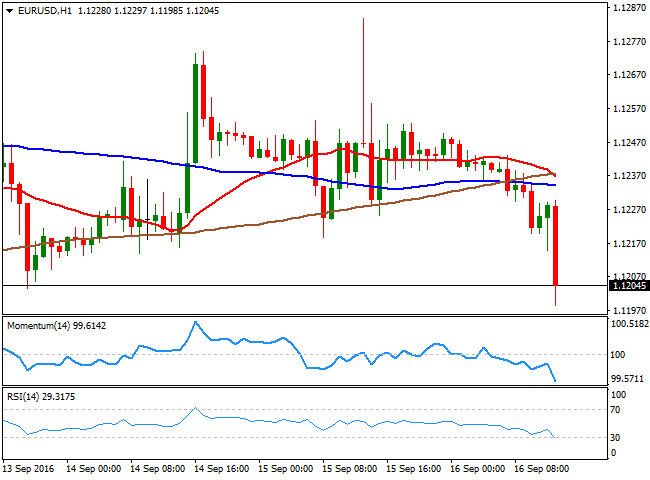

EUR/USD Current price: 1.1204

The American dollar traded marginally higher against most of its major rivals during the first two sessions of the day, as risk sentiment returned to markets, dragging stocks lower in Asia and Europe. Movements across the FX board however, were restricted ahead of the release of the last piece of relevant data of the week, US August inflation. Consumer prices in the US rose by more than projected in August ticking up to 0.2% from previous flat reading at 0.0%. The year-on-year figure also came in better-than-expected, up by 1.1% whilst the core yearly reading printed 2.3%.

The EUR/USD pair fell to a fresh weekly low of 1.1198 right after the release, as the strong figures support the case of a FED rate hike. From a technical point of view and for the short term, the bearish momentum seems ready to extend, as in the 1 hour chart, the price has accelerated its decline below its moving averages that anyway remain within a tight range, reflecting the latest range, while the technical indicators have turned strongly lower within negative territory. In the 4 hours chart, the price is breaking below also directionless moving averages, whilst technical indicators also heading south within negative territory, adding to the bearish case on a downward acceleration below 1.1200.

Support levels: 1.1200 1.1160 1.1120

Resistance levels: 1.1235 1.1280 1.1310

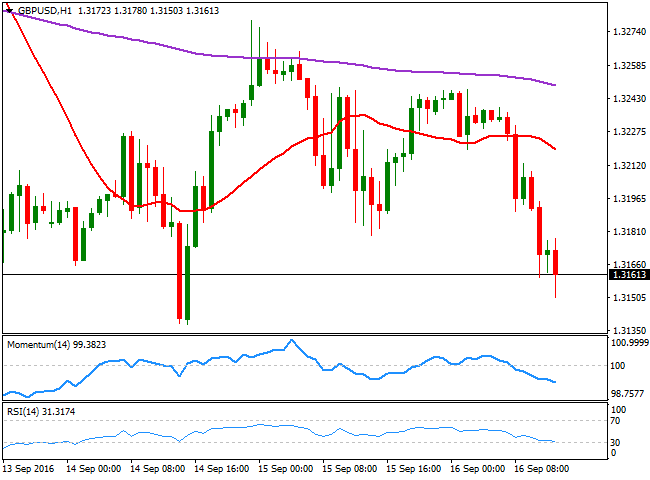

GBP/USD Current price: 1.3160

View Live Chart for the GBP/USD

The GBP/USD pair extended its decline below the 1.3200 level following the release of strong US inflation data, with the Pound already pressured by the conservative stance of the Bank of England, after their Thursday's economic policy meeting. The pair is nearing its weekly low, set at 1.3138 last Wednesday, and the intraday technical picture suggests that the pair may extend its decline, as in the 1 hour chart, the price is further below a modestly bearish 20 SMA, whilst the technical indicators head sharply lower near oversold readings. In the 4 hours chart, the price has been capped by a bearish 20 SMA, currently around 1.3210 while the Momentum indicator head sharply lower below its 100 level and the RSI also declines around 37, leaving room for further slides on a break below the mentioned weekly low.

Support levels: 1.3135 1.3100 1.3060

Resistance levels: 1.3170 1.3210 1.3250

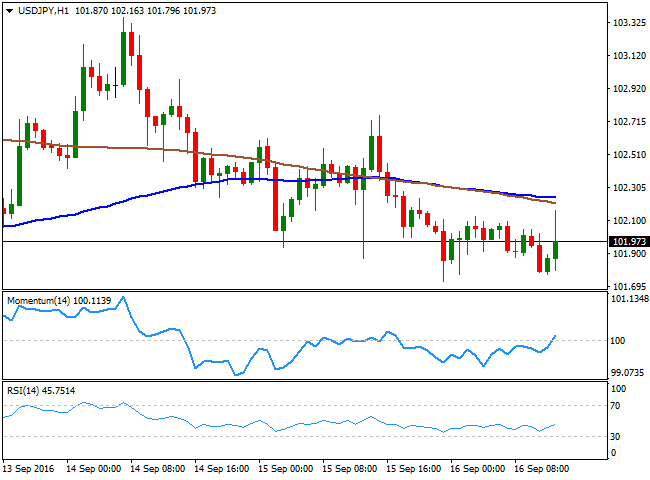

USD/JPY Current price: 101.03

View Live Chart for the USD/JPY

The USD/JPY pair spiked up to a fresh daily high of 102.16 following the release of upbeat US inflation figures, but it's still incapable to settle above the 102.00 level, broken late Thursday. During the upcoming week, both Central Banks will have their economic policies meetings. Chances of the FED acting as soon as this month are low, and on the contrary, market is expected some kind of easing announcing coming from the BOJ, which should favor the upside in the pair. Still the upward potential seems limited from a technical point of view, as the pair has been clearly bearish pretty much since late January. Short term, the 1 hour chart shows that indicators turned higher within neutral territory, but that the price is below its 100 and 200 SMAs, both heading modestly lower in the 102.20/30 price zone. In the 4 hours chart, technical indicators remain well below their mid-lines, barely losing their downward strength, whilst the price holds below its 100 SMA, around 102.40, and the level to surpass to confirm a more constructive outlook for this Friday.

Support levels: 101.60 101.25 100.70

Resistance levels: 102.40 102.90 103.35

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.