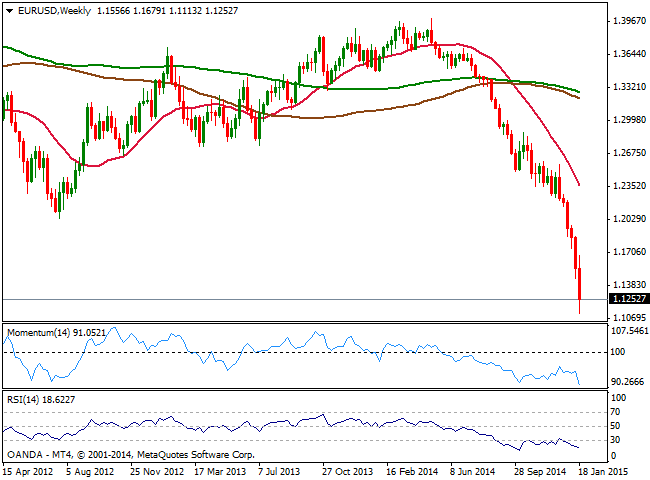

Fundamentally, the downside remains favored following ECB’s movement, and the pair is in risk of gapping lower next Sunday Asian session opening, depending on the results of Greece elections. In the meantime, the daily and the weekly chart show indicators in extreme oversold levels, but maintaining their bearish slope, meaning there is no technical sign the downward rally is exhausted. If the decline extends below 1.1110, the next line in the sand comes at the critical psychological figure of 1.1000, a more than likely bearish target for next week. If somehow the level is also taken, next strong support comes at 1.0816.

It’s impossible however to disregard the possibility of an upward corrective movement, although risk remains limited as long as price holds below 1.1290. The next important resistance level comes at the 1.1350/70 price zone, where selling interest should be even stronger. Gains above this level seem unlikely for the upcoming days, thus above it, the pair has room to extend up to 1.1540 without really harming the dominant bearish trend.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD rises to near 1.2450 despite the bearish sentiment

GBP/USD has been on the rise for the second consecutive day, trading around 1.2450 in Asian trading on Wednesday. However, the pair is still below the pullback resistance at 1.2518, which coincides with the lower boundary of the descending triangle at 1.2510.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.