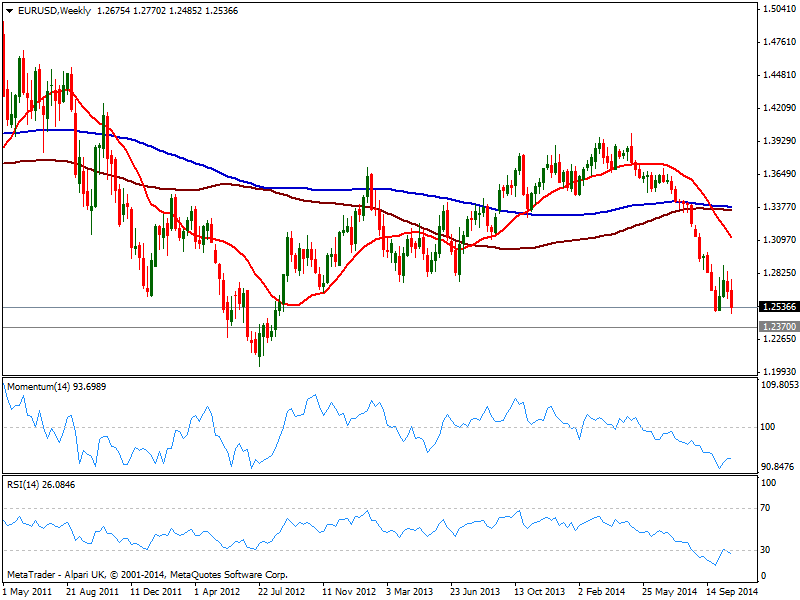

Technically, the weekly chart shows indicators turned back south in oversold territory after limited corrections, while 20 SMA maintains a clear bearish slope well above current price, all of which supports the ongoing bearish strength. In the daily chart price failed to regain its 20 SMA, now around 1.2690, while indicators turned back lower below their midlines.

Price action will likely be choppy early next week, with upward corrections seen limited by above mentioned 1.2690, but selling higher will likely be the norm. Next strong support stands at 1.2440, and once below there’s not much in the way down to 1.2370, where the pair presents several weekly historical highs and lows. If the level gives up by next Friday, 1.2000 becomes the next realistic target in the pair.

The 1.2620 price zone comes as immediate resistance and first strong selling level, followed by 1.2690. A price acceleration above it should signal another round of short covering and profit taking, base of an upward correction up to 1.2780 price zone, the land in the sand for the ongoing bearish trend.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery gains above 1.0650

EUR/USD stays in a consolidation phase following Wednesday's rebound and trades in a narrow range above 1.0650. The improving risk mood doesn't allow the US Dollar to gather strength as markets await mid-tier data releases.

GBP/USD clings to moderate gains above 1.2450

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside retreating US Treasury bond yields. Fed policymakers will speak later in the day.

Gold shines amid fears of fresh escalation in Middle East tensions

Gold trades in positive territory near $2,380 on Thursday after posting losses on Wednesday. The precious metal holds gains amid fears over tensions in the Middle East further escalating, with Israel responding to Iran's attack over the weekend.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.