The economic prospects index in November posted the largest monthly fall for 18 months, but it comes on the back of record highs in the previous two months and it suggests a maintenance of current robust pace of growth rather than a slowdown.

Companies’ perceptions of their own trading prospects fell slightly in November, but it is equivalent to the previous 3-month average. Moreover, the index of expected staff levels in the coming year rose.

Overall optimism fell in the industrial and consumer services sectors, but rose in business and other services. It also softened among firms in the Midlands and the South, but remains higher than companies in the North.

THE FALL IN SENTIMENT SUGGESTS GROWTH WILL STABILISE AT CURRENT ROBUST LEVELS

UK companies’ confidence about economic prospects compared with three months ago fell 13 points to 50 in November, the largest fall since May 2012, which was during the indeterminate outcome of the Greek elections, resulting in a renewed rise in euro periphery spreads. The decline in the economic prospects index this month is on the back of successive all-time highs in both September and October. Hence, despite the fall, it remains at a relatively elevated level consistent with economic growth in Q4 being at least as strong as in Q3. Indeed, the share of companies more pessimistic about economic prospects was basically in line with the recent monthly average, while there was a rise in the proportion of ‘neutral ’ firms at the expense of ‘optimistic’ firms (see Table 1).

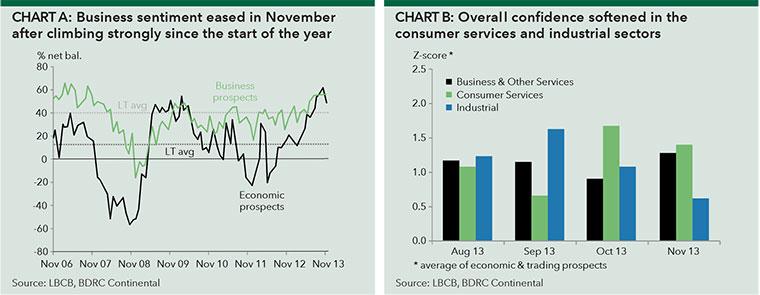

The survey’s other main question regarding companies’ perceptions of their own business prospects fell slightly, by 2 points to 57 in November, which is equivalent to the average level of the previous three months (Table 2). Moreover, the net balance on staff levels in the coming year increased 15 points to 42, the highest level since June 2011 when the question was first asked - a further sign that firms do not seem to be anticipating a marked slowdown in economic growth. Chart A shows the trends in both the economic and business prospects.

CONFIDENCE ROSE IN BUSINESS & OTHER SERVICES, BUT FELL IN OTHER SECTORS

Overall economic and business confidence continues to lag behind among companies in the North, though it was little changed on the month. In contrast, overall confidence among firms in the South and in the Midlands - while still higher than in the North - registered declines in November. From a sector perspective, overall economic and business confidence fell quite sharply in the industrial sector which now lags behind both the consumer services and business & other services sectors. The latter was the only sector where overall confidence rose in November (chart B).

Whilst care has been taken in the preparation of the content of this report, we disclaim (to the extent permitted by law) all warranties, express or implied, as to the accuracy of the information contained in any of the materials. Neither Lloyds TSB Bank plc, Lloyds TSB Scotland plc, Bank of Scotland plc nor any party involved in creating, producing or delivering this material shall be liable for any direct, incidental, consequential, indirect or punitive damages arising out of access to, use of or inability to use the internet web site, or any errors or omissions in the content thereof. However, we do not exclude or restrict any duty or liability under the Financial Services and Markets Act 2000 or the regulatory system under that Act.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.