European data did little for the pair, as it came out as expected, with monthly CPI ticking up to 0.4%, still in the verge of deflation, and unemployment remained steady at 11.5%: the pair spiked 10 pips higher with the news, but that was it.

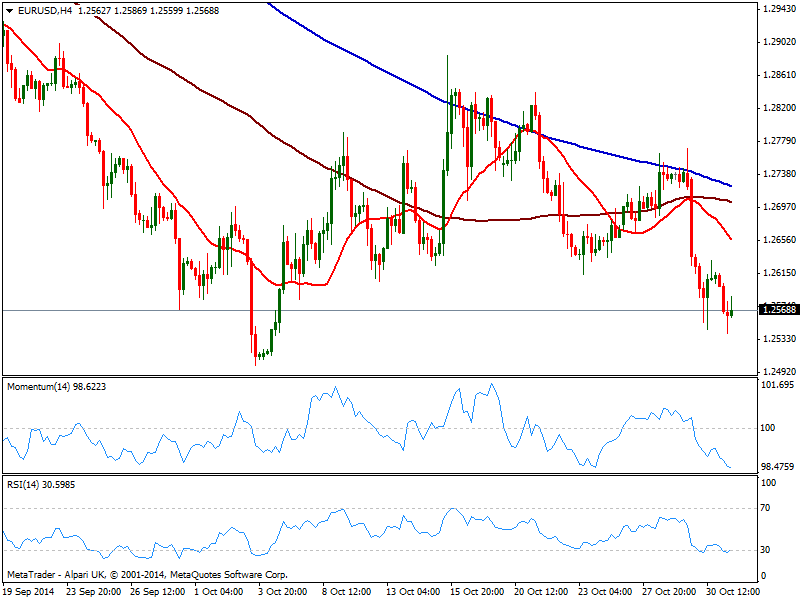

Technically, the 4 hours chart maintains a strong bearish bias according to technical readings, with price well below a bearish 20 SMA and momentum heading south below 100, as RSI remains flat at 30. Despite choppy, the downside is still favored with a price acceleration below 1.2550 leading to a retest of the year low at 1.2501. If price manages to extend below this last, stops will likely be triggered and see the bearish run extending further, down to 1.2440 price zone.

To the upside, 1.2620 continues to be the key resistance level, and approaches to it are more likely be seen as selling opportunities than signs of a reversal.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.