The latest spark of optimism regarding the EU and a crisis that is here to stay since late 2009 was triggered by the ECB in its September 2012 monthly meeting, when Mr. Mario Draghi announced the OMT. The pompous Outright Monetary Transactions’ name stood for yet another form of bond buying, this time unlimited but of course, only available for those willing to submit to austerity measures.

Following previous facilities programs, OMT came to provide sterilized bond purchases and not just plain QE; “sterilized” stands for manipulating the value of the currency, in this particular case, encouraging banks to shift balance reserves from the fully liquid current accounts into fixed term deposits, which are just another form of reserves.

And therefore following SMP, EFSF, ESM, and LTRO, the ECB gave markets a reason to trust in the EU beyond the “whatever it takes”. The sole announcement was enough to drive yields differentials strongly down among peripheral countries, giving the common currency a well deserved breathe. The EUR/USD was quoting back then around 1.2600 and monthly basis rose steadily up to this year high of 1.3710 early February this year, when confidence in a recovery started to erode. Why?

There are several reasons that include discouraging fundamental data, a downside revision to growth and increasing unemployment, but the main one, the one that no one talks about, is that not even EU members trust in the EU no more: the OMT has been available for already 8 months, and not one single troubled country, resort to it. Not Spain neither Italy, were willing to ask for help on the condition of austerity measures, not after what happened to Greece. Is true that with lower yields there was no need to ask for help, but that was a hanging-by-a-thread situation, that finally exploded when Cyprus crashed, and a “corralito” was imposed along with a bail-in trough banks deposits levy.

At this point you may wonder why the ECB did not offered Cyprus the OMT for what would be the smallest European bailout so far of €6B. I wonder that too.

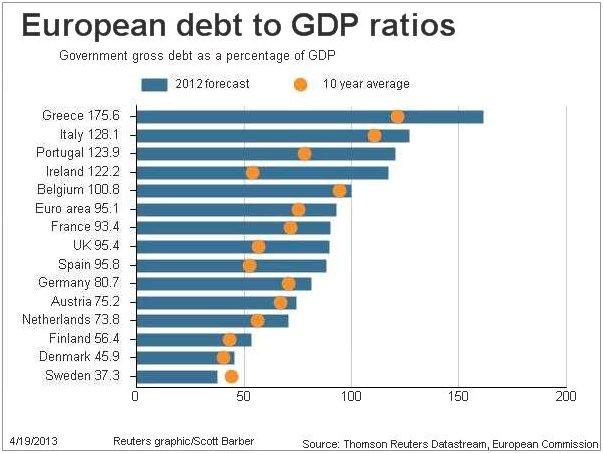

The last resort has become the latest resort and many experts speculate the ECB will save it for when debt restructuring times come. Because they will come, no doubts: the Central Bank has repeatedly reiterated its preparedness to buy short term maturity debt, meaning three years or less. That means governments debts will gradually become more short term, and that the debt to GDP ratio will rise faster in the upcoming years, leading to what at some point, will be an unsustainable situation, considering that debt is already too high across Europe, and not only limited to peripheral-troubled countries. Believe me restructuration will be needed, if the EU plans to ever revert current recession and kick start growth.

But until then, credibility will be an asset too far away for ECB’s hands to reach it.

Is the Eurozone heading to a lost decade?

Credibility needs facts to exist. Bundesbank president Jens Weidmann warned some days ago that the eurozone would be facing a lost decade as "overcoming the crisis and the crisis effects will remain a challenge over the next decade." This statement seems to be in line with what Jim O’Neill, former Chairman of Goldman Sachs Asset Management, commented in a recent interview: O'Neill believes that the crisis is currently segmented to developed countries, adding that "It’s all about the developing world. To put it into context economically, China creates another Cyprus every week. It’s still all about the acronym that made him globally famous and not just in finance." O'neill concluded stating that "for any global investor, there is no crisis – there is plenty of growth. It’s just not in the old world."

And it seems to be true. In 2013, the emerging and developing countries will be growing by 5.3% according to the IMF, while the euroarea will decline by 0.3% and the US will advanced 1.9%. So, let’s take a look on what market and experts are expecting from in the eurozone.

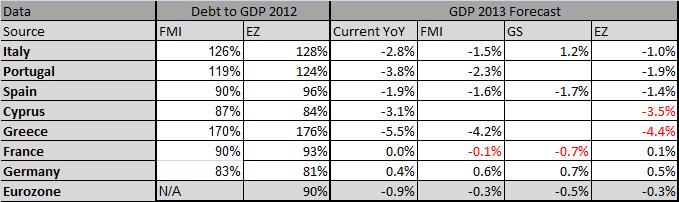

Watching the debt to GDP ratio, European countries are highly leveraged and the whole eurozone has a government debt for 90% of its GDP. To put it into perspective, countries such as Switzerland (46%), Brazil (64%), China (22%) and even Colombia (32%), which in the past was highly indebted, now have healthier finances.

In the European case, only Denmark and Sweden are below the 50% mark as you can see in the Reuters chart. Close is Finland with 56.4% debt to GDP ratio but the rest of the countries are above the 70% of debt with 5 nations are over 100%.

One of the major concerns in Germany is to avoid printing money and allowing countries to borrow more money is the 1 billion Mark note that German used in the Weimar Republic. Let’s take a look to inflation forecast for 2013.

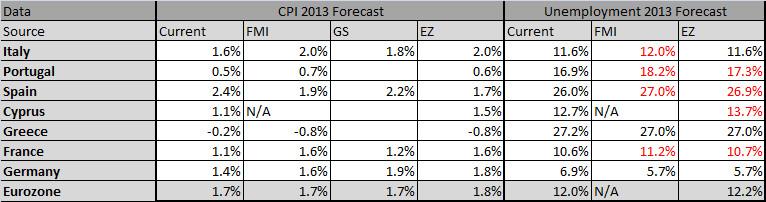

As you may see in the following table, the Eurozone CPI is currently at 1.7%, level that the IMF and Goldman Sachs analyst expect to mach for the whole 2013. However, the eurozone sees prices rising 1.8% in the current year. Inflation in Germany will rise in 2013 from the current 1.4% towards the end of the year, to reach between 1.6% and 1.9%. Greece will experience deflation this year.

Switching to unemployment levels, the labor market is expected to be somehow better only by the end of the year. The situation will be dramatic in Spain (even worst), Greece (holding the current levels) and Portugal.

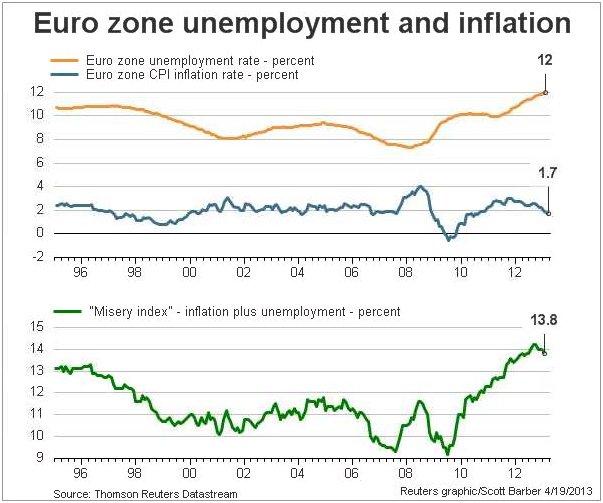

France will be in a juncture as its unemployment levels will close the year above current ones and its GDP would contract according to Goldman Sachs and the IMF. And at this point, I would like to share with you the “Misery index” of the European countries. The index, created by Arthur Okun, adds CPI to unemployment rates to measure how hard is life for the common citizen. It assumes that higher unemployment plus costlier items and services will be considerable worsening the people’s standards of life.

As you may see, Europeans had already seen how their life’s’ standards deteriorated in the last three years with the misery index jumping from 9% in 2009 to reach 14% by the end of 2012.

So, the question here is: Are the Europeans living better than 5 years ago when the crisis burst into governments faces? Had been useful to ‘the street’ those many political turmoils? Austerity is working? Where are the growth measures?

Credibility… big word, after several misunderstanding between politics, meetings with no agreements, delays and statements or contra-statements, the street is tired of the situation; will the politicians finally own credibility?

Will the people believe?

General Risk Warning for stocks, cryptocurrencies, ETP, FX & CFD Trading. Investment assets are leveraged products. Trading related to foreign exchange, commodities, financial indices, stocks, ETP, cryptocurrencies, and other underlying variables carry a high level of risk and can result in the loss of all of your investment. As such, variable investments may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall Witbrew LLC and associates have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to investment trading or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.