EUR/USD

Consolidating after bearish reversal.

-

EUR/USD recovery rally has faded below declining trend line at 1.1292. Hourly support is given at 1.1196 (23/09/2016 low). Key resistance is given at 1.1352 (23/08/2016 high) then 1.1428 (23/06/2016 high). Strong support can be found at 1.1046 (05/08/2016 low). Expected to decline towards 1.1100.

-

In the longer term, the technical structure favours a very long-term bearish bias as long as resistance at 1.1714 (24/08/2015 high) holds. The pair is trading in range since the start of 2015. Strong support is given at 1.0458 (16/03/2015 low). However, the current technical structure since last December implies a gradual increase.

GBP/USD

Stalled near the declining trendline.

-

GBP/USD is back below 1.300 after a weak attempt at declining trendline. Persistent selling pressure suggests further weakness. Hourly resistance is given at 1.3121 (22/09/2016 high). Key resistance lies at 1.3445 (06/09/2016 high). Hourly support can be found at 1.2947. Expected to show continued downside pressures.

-

The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

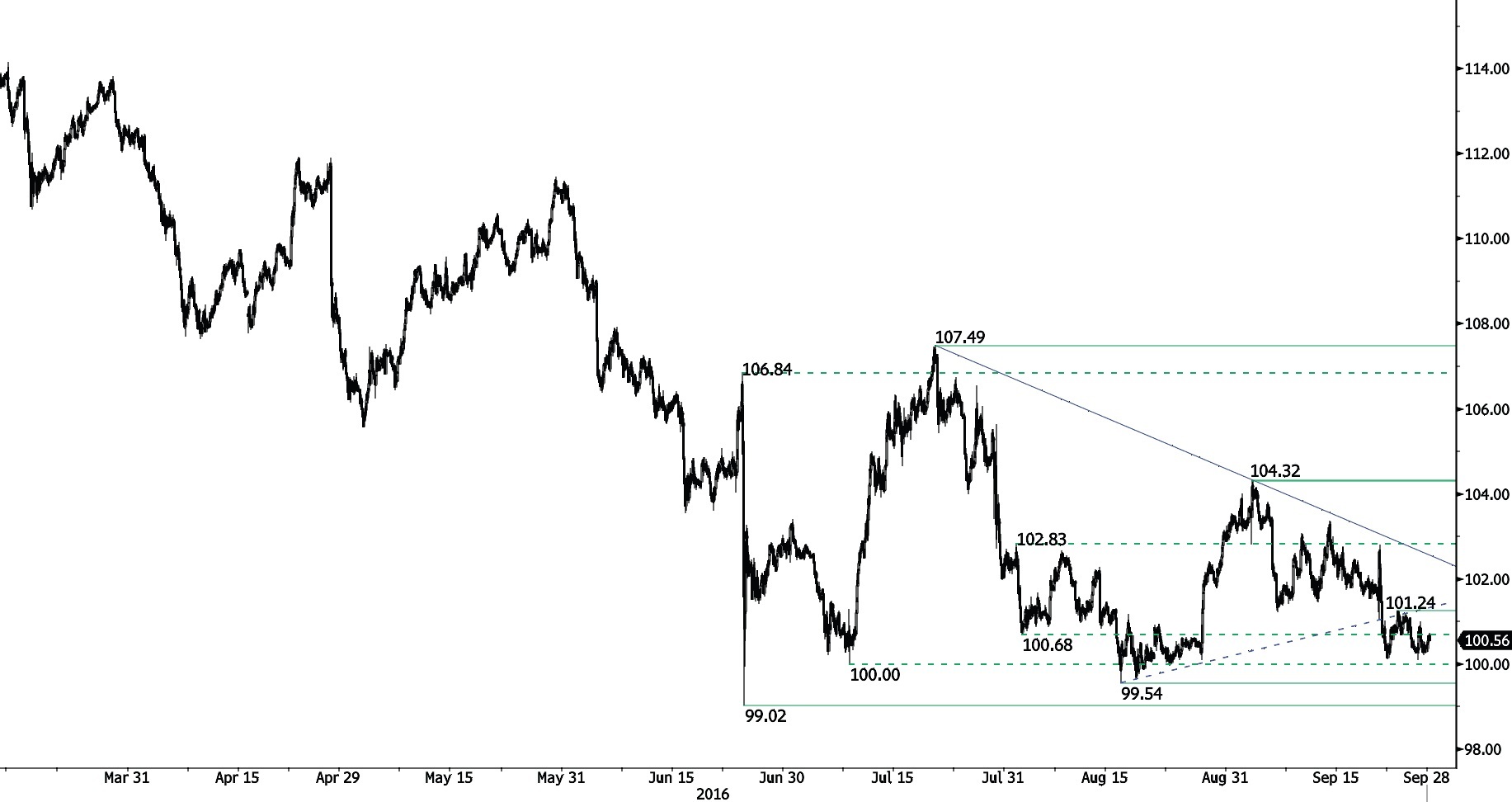

USD/JPY

Recovery bounce weak.

-

USD/JPY rally remains weak below hourly resistance at 101.24, with bullish rallies losing momentum. A break of resistance is needed to suggest something more than a temporary rebound. Strong resistance can be found at 104.32 (02/09/2016 high) while hourly resistance is given at 102.79 (21/09/2016 high). Psychological support at 100 is not far away. A key support lies at 99.02 (24/06/2016 low). Expected to further weaken.

-

We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF

Sideways bounce.

-

USD/CHF has bounced close to the strong support at 0.9632. However, as long as prices remain below the resistance at 0.9885 (01/09/2016 high), the short-term technical structure is negative. There are alternating periods of strong and low volatility and the pair seems without direction. Next resistance lies at 0.9956 (30/05/2016 high).

-

In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.

USD/CAD

Fading near the resistance at 1.3253.

-

USD/CAD has broken the resistance implied by its horizontal July high, confirming an improving technical structure. However, the resistance area between 1.3253 and 1.3405 will likely be hard to break. Minor support can be found at 1.3176 (declining trendline) then 1.3000 (22/09/2016 low).

-

In the longer term, the pair is still trading below its 200-day moving average. Strong resistance is given at 1.4690 (22/01/2016 high). Long-term support can be found at 1.2461 (16/03/2015 low). The pair is likely in a consolidation phase within a new long-term decline.

AUD/USD

The resistance at 0.7676 has been breached.

-

AUD/USD continues to trade close ot it rising trendline. The short-term bullish momentum is intact as long as the hourly support at 0.7600 (base low) holds. Key resistance is located at 0.7756 (10/08/2016 high). Support is found at 0.7610 (26/09/2016 and uptrend channel) and 0.7535 (21/09/2016 low).

-

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view.

EUR/CHF

Grinding higher.

-

EUR/CHF is retracing part of its recent decline. Key resistance still lies at 1.1037 (24/06/2016 high) while support can be found at 1.0826 (16/08/2016 low). We continue to consider that selling pressures are very important at this level. Expected to see further weakness.

-

In the longer term, the technical structure remains positive. Resistance can be found at 1.1200 (04/02/2015 high). Yet,the ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

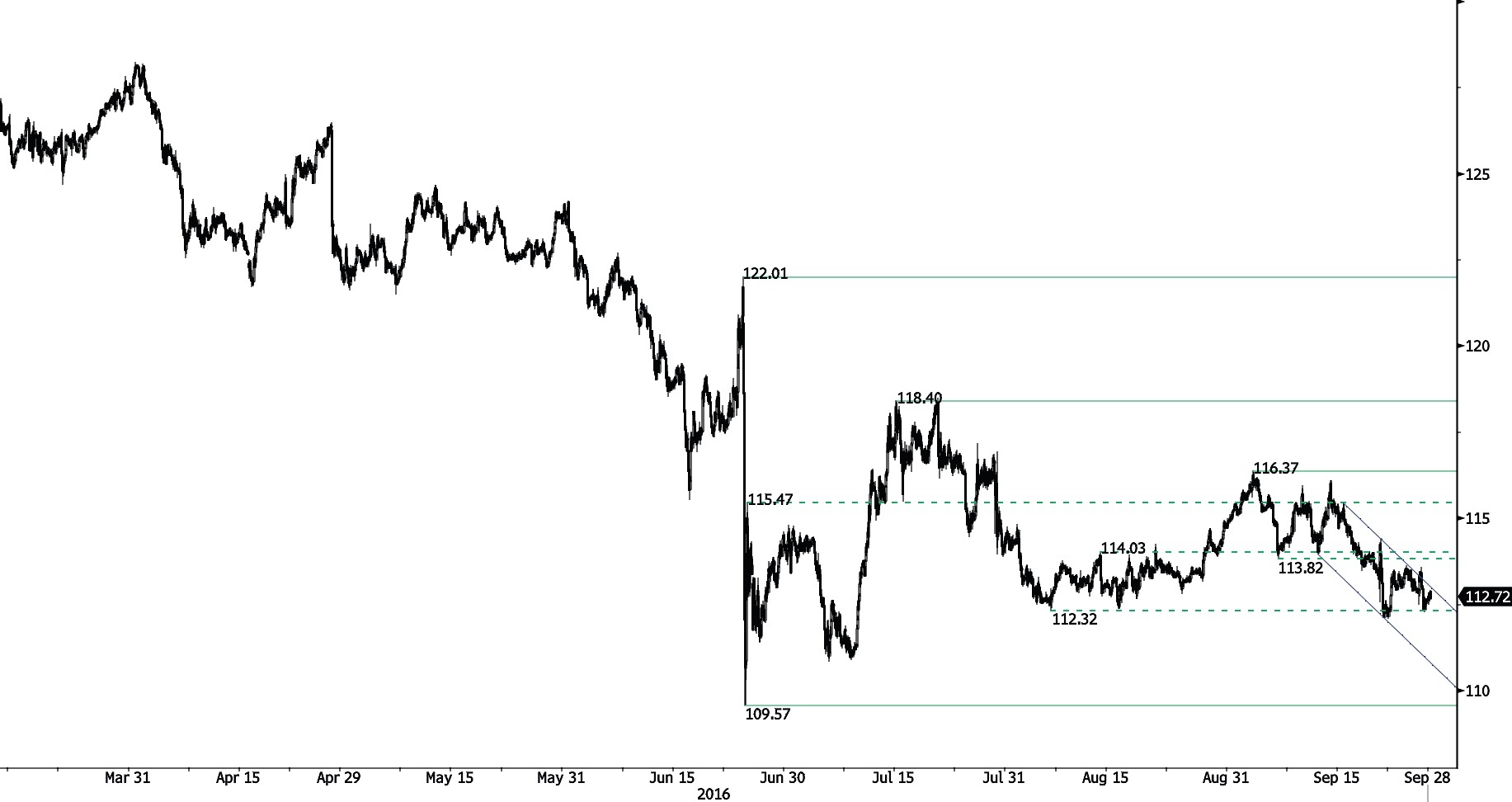

EUR/JPY

Trying to bounce.

-

EUR/JPY is trying to bounce near the support at 112.32. However, a break of the hourly resistance at 113.82 (25/09/2015 high) is needed to invalidate the current short-term bearish technical structure. Hourly support is given at 112.32 (05/08/2016 low) while hourly resistance is located at (113.22 declining trendline) then 114.40 (21/09/2016 high). The pair should head further lower.

-

In the longer term, the technical structure validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. The road is now wide open towards strong support at 94.12 (24/07/2012 low).

EUR/GBP

Rejection.

-

EUR/GBP has broken the support at 0.8598 (rising trendline) opening the way for further weakness. Key resistance lies at 0.8725 (16/08/2016 high) while hourly support can be found at 0.8535 (19/09/2016 low). Expected to show continued weakness.

-

In the long-term, the pair is currently recovering from recent lows in 2015. The technical structure suggests a growing upside momentum. The pair is trading far above from its 200 DMA. Strong resistance can be found at 0.8815 (25/02/2013 high).

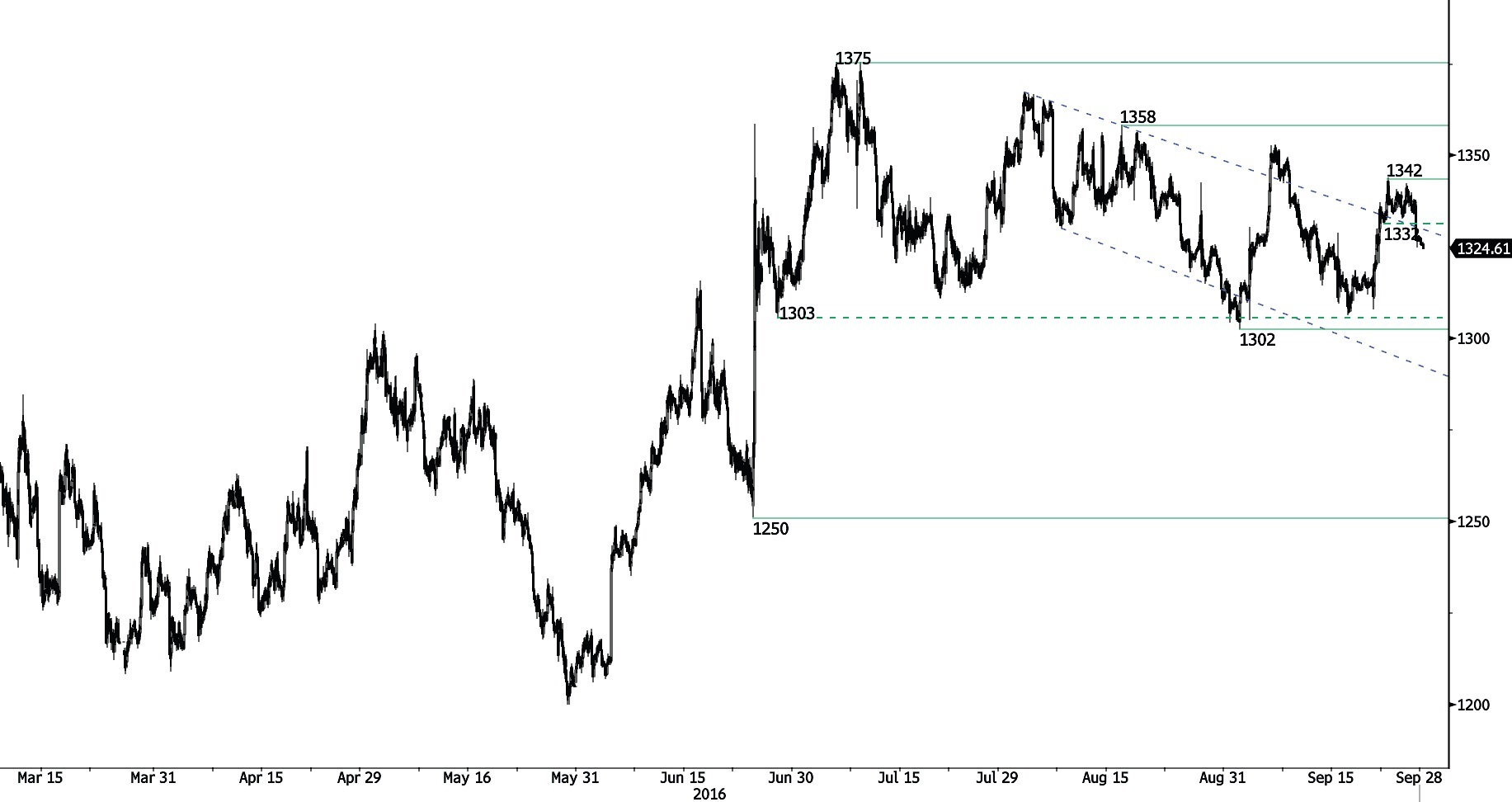

GOLD (in USD)

Bearish breakout.

-

Gold has broken the sideways channel support at 1332 opening the way for further weakness. Expect bearish pressure to hourly support at 1320 (21/09/2016 reaction low), while a key support stands at 1302 (01/09/2016 low). Hourly resistance can be located at 1337 (27/09/2016 high).

-

In the long-term, the technical structure suggests that there is a growing upside momentum. A break of 1392 (17/03/2014) is necessary ton confirm it, A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Monitor support at 18.98.

-

Silver has significantly weakened recently after break of the symmetrical triangle. Support can be found at 18.98 (rising trendline), break would trigger extension to 18.66 support. Hourly resistance is given at 20.13 (06/09/2016 high) while key resistance is given at 21.13 (04/07/2016 high).

-

In the long-term, the metal is now in an increasing uptrend. Resistance is located at 25.11 (28/08/2013 high). Strong support can be found at 11.75 (20/04/2009).

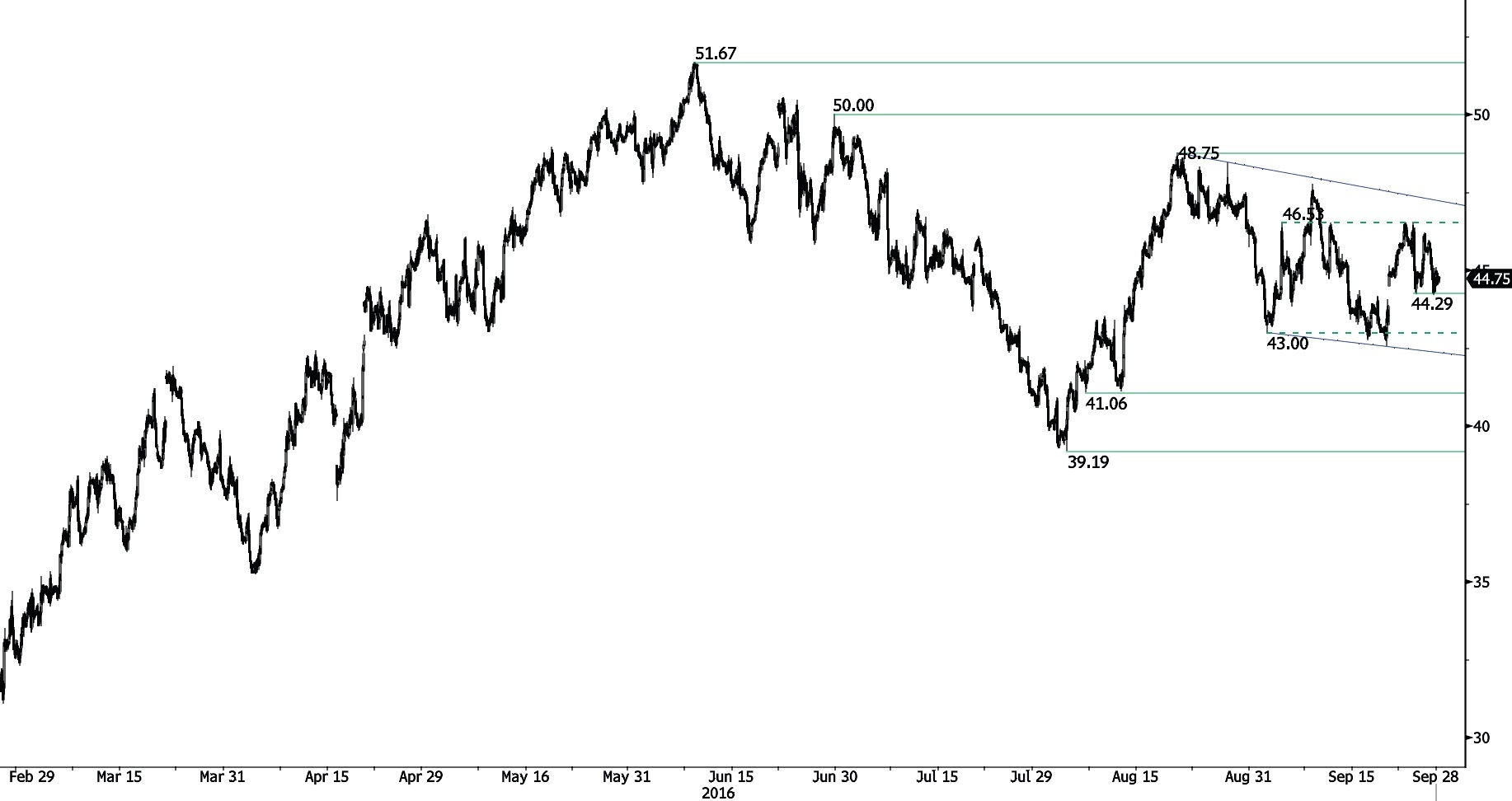

Crude Oil (in USD)

Trying to bounce.

-

Crude oil is pinned against 44.29 support confirming increasing selling pressures. Monitor the test of the support at as break would suggest bearish extension. Hourly resistance can be found at 47.75 (08/09/2016 high). An unlikely break of resistance at 47.75 would mean that buying interest is strong. Time to reload bearish positions.

-

In the long-term, crude oil is now recovering from its sharp decline and the signs of recovery are now strong. Strong support lies at 24.82 (13/11/2002) while strong resistance at 50.96 (09/10/2015 high) has been broken. Crude oil is holding way above its 200-Day Moving Average. Expected to reach 60 before year-end.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.