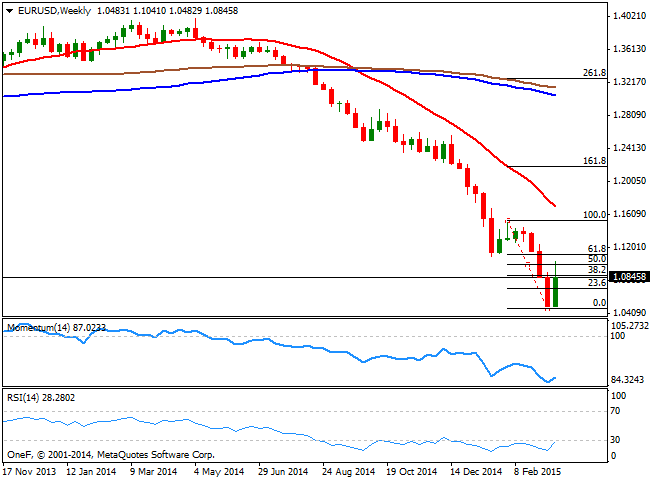

Let's take a look at the weekly one: the pair is closing below previous week opening, and below the 38.2% retracement of its latest bearish run around 1.0865, while the technical indicators are bouncing from extreme oversold levels, still far from signaling an upward continuation, even in corrective mode. Furthermore, the 61.8% retracement of the same decline stands at 1.1120, meaning that the EUR can extend up to that level, without actually harming the dominant bearish trend, considering we are talking just about this year decline and not about the whole fall from around 1.40. Nevertheless, the 1.1120 has become now a line in the sand, as stops are right now building up above the level and if triggered, the pair can continue rallying up to 1.1533, this year high, albeit not next week. Therefore, 1.0685 the Fibonacci level, 1.1040, this week high, and 1.1120, another Fibonacci level, are the critical resistances for this week.

To the downside, post FED low is the level to follow, the 1.1610 price zone, as if below, the dollar may resume its bullish tone and retest the 1.0460 level next week.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.