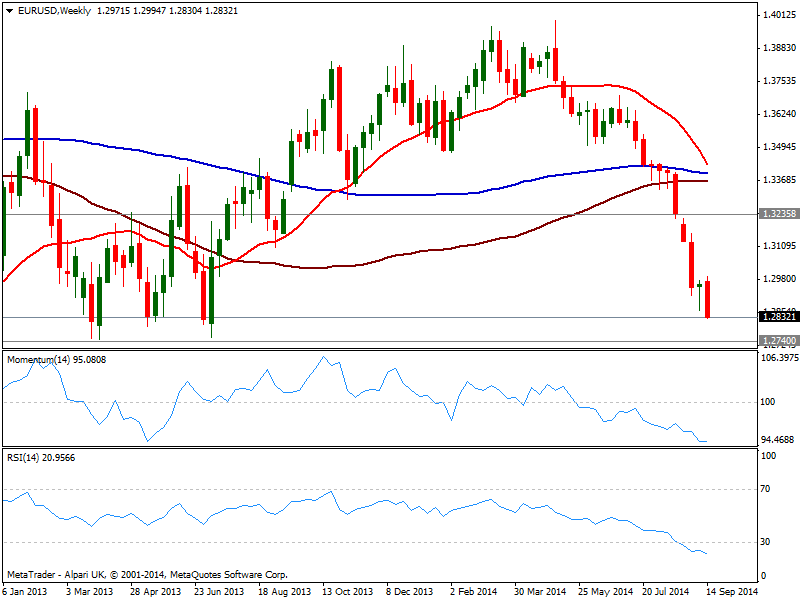

The rally is indeed overextended, but the daily chart also presents a strong bearish tone coming from technical readings, with 20 SMA having extended its decline to the 1.3000 level, which may be now the line in the sand for current bearish trend: if somehow the pair manages to recover, a pullback to such level will likely be seen as corrective rather than the confirmation of a bottom. But risk of an upward correction of course is there, and increased weekly basis, considering there was almost no corrections in this 900 pips slide.

Question is therefore what worth more, if trying to pick a bottom, or wait until the correction is over, the market shrugs off the excess of bulls and then sell. My take is that there is room for further declines, with 1.2740 as next critical support. If price breaks below it, I would forget about waiting to sell at higher levels, as the impact will probably drive the pair towards 1.2500 then. At current levels, an upward correction may extend up to 1.2920/50 area, so if the levels holds, then the pair will likely resume its slide. Above it, a quick test of 1.3000 is possible, and if somehow price breaks above, then the bottom will look more shaped, with chances of a recovery up to 1.3250 price zone.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.