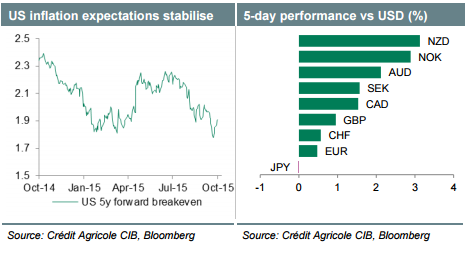

We could be at an important junction that could determine the price action in the FX markets going into year-end. The IMF meetings of central bankers and finance professionals in the next few days should tell us more about what policy action will be taken to address the growing downside risks to global growth and inflation. We worry that the lack of stimulus plans, especially in China, could undermine the latest nascent recovery in risk sentiment and drag down G10 riskcorrelated and commodity currencies. Disappointing trade data out of China next week should strengthen investors’ defensive positioning.

Next week could prove pivotal for the policy divergence trade with important releases out of the US and the UK likely to determine whether the recent aggressive repricing of Fed and BoE rate hikes has been justified. We think that the US activity and inflation data as well as the UK inflation and labour market data will highlight that investors may have overreacted selling USD and GBP of late. At the same time, we think that data out of Japan should strengthen the case for more QE at the end of the month (CACIB’s central case) and weaken JPY.

Elsewhere, Australian labour data will attract attention, especially after the RBA kept an unchanged policy stance this week. Continuing uncertainty related to Asia may keep the risk of slowing conditions intact.

What we’re watching:

JPY – CACIB economists have front-loaded their call for BoJ QE to 30 October from January 2016. We revised our year-end forecast for USD/JPY higher to 125 from 123 previously.

USD – Better-than-expected data may bring expectations of the Fed considering higher rates this year back on the agenda.

GBP – Still constructive labour market conditions as reflected in next week’s data should prevent rate expectations from falling further.

AUD – Disappointing labour data should keep RBA rate expectations strongly capped. We remain in favour of selling AUD rallies.

This content has been provided under specific arrangement with eFXnews.

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.