Steadied at 1.1132 low which stands just above the 200-day MA at 1.1121. Break here will see further slide to the 1.1100 level and see risk for further decline to 1.1071 then 1.1046, Aug low. Resistance now at 1.1180 then the 1.1200 level, lift over the latter needed to clear the way for stronger recovery to 1.1245. [PL]

Clear break of the .9800 level see rally reaching .9844 high. Beyond this will clear the way to the .9900 level then .9950/56, Jul/May highs. Divergence on intraday tools see the latter keeping out of reach for now and caution pullback to the .9793/62 area. Failure to hold the latter will see room for deeper correction. [PL]

USD/JPY

Pressure stays on the upside to reach 103.23 high so far and nearby see strong resistance coming into play at the 103.40/55 area then the 104.00 level. The downside seen well protected with support now at 102.39 and 101.76. Only break of the latter will weaken and trigger deeper pullback. [PL]

EUR/CHF

Still stretching up-leg from the 1.0827 low and higher see scope to target 1.0986 then the 1.1000 level. Divergence on intraday tools caution pullback with the 200-day MA at 1.0925 then the 1.0900 level to watch. Would take break to trigger deeper pullback to 1.0869 support. [PL]

GBP/USD

Intraday trade tight in consolidation within the broader 2-month triangle and slippage below 1.3060 support will expose setback to 1.3024 ahead of the stronger support line of this formation at 1.2895, where break will be a bigger boost on the downside. [W.T]

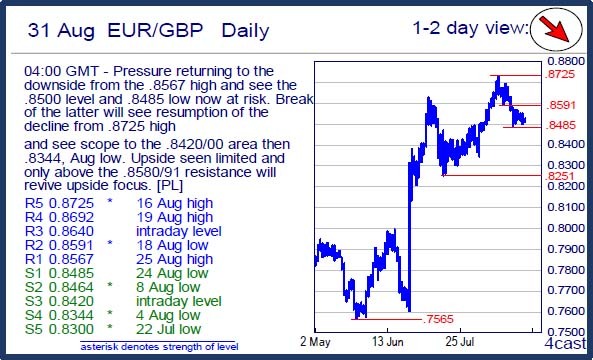

EUR/GBP

Pressure returning to the downside from the .8567 high and see the .8500 level and .8485 low now at risk. Break of the latter will see resumption of the decline from .8725 high and see scope to the .8420/00 area then .8344, Aug low. Upside seen limited and only above the .8580/91 resistance will revive upside focus. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.