EURUSD touched significant support at 1.12000. GBPUSD fell after UK Parliament rejected Brexit alternatives. Bitcoin in the moment jumped by 20%. Brent Crude is one step from key technical levels.

Stocks

Key stock indices maintain a positive bias, although the growth momentum has dried up without new impulses after the China A50 index has updated annual highs, and the S&P 500 raised to 2870 – the highest level since October 2018. The growth impulse after strong Chinese data was supported by statistics from the United States in the areas of production activity and construction costs, which surpassed expectations. Today on the agenda in the US publication of data on orders for durable goods and car sales. Cars and high-priced products are a reliable indicator of prospects.

Bonds

The yield on 10-year US government bonds remains higher than the yield on 3-month securities, but there is a slight decrease from the level of 2.5%. A further slide below 2.4% (the current yield of 3-month securities) can return a sense of fear of the impending recession to the markets.

EURUSD

EURUSD, a key pair of the currency market, as expected, came under pressure in the evening, touching on the 1.1200. On Tuesday morning, the pair to a greater extent, by inertia, dropped to 1.1190. Eurozone inflation once again disappointed. PPI in the region was worse than expected, although year by year the index accelerated to 3.0%. In early March, EURUSD received support near 1.1200, so market participants are in no hurry to pass these levels without significant drivers. At best, data from the United States can be a similar driver. But, most likely, to determine the medium-term trend based on the data, you will have to wait for tomorrow’s PMI or ADP.

The British pound is trading near 1.3050, dropping from 1.3120 at the very beginning of the day in response to British lawmakers reject of all alternative ways to exit from the EU. This outcome increases Brexit’s odds without a deal on April 12. Officials from Germany and France warn that now the only way out is exit without a deal, although the British government is now choosing between this option, as well as a new referendum and new elections, to break the legislative deadlock.

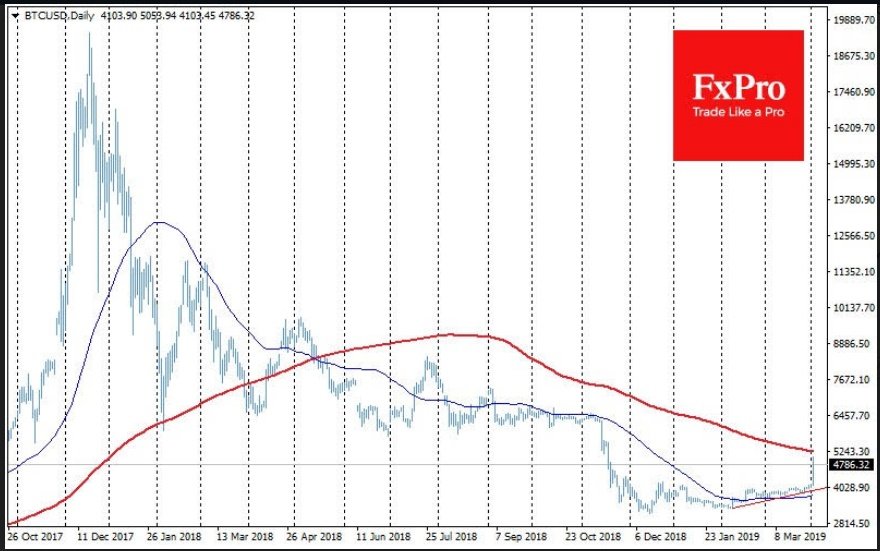

For the first time since November, without any particular reason, the Bitcoin price spiked by almost 20% in a matter of hours to $ 5,000, and even crossed this mark, according to data from some exchanges. It is worth paying attention to further subsequent levels. MA (200) exceedance, now passing through $5200, can be an important indicator that the market is ready for further cryptocurrency purchases.

Brent

The Brent crude surged more than 2.5% since the beginning of the week, trading above $69 a barrel on the news of possible new US sanctions against Iran and Venezuela. Further growth is attracting attention, as black gold prices are within reach of an important level of the 200-day moving average. Growth above this level can inspire further purchases of oil.

Trade Responsibly. CFDs and Spread Betting are complex instruments and come with a high risk of losing money rapidly due to leverage. 77.37% of retail investor accounts lose money when trading CFDs and Spread Betting with this provider. The Analysts' opinions are for informational purposes only and should not be considered as a recommendation or trading advice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.