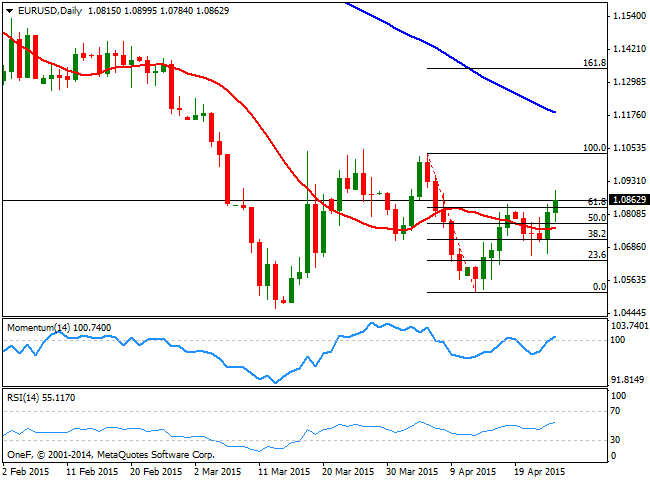

Nevertheless, the EUR/USD managed to close the week higher, around 60 pips above its weekly opening, and with the weekly chart showing a higher low and a higher high, usually a sign of mounting bullish pressure. The recovery that began the previous week has dragged the weekly indicators further above from extreme oversold levels, albeit the stay well below their mid-lines. In the same chart, the price is pointing to close the week above the 61.8% retracement of its latest decline, supporting a retest of the 1.1000/50 region. In the daily chart, technical indicators are biased higher above their mid-lines, whilst the price extended above a directionless 20 SMA.

With the FOMC Meeting next week, the pair may continue to trade within familiar ranges at the beginning of the next week, but with the market going into the meeting with limited hawkish expectation, chances are of a move higher: a break above 1.0900 should lead to a retest of the mentioned 1.1000/50 region, while if it manages to advance above this last, 1.1120 comes next. The 1.0710 level, 38.2% retracement of the same bearish run is the key support to follow, as if the price falls beyond it, the decline can extend down to 1.0620, whilst below this last, the year low at 1.0460 comes next.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Ethereum could remain inside key range as Consensys sues SEC over ETH security status

Ethereum appears to have returned to its consolidating move on Thursday, canceling rally expectations. This comes after Consensys filed a lawsuit against the US SEC and insider sources informing Reuters of the unlikelihood of a spot ETH ETF approval in May.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.