The EUR/USD pair advanced up to 1.0966 during the Asian session, but the European opening brought another round of dollar's buying, which send the pair down to 1.0920. The pair holds therefore, near the 1.0892 low set late Thursday, following the release of the US advanced second quarter GDP. The figure was not enough to match expectations of 2.6%, but the 2.3% number indeed maintains the FED in the tightening path.

View live chart of the EUR/USD

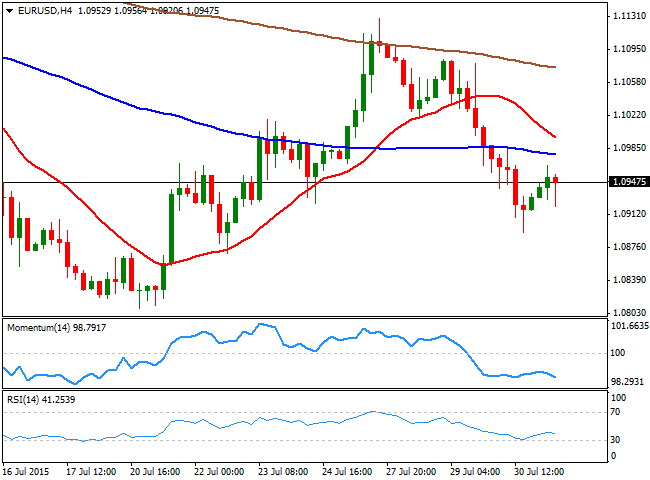

Just released, the EU inflation figures show that yearly basis it remains at 0.2%, albeit the Core CPI for July came out at 0.9% slightly above expected. The EUR/USD posts a tepid recovery, hovering around the 1.0950 level at the time being, but the technical intraday picture continues to favor the downside, as in the 4 hours chart, the price stands well below a bearish 20 SMA, currently around 1.1000, whilst the technical indicators have corrected partially higher, before resuming their slides below their mid-lines.

At this point, the pair needs to break below 1.0910 to confirm a bearish continuation, with the next short term intraday supports at 1.0880 and 1.0850. Approaches to the mentioned 1.1000 level will likely be seen as selling opportunities, although a break above it may see the pair extending up to 1.1045.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.