Regarding Greece, negotiations are expected to continue over the weekend. The creditors have offered the country a 5-month extension to the current bailout plan, but the latest news suggest Tsipras wants a longer term deal, more in line with its anti-austerity policy. A deal must be reached before next Tuesday, June 30, or Greece will default on the €1.6B debt with the IMF. The implications have been largely discussed to exhaustion lately, with bank runs, and capital controls expected, alongside with the loss of the EU credibility. It's just a matter of who will give up first, Greece and face default, or Europe, and see how 15 years of work go down the toilet.

Given a holiday in the US on Friday, the country will release its monthly employment report on Thursday. Nonfarm payrolls tepid start of the year was reverted in May, as the economy managed to create 280,000 new jobs; the unemployment rate stood at 5.5% in the same month. With the Greece issue out of the picture, either for good or for bad, market's attention will likely return to the imbalance between Central Banks, and the FED's chances of rising rates. Should the report surge beyond May one and expectations, the dollar will likely close the week with strong gains against most of its rivals. A bad number on the other hand, may favor overall Pound, which is the one with more chances of advancing sharply on dollar weakness.

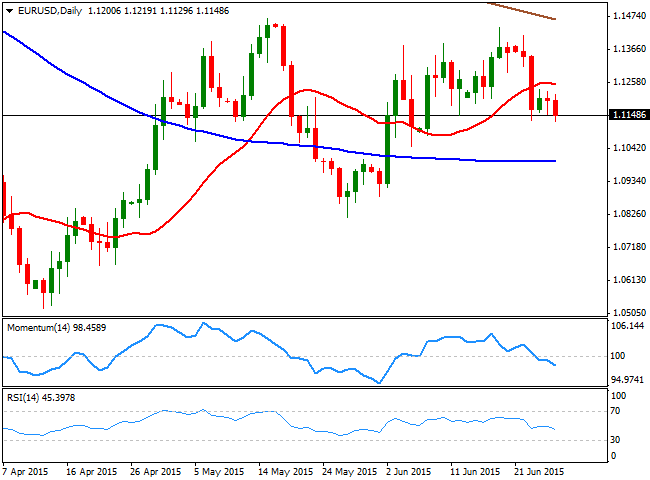

View live chart of the EUR/USD

EUR/USD Forecast: down to 1.1050 and beyond

As for the EUR/USD pair technical picture, it ended the week in the red, erasing half of the past three weeks advance. The weekly chart shows that the technical indicators have reversed sharply, with the Momentum heading lower but still above the 100 level, whilst the RSI has resumed its decline and heads south around 45. In the same chart, the 20 SMA stands flat around the critical 1.1000 figure.The daily chart shows a clearer bearish momentum, with the price having been capped by its 20 SMA for most of this past week, whilst the technical indicators head lower below their mid-lines. The pair has an immediate support around 1.1120, followed by 1.1050, both strong static support levels. Should this last give up, the pair will likely extend its decline down to the 1.0920/60 price zone.

The upside seems limited for the next week, with the immediate resistance around 1.1250. Above this level, the pair can extend up to 1.1400, albeit selling interest will likely prevent it from advancing further.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.