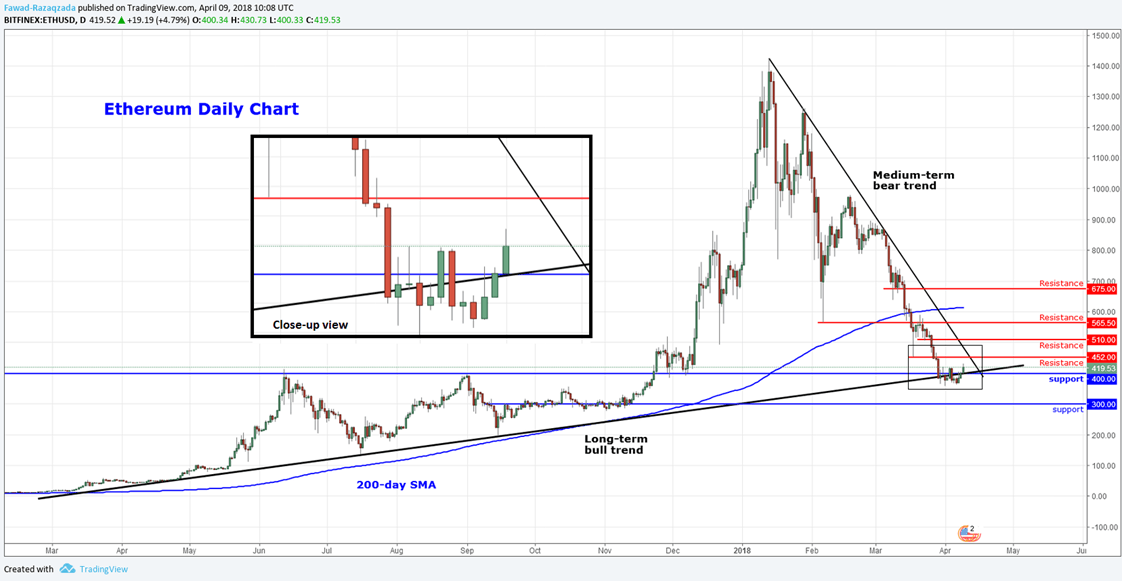

Ethereum has reached and reacted from a key support area around $400. As can be seen from the chart, this price level was a significant resistance and then support in the past, and is where a long-term bullish trend line comes into play. If the sellers were to remain in full control, they would need to hold Ethereum below this level. However, the cryptocurrency is refusing to go down without a fight. Over the past several days, it has consolidated tightly around $400 and now it looks like it wants to push higher. Granted, no technical breakthrough has yet been achieved by the bulls, but this is nonetheless a tentative bullish sign which points to waning selling pressure. The bulls would now like to see the breakdown of a few resistance levels, starting with $452, before they can become confident about a possible reversal in the trend. The next resistances are seen at $510 followed by $565, levels which were formerly support. Meanwhile if support at $400 gives way then there is little further support seen until $300. It is worth remembering that technically the trend is still bearish and the path of least resistance to the downside. Traders need to approach Ethereum with a very open mind at this stage, as we haven’t had a break in market structure of lower lows and lower highs yet. If and when we create a few higher lows and higher highs only then can we become confident about a possible trend reversal. For now, the hesitation around the $400 support level could just be a short-covering bounce, rather than anything significant. Still, the importance of the $400 support level should not be ignored. There is always the possibility that this bounce could turn into something more significant. So, watch Ethereum prices closely here.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.