CAD is one of the top performing currencies over the past month among the major G10 countries. In fact, while it moderately declined against the USD since late October, it outperformed the rest of the G10 on the crosses. The average decline was 2.4% with JPY, NOK and AUD the biggest losers against CAD.

We still hold a short NZD/CAD in our model portfolio and also maintain a strong conviction that cross should continue to move lower. The trade is up 0.5% and we target a move to 0.8385 in the coming months.

So what’s driving CAD? We identify two important factors.

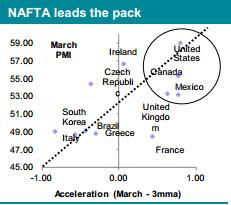

First, we note the leverage to US growth. The US economy grew at a 3.9% annualized clip in Q3 and bar the weather-induced slump in Q1 2014 growth has averaged over 4% the past year. The forward looking guidance from less volatile, high frequency data underscore that the US economy is steadily humming above its potential. Given its proximity and trading links this has spilled over to Canada’s economy. Indeed, the release of Canada’s October PMI showed both a strong level and acceleration. Among the 26 countries tracked by Markit Canada ranked third in overall growth and fourth in our measure of acceleration.

Second, the pickup in growth has fed into prices. For instance, CAD’s sharp decline in H1 2014 was driven largely dovish BoC rhetoric amid concerns about persistently low inflation. Q1 2014 marked the low in inflation and since then both the core and headline have gradually moved higher through 2014. What’s more, since January actual inflation releases have exceeded market expectations 80% of the time, which is among the highest in the G10. We suspect the recent decline in oil prices has weighed on CAD but macro fundamentals support CAD on the crosses.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.