 255,000 in July).

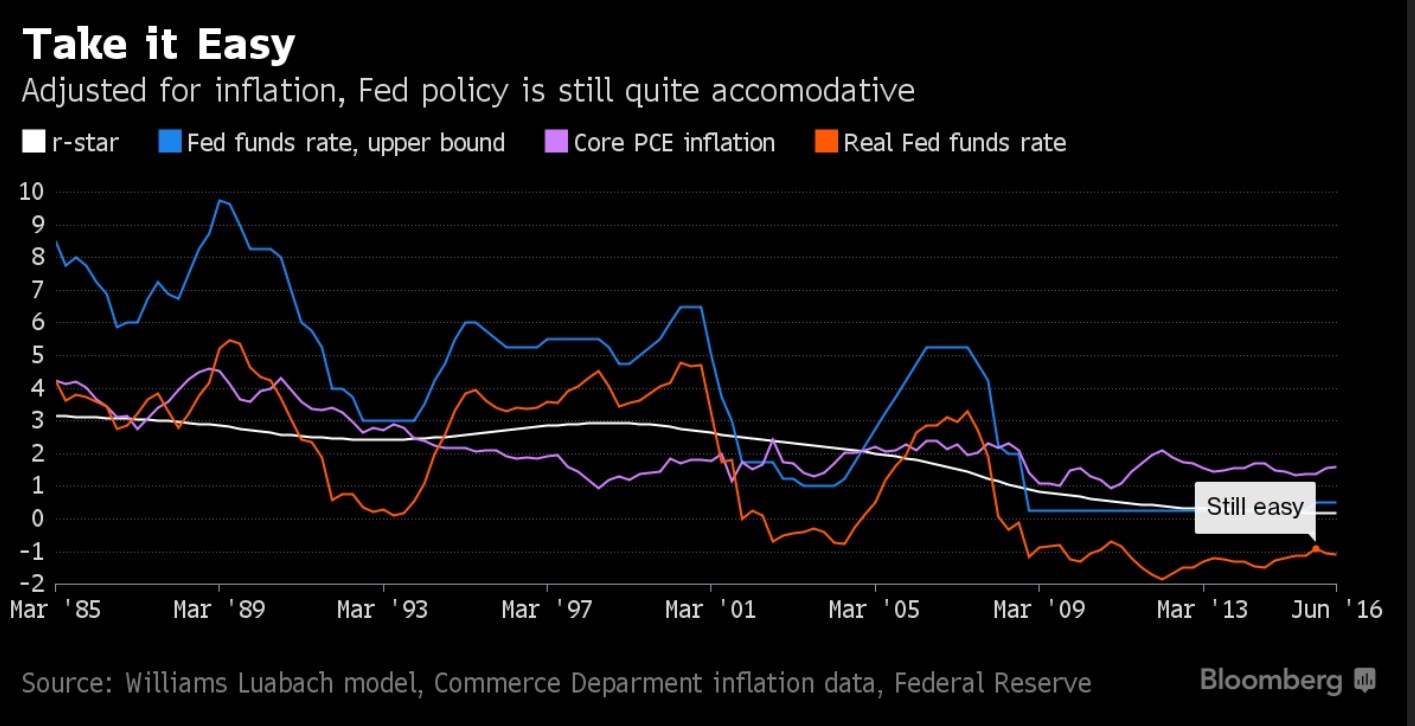

So we have Fischer out beating the drum for a rate hike while elsewhere, we have to note that Japan has full employment but low growth and no inflation. In addition, Fischer is flying in the face of the San Francisco Fed study already reported about the "neutral rate" that makes the Fed too optimistic about the height rates can reach—given that the neutral rate is near zero now and will rise to 1% only by a decade hence (2026). See the chart. The real Fed funds rate (at 0.25% to 0.50%) is below zero if you price in inflation at 1.6%. It will still be below zero with a 25 bp hike.

So what is Fischer talking about? Perhaps that even after one rate hike, policy will still be "easy." Y ou can have a hawkish Fed and easy policy at the same time.

A big picture analysis would have the Fed on hold. The US economy is not Japan, of course, but full employment is not the only criterion for hiking rates when there is no inflation to speak of and capital investment is low and thus so is productivity and therefore expected wages increases. But Fischer wants the markets to believe the rate hike is baked in the cake. We have to believe him but it's worrisome that nobody is asking him about full employment in Japan (with negative rates) and how, exactly, technological advances will serve the US instead of China or Taiwan.

Another idea (and one we like) is that the long-delayed rate hike will prove the resilience of the US economy and possibly shove some capital investors off their fat bums and get them to re-invest.

Maybe we shouldn't examine Fischer's comments too closely and just take them at face value. Maybe the disconnects between at least some of the data and the Fed's intent have to be put on the back burner. If so, yields should rise and the curve should steepen, supporting the dollar, especially if tomorrow's eurozone inflation number is bad and expectations rise for some ECB action as early as the Sept 8 policy meeting. Sometimes pigs do fly.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 102.31 | LONG USD | WEAK | 08/29/16 | 102.13 | 0.18% |

| GBP/USD | 1.3079 | SHORT GBP | STRONG | 07/20/2016 | 1.3101 | 0.17% |

| EUR/USD | 1.1169 | SHORT EUR | WEAK | 08/29/16 | 1.1182 | 0.12% |

| EUR/JPY | 114.27 | SHORT EURO | WEAK | 05/02/2016 | 122.33 | 6.59% |

| EUR/GBP | 0.8539 | LONG EURO | STRONG | 06/24/2016 | 0.8006 | 6.66% |

| USD/CHF | 0.9798 | LONG USD | STRONG | 08/08/2016 | 0.9817 | -0.19% |

| USD/CAD | 1.3036 | LONG USD | WEAK | 06/27/2016 | 1.3010 | 0.20% |

| NZD/USD | 0.7232 | LONG NZD | WEAK | 08/02/2016 | 0.7204 | 0.39% |

| AUD/USD | 0.7549 | LONG AUD | WEAK | 08/02/2016 | 0.7576 | -0.36% |

| AUD/JPY | 77.23 | SHORT AUD | STRONG | 08/02/2016 | 77.02 | -0.27% |

| USD/MXN | 18.6519 | LONG USD | WEAK | 05/06/2016 | 17.9418 | 3.96% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.