We are updating the main count according to the latest price action and it is worth noting that the latest downwards movement is not as clear as we would have preferred and therefore we are adding an alternate count which explores the possibility of further decline for Cable.

At this stage, both counts have equal probabilities and as always we will wait for either count`s confirmation point to be reached to determine the highly probable count.

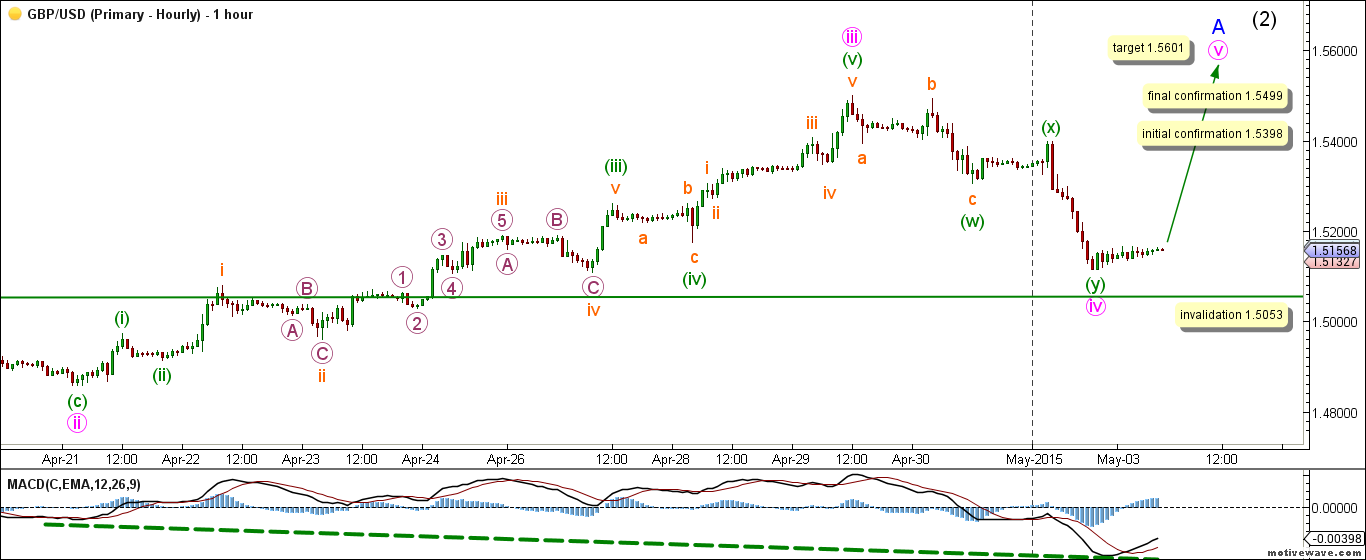

Main Hourly Count

– Invalidation Points: 1.5053

– Confirmation Point: 1.5398 — 1.5499

– Upwards Targets: 1.5601

– Wave number: v pink

– Wave structure: Motive

– Wave pattern: Impulse/Ending Diagonal

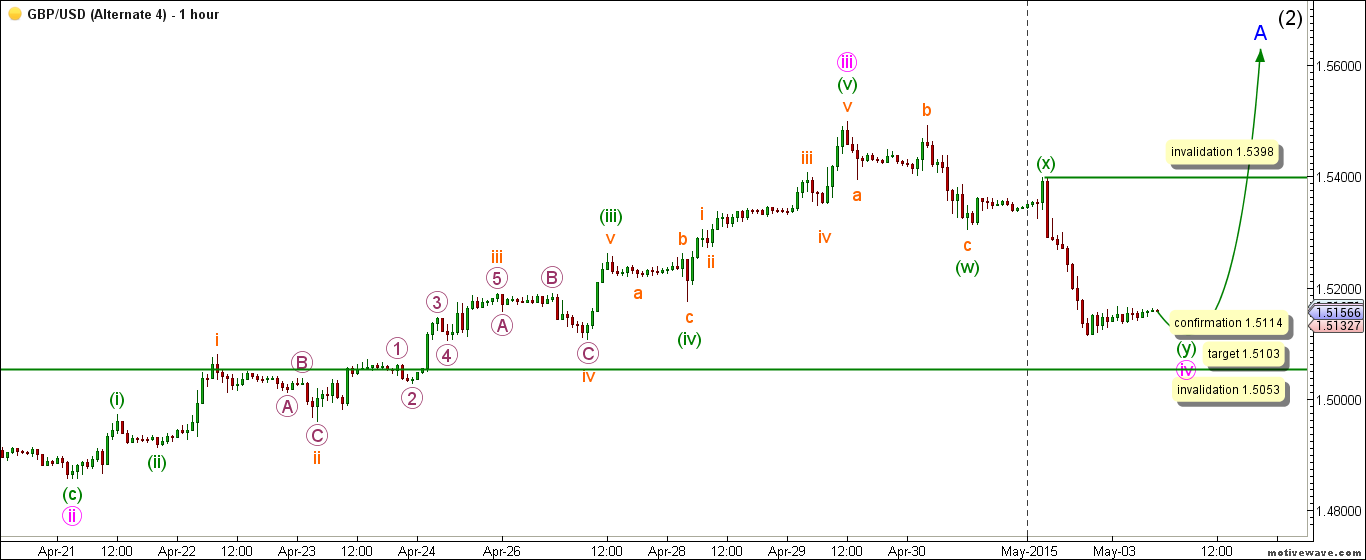

Alternate Hourly Count

– Invalidation Points: 1.5053 — 1.5398

– Confirmation Point: 1.5114

– Downwards Targets: 1.5103

– Wave number: iv pink

– Wave structure: Corrective

– Wave pattern: Double Zigzag

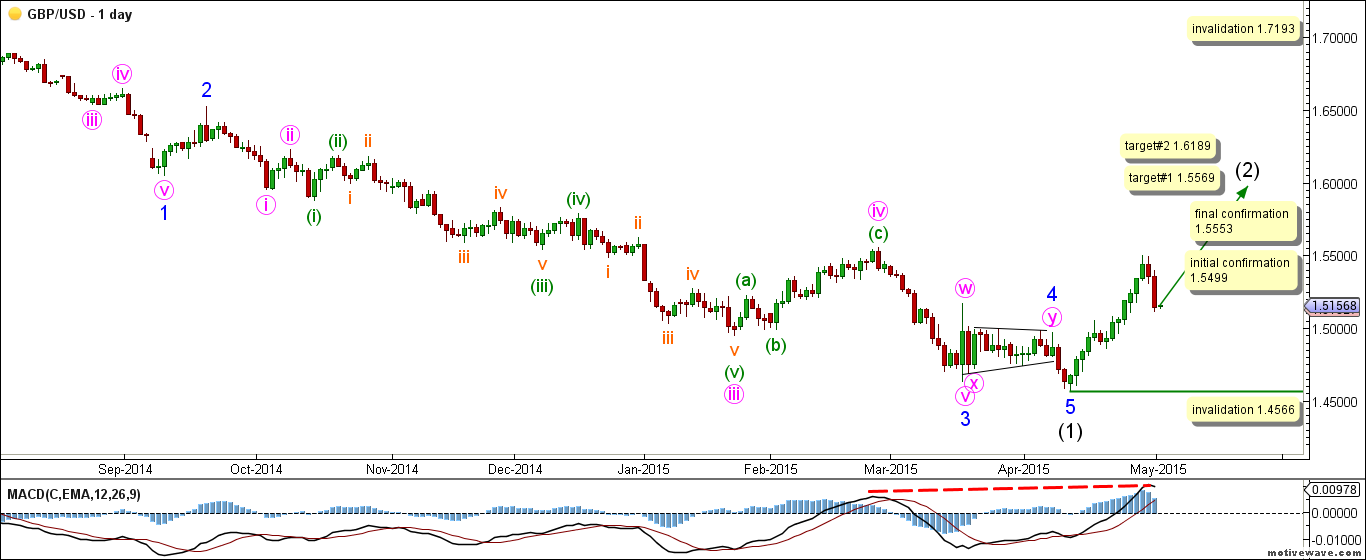

Main Daily Wave Count

This count expects that primary wave B maroon is complete as a zigzag labeled intermediate waves (A), (B) and (C) black and that primary wave C maroon is unfolding towards the downside.

Within wave C maroon intermediate wave (1) black is likely complete as an impulse labeled minor waves 1 through 5 blue and intermediate wave (2) black has started unfolding towards the upside.

Wave 1 blue unfolded as a leading diagonal labeled minute waves i through v pink.

wave 2 blue unfolded as a zigzag structure labeled minute waves a, b and c pink.

Wave 3 blue unfolded as an impulse labeled minute waves i through v pink.

Wave 4 blue unfolded as a triangle labeled minute waves a through e pink.

As far as MACD study goes, We can see the start of a bearish divergence on the daily MACD as MACD is starting to register higher highs while price action did not follow suite.

This count would be initially confirmed by movement above 1.5499 and the final confirmation point is at 1.5553 .

At 1.5569 wave (2) black will reach 0.382 the length of wave (1) black and at 1.6189 wave (2) black will reach 0.618 the length of wave (1) black.

This count would be invalidated by movement above 1.7193 as wave (2) black may not retrace more than 100 % the length of wave (1) black. As well, this count would be invalidated by movement below 1.4566 as within wave A blue within wave (2) black no second wave may retrace more than 100 % the length of the first wave.

Main Hourly Wave Count

This count expects that minor wave (1) black is complete and that wave (2) black has started unfolding towards the upside.

Wave 5 blue unfolded as an impulse labeled waves i through v pink.

Wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

Within wave (2) black, it is expected that wave A blue is unfolding towards the upside as an impulse labeled waves i through v pink with waves i through iii pink likely complete and wave iv pink is underway.

Wave i pink unfolded as an impulse labeled waves (i) through (v) green.

After the completion of wave i pink, wave ii pink unfolded as zigzag towards the downside labeled waves (a), (b) and (c) green.

Wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

Wave (iii) green unfolded was an extended third wave labeled waves i through v orange.

Wave ii orange unfolded as a zigzag labeled waves A, B and C purple.

Wave iii orange unfolded as an impulse labeled waves 1 through 5 purple.

Wave iv orange unfolded as a zigzag labeled waves A, B and C purple.

Following the completion of wave (iii) green, wave (iv) green unfolded as a zigzag labeled waves a, b and c orange.

To complete wave iii pink, wave (v) green unfolded towards the upside as an impulse labeled waves i through v orange.

Wave iv pink is likely complete as a double zigzag labeled waves (w), (x) and (y) green. The subdivisions within wave (y) green are not as clear as we would have preferred, the alternate count covers the possibility of an incomplete wave (y) green.

This count would be initially confirmed by movement above 1.5398 and the final confirmation point is at 1.5499.

At 1.5601 wave v pink will reach equality with wave i pink.

This count would be invalidated by movement below 1.5053 as wave iv pink may not enter price territory of wave i pink and it should be noted that the invalidation point will be moved to the end of wave iv pink once we have confirmation on the hourly chart that wave v pink is unfolding towards the upside.

Alternate Hourly Wave Count

The difference between both main and alternate counts is within the subdivisions of wave (y) green within wave iv pink. This count expects that wave iv pink has more to offer towards the downside.

Wave iv pink is expected to be unfolding as a double zigzag labeled waves (w), (x) and (y) green with waves (w) and (x) green complete and wave (y) green is unfolding towards the downside.

Wave (w) green unfolded as a zigzag labeled waves a, b and c orange.

This count would be confirmed by movement below 1.5114.

At 1.5103 wave iv pink will reach 0.618 of wave iii pink.

This count would be invalidated by movement below 1.5053 as wave iv pink may not enter price territory of wave i pink and as well this count would be invalidated by movement above 1.5398 as within wave (y) green no B wave may retrace more than 100 % of an A wave.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.