Last week, Cable unfolded as expected and target was reached and exceeded. That indeed was a beautiful setup to watch unfolding.

This week Cable does not provide us with the same opportunity we had last week as this week`s opportunity is not as clear, however -as traders- we do not expect the market to be that clear all of the time. We gather clues and wait for the next ride.

We are updating the main count according to the latest price action and as well adding an alternate count which expects that Cable`s correction is incomplete.

As always we will wait for either count`s confirmation point to be reached to determine the highly probable count.

P.S.: I tried recording this week`s video analysis but as I am going through an acute case of Tonsillitis, my voice is barely audible and the audio quality was quite bad. Please accept my apologies for not publishing the video analysis this week.

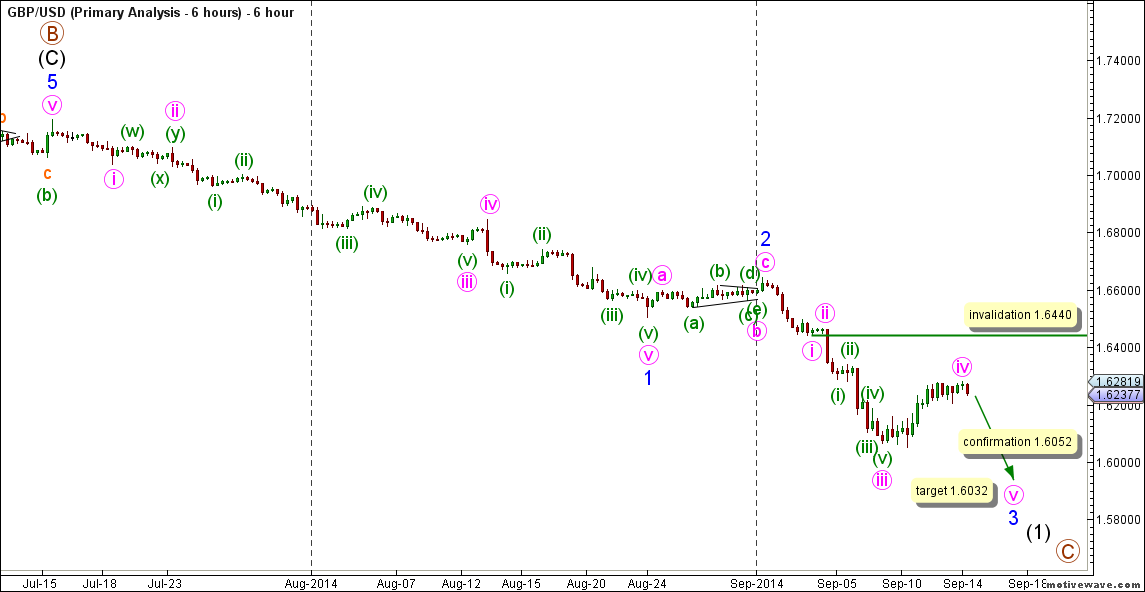

6-Hours Main Count

- Invalidation Point: 1.6440

- Confirmation Point: 1.6052

- Downwards Target: 1.6032

- Wave number: v pink

- Wave structure: Motive

- Wave pattern: Impulse/Ending diagonal

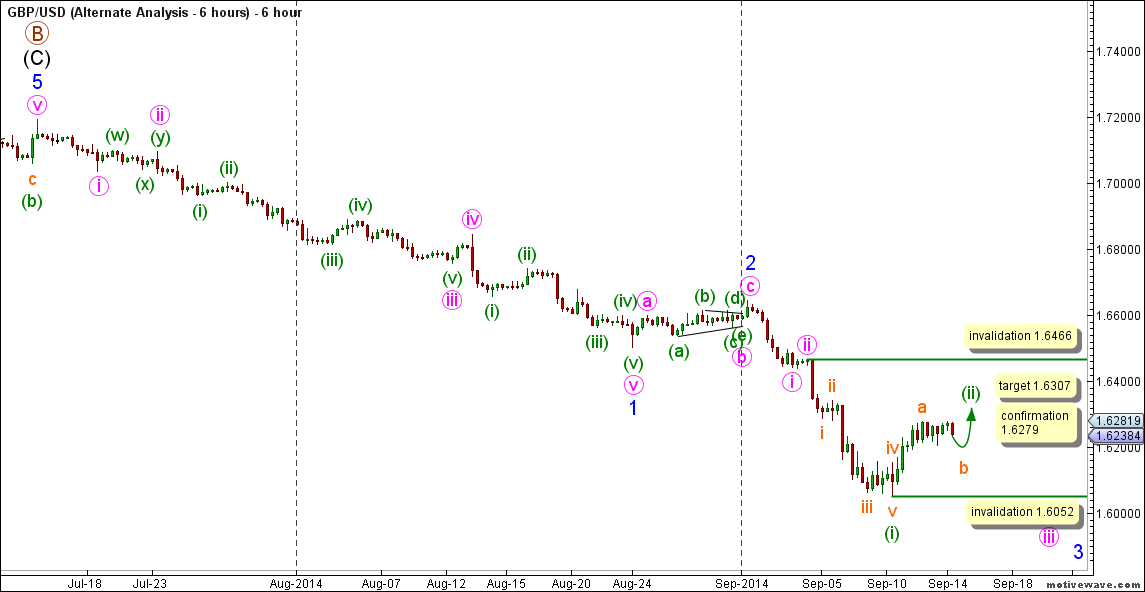

6-Hours Alternate Count

- Invalidation Point: 1.6466 -- 1.6052

- Confirmation Point: 1.6279

- Downwards Target: 1.6307

- Wave number: (ii) green

- Wave structure: Corrective

- Wave pattern: Zigzag

Main Wave Count

This count expects that wave B maroon is complete as a zigzag labeled waves (A), (B) and (C) black and that wave C maroon is starting to unfold towards the downside.

Wave (C) black within wave B maroon unfolded as an impulse labeled waves 1 through 5 blue.

Within wave C maroon wave (1) black is expected to be underway with waves 1 and 2 blue complete and that wave 3 blue is underway.

Wave 1 blue unfolded as an impulse labeled waves i through v pink.

Wave ii pink unfolded as a double combination labeled waves (w), (x) and (y) green.

Wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

Wave v pink unfolded as an impulse labeled waves (i) through (v) green.

Wave 2 blue unfolded as a zigzag labeled waves a, b and c pink with wave b pink unfolding as a triangle labeled waves (a) through (e) green.

Within wave 3 blue waves i through iii pink are expected complete and as well it is expected that wave iv pink is likely complete and that wave v pink is starting to unfold towards the downside.

Wave iii pink unfolded as an impulse labeled waves (i) through (v) green.

This count would be confirmed by movement below 1.6052.

At 1.6032 wave v pink will reach 0.618 the length of wave iii pink.

This count would be invalidated by movement above 1.6440 as wave iv pink may not enter the price territory of wave i pink and it should be noted that the invalidation point will be moved to the end of wave iv pink once we have confirmation on the hourly chart that wave v pink is underway.

Alternate Wave Count

This count expects that wave iii pink is extending towards the downside with wave (i) green complete as an impulse labeled waves i through v orange and that wave (ii) green is at its late stages.

Within wave (ii) green wave a orange is expected complete and wave b orange is unfolding towards the downside, following the completion of wave b orange, wave c orange is expected to unfold towards the upside to complete wave (ii) green.

This count would be confirmed by movement above 1.6279.

At 1.6307 wave (ii) green will reach 0.618 the length of wave (i) green and we should pay extra attention to sign of trend exhaustion near that target level as that target represents the end of a corrective phase and the start of a powerful impulsive decline and we would not want to be caught on the wrong side of the trade.

This count would be invalidated by movement above 1.6466 as wave (ii) green may not retrace more than 100 % the length of wave (i) green and as well this count would be invalidated by movement below 1.6052 as wave b orange may not retrace more than 100 % the length of wave a orange.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.