The Brexit shock has left investors disoriented when it comes to the EUR/USD pair, as after plummeting some 500 pips, the pair entered a consolidative stage of mere 200 pips, between 1.1000 and 1.1189, the post-Brexit high. Still, the bearish tone is quite clear as after some consolidation during the previous week, the pair has edged lower during this one, barely holding around the lower end of the range, the 1.1000 critical psychological support.

US data has continued to beat expectations, supporting the case for solid growth in the world's largest economy. Wall Street soared to record highs, and despite a sharp intraday retracement on Thursday, indexes hold on to gains, as confidence among investors is strong. It’s quite a contradictory scenario, as usually, strong data suggest that the FED is closer to raising rates, and therefore stocks tend to fall. But in this particular case, the US Federal Reserve is hardly expected to act this year amid global woes, which means that, as an exception to the usual behavior since the 2008 crisis, the dollar can rally alongside Wall Street.

And in fact, the greenback is stronger against all of its major rivals, but the EUR/USD pair refuses to give up. European data has been generally softer, with only German figures resulting up beat. So why is the pair so reluctant? To be honest I don't have the answer. Probably, investors were waiting for Draghi to jump into the easing path. The fact that he didn't has only fueled the ongoing uncertainties.

In the meantime, the pair is unable to fall, but the upward potential is quite limited in the current environment, as there are no reasons for an EUR rally, nor technical, neither fundamental. The pair seems nowhere near of leaving its lethargy right now, as in fact, it has been ranging since March 2015, of course, within a wider range, but range at the end. There's a major support area, clear in the weekly chart around 1.0800/40, and it would take a clear break below the level to talk about a bearish continuation. Luckily, next week, the pair can reach it.

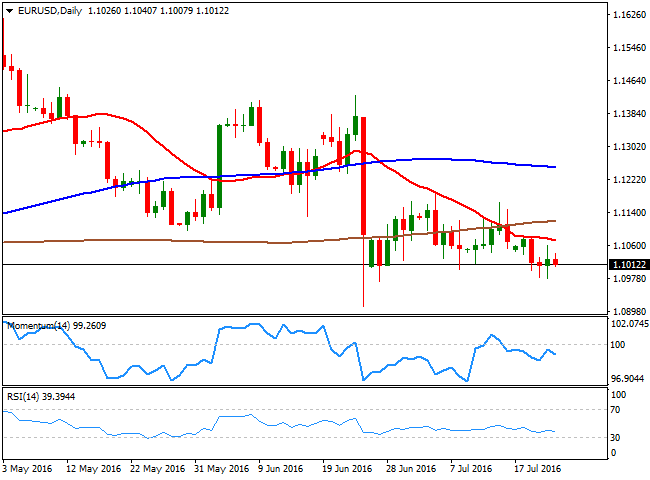

Technically, and according to the daily chart, the risk is towards the downside, as the 20 SMA maintains a strong bearish slope after crossing below the 100 and 200 SMAs, while the Momentum indicator faltered around its mid-line before resuming its decline and the RSI indicator heads lower around 39. There's an immediate support at 1.0960/70, followed by 1.0910, the post-Brexit low. Below this last, the long term mentioned region at 1.0800/40 is the next probable bearish target.

The 1.1100 level is the immediate resistance, with some steady gains above it favoring a test of the higher end of the range, 1.1190. Gains beyond this last are not seen, but the pair can gain momentum on a break above it, with scope then to extend its rally up to the 1.1250 region, as the most.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.