The EUR/USD pair continued trading lifeless these past days, confined to a tight range for the fifth consecutive week, as investors are still looking for a fresh catalyst beyond Central Banks.

Market's attention is slowly turning towards US elections after the first US Presidential debate, called by media as a point-win for the Democrat candidate Hillary Clinton. The next debate will take place in a couple of weeks, and markets will be looking if any of the candidates is able to launch a bazooka to lean the scale one way or the other. Despite forecasting the effect of the election over financial markets is not an easy task, there's a general agreement that Clinton represents stability, while Donald Trump is more like a wild card, and his victory will probably mean risk-off.

Next Friday, the US will release its September employment data, and expectations point for a steady unemployment rate at 4.9% and a slightly rise in jobs ' creation, up to 170K from previous month 151K. A result in line with expectations will hardly be a game changer for the greenback, and attention will turn then, into wages. But considering Friday's figures on spending and income, seems wages will disappoint again. Personal income rose 0.2% in August, matching expectations, while spending was flat, against market's expectations of a 0.1% advance, according to the Department of Commerce. The same report shows that core personal consumption expenditures, , rose 0.2% month-on-month, while yearly basis, it climbed modestly for the first time since February, to 1.7% from 1.6%.

The dollar closes the week with a firmer tone, helped by risk sentiment rather than by strong local data, with the EUR/USD pair still stuck around the 1.1200 figure.

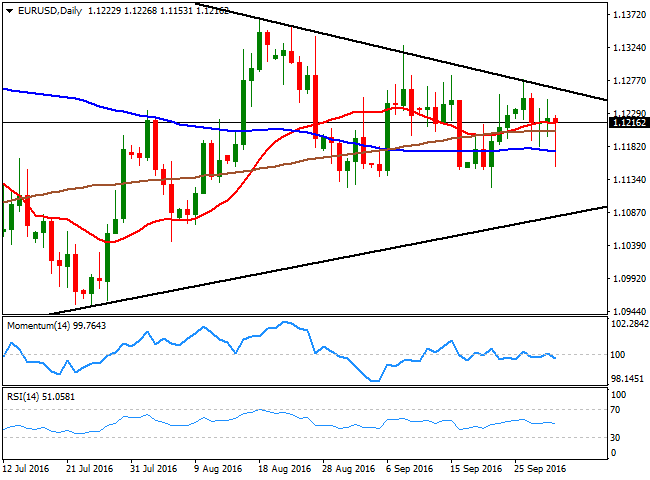

From a technical point of view, the pair is well limited between 1.1120 and 1.1280, and unless it is able to gain momentum either side of that range, it will have little to offer for one more week. Technical readings in the daily chart maintain the neutral tone, as the keeps hovering around its moving averages, while technical indicators aim modestly lower, but lack strength within neutral territory.

The levels to watch these upcoming days are the same seen last week, with 1.1160, as the immediate support, ahead of the base of the range at 1.1120, the lows for the last couple of weeks. Below this last, a downward extension can see 1.1000/40 by the end of the week, particularly if the NFP is a huge upward surprise.

The immediate resistance on the other hand is 1.1245, followed by the 1.1280/90 region. Beyond this last the rally can extend up to 1.1366, August high, en route to 1.1460, the level that caps the upside since early 2015.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.