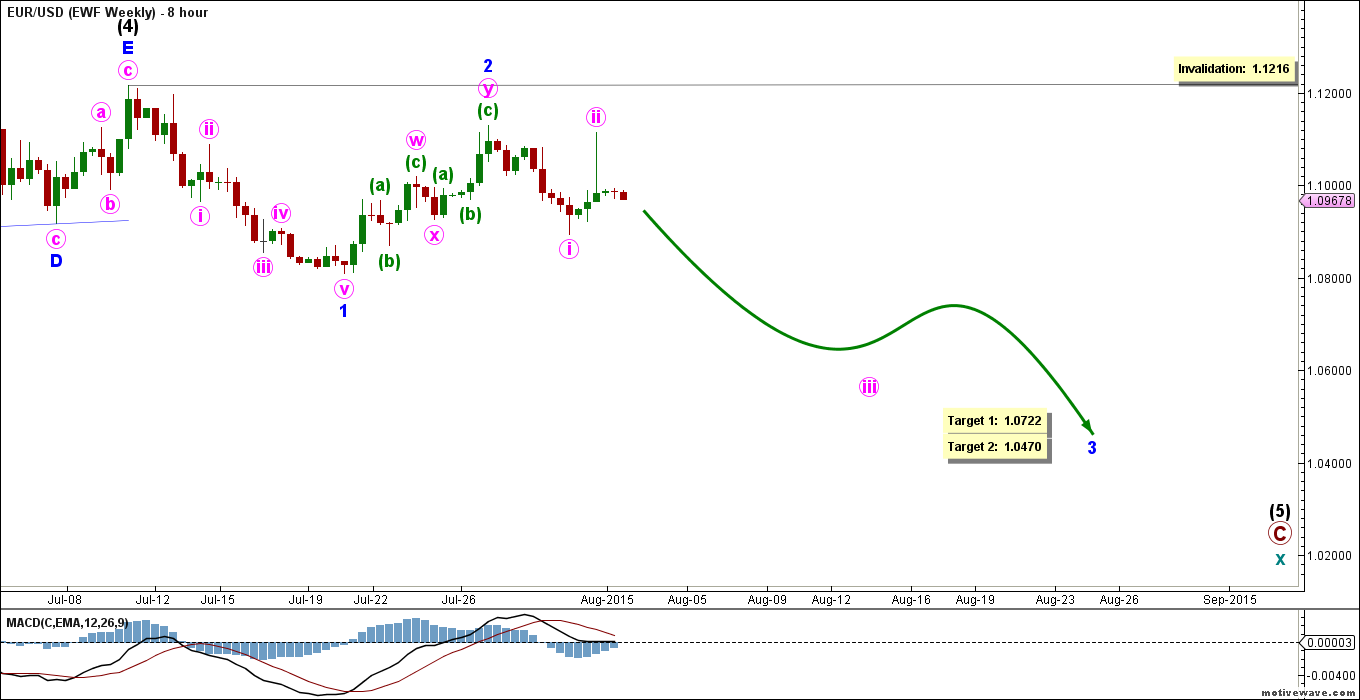

EUR/USD has been behaving consistently as expected since its recent high at 1.1216.

First, price declined over 400 pips in a fairly impulsive manner, and then it retraced exactly 78.6% of that decline with what looks like a clear upwards double zigzag.

The stage is now set for a new round of impulsive decline, and since we’re expecting a third wave, be prepared for the price action to be strong and swift.

Weekly Main Count

– Invalidation Point: 1.1216

– Confirmation Point: 1.0893 – 1.0809

– Downwards Target: 1.0722 – 1.0470

– Wave number: Minor 3

– Wave structure: Motive

– Wave pattern: Impulse

Please click on the charts below to enlarge.

Main Weekly Wave Count

This count sees that the euro is still moving towards the downside in primary wave C of cycle wave x, which is forming an impulse labeled intermediate waves (1) through (5).

Intermediate wave (4) formed a contracting triangle labeled minor waves A through E, retracing a few pips short of 23.6% of intermediate wave (3).

Intermediate wave (5) is most likely forming an impulse labeled minor waves 1 through 5.

Within it, minor wave 1 formed an impulse labeled minute waves i through v.

Minor wave 2 formed a double zigzag labeled minute waves w, x and y, each forming a zigzag labeled minuette waves (a), (b) and (c). It retraced exactly 78.6% of minor wave 1, and it’s most likely complete.

This count expects the euro to resume moving towards the downside in minor wave 3, which will be forming an impulse labeled minute waves i through v. This will be confirmed by movement below 1.0893, with higher confirmation below 1.0809.

At 1.0722 minor wave 3 would reach 100% the length of minor wave 1, then at 1.0470 it would reach 161.8% of its length.

This wave count is invalidated by movement above 1.1216 as minor wave 2 may not move beyond the start of minor wave 1. Once price reaches our confirmation points, we may lower the invalidation point to the end of minor wave 2, which currently stands at 1.1129.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.