In its weekly note to clients, Morgan Stanley discusses its current outlook and strategy for trading the USD.

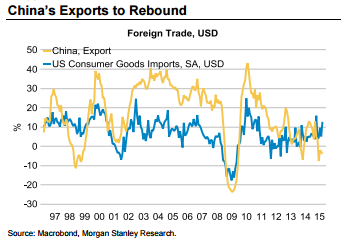

EM rally has legs: "With the help of rebounding risk appetite and rising commodity prices, we expect the EM rally to gain momentum. The detailed read of August trade statistics suggests that rising US imports ultimately mean higher Asian exports. Better Asian export data should help to contain capital outflows, which allows for greater control over monetary conditions. China cutting its RRR and interest rates should boost risk appetite further.

At the same time, markets may put fears of a quick pace of Fed tightening aside. In September, the Fed was appropriately cautious by keeping rates on hold amid low inflation expectations. Markets may anticipate a relatively flat US rate profile going forward, which should take some wind out of USD’s sail," MS argues.

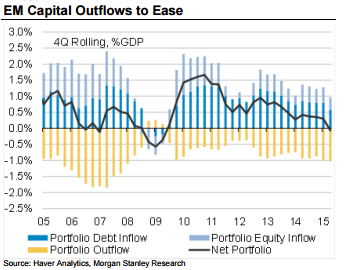

Slowing repatriation: "Nonetheless, our strongest argument for USD coming off from here is found in the analysis of flows. USD has risen on repatriation flows coming on the back of EM portfolio liquidation. Seeing EM portfolio outflows for 11 consecutive weeks (as per our daily EM flow tracker) is unusual, indicating that holdings have been reduced materially. A slight improvement in EM’s macro outlook may lead to a good rebound as investors reassess relative investment returns, especially given the higher yields being offered," MS adds.

Selling USD tactically: "We have removed all USD long positioning from our Strategic FX Portfolio. We tactically position for USD to lose another 5% from current levels, implying a decline in the Fed’s broad TWI to 113/114," MS advises.

MS runs a short AUD/USD position in its portfolio targeting a move to 0.71.

This content has been provided under specific arrangement with eFXnews.

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.