Morgan Stanley is out with its 2016 FX outlook and top 10 trades. The following are the key points in MS' outlook along with the list of its top 10 trades and their related rationales.

FX outlook: The Framework:

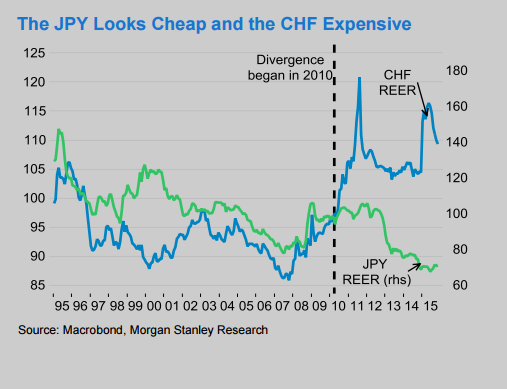

"The JPY should join the USD in outperforming relative to its G10 peers and most of EM, in our view.

Repatriation flows have pushed USD higher, as EM portfolio outflows have led to EM weakness.

Going forward, deleveraging-related EM outflows should allow a bigger degree of differentiation.

Unlike the Fed tightening cycle that began in 2004, higher US rates will likely weaken EM currencies.

Low local investment returns and rising funding costs create balance sheet pressures.

Increasing DM-EM divergence should push real EM funding costs higher, encouraging some EM central banks to run accommodative monetary conditions.

We sell most AXJ currencies (except INR and PHP).

"EUR and CHF are preferred funding currencies, while we think JPY is likely to rally," MS projects.

For latest trades & forecasts from major banks, sign-up to eFXplus

Top Trades for 2016:

1- Short GBP/JPY: Performs best in a risk-off and Brexit scenario.

2- Short CHF/JPY: Relative FX valuation and diverging monetary policies favour the JPY.

3- Long USD vs AUD, CAD, NZD and NOK Basket: Terms of trade weakness and commodity dis-investment should keep commodity FX offered.

4- Long USD vs SGD, TWD and THB Basket: Deleveraging Asian balance sheets create USD demand.

5- Long JPY vs KRW and CNH Basket: A trade benefiting from valuation differentials and Asian balance sheet deleveraging.

6- Short EUR/INR: A carry trade benefiting from high INR rates and a dovish ECB weakening the EUR.

7- Short EUR/MXN: The MXN should benefit from relatively unleveraged balance sheets and strong US trade.

8- Long USD/BRL: We expect a downgrade to non-investment grade, which should drive capital outflows.

9- Long USD/PLN: Upcoming changes to the NBP may bring about new risks for PLN, and widen the USD supportive yield spread.

10- Short CAD/RUB: RUB should benefit from fairer valuations and high yield support. Funding via CAD partially reduces oil sensitivity.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.