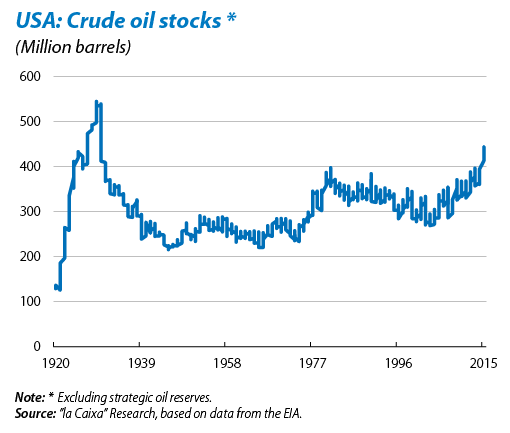

In a low-price environment (largely due to excess supply) with expectations of price increases in the future, some producers prefer to store part of their crude oil and wait for prices to rise before putting their stocks on the market. Consequently, today's abundant supply of oil has resulted in a significant accumulation of stock in most OECD countries, with the International Energy Agency estimating that stocks will be at an all-time high in OECD countries by mid-2015. However, as these stocks increase, so do storage costs as the cheaper storage facilities fill up, reducing the economic incentive to continue accumulating reserves. This smaller return could encourage some of the supply previously allocated to storage pending price rises to come onto the market, which would push down prices.

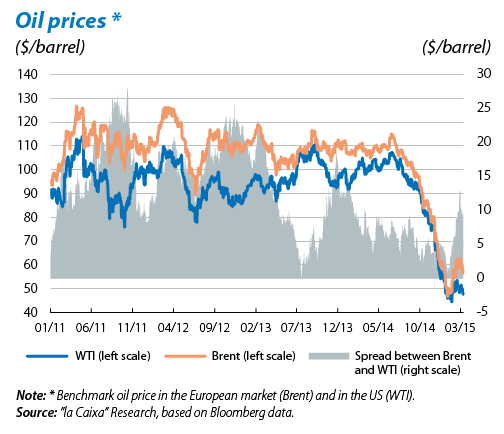

One notable fact within the current context of stock accumulation has been the larger amount of stocks amassed by the US compared with the rest of the OECD regions. The market's reaction to this sharper rise in US stocks has been swift. The spread between the Brent price and its US counterpart, West Texas Intermediate (WTI), has once again widened (see the second graph). While in 2014 the Brent price was 6.5 dollars above the WTI price on average, since mid-February the spread has been around 10 dollars.

A combination of different factors explain this larger accumulation of stock in the US, one of the main ones being the slow adjustment of US crude production. Although investment in the sector has dropped off sharply in recent months, production, which seems to have more inertia than expected, has continued to increase and is now at its highest level since the 1970s. Another factor also pushing up crude stocks is the fact that the country's oil refining capacity has been temporarily interrupted. It should be noted that US petrol firms cannot export crude (but can export refined products), a restriction that dates back to 1973 when the country was affected by an embargo imposed by numerous oil-exporting countries in retaliation for the US supporting Israel in the Yom Kippur war. Two circumstances lie behind this current interruption in oil refinement. Firstly, the maintenance that most US refineries carry out at the beginning of each year (this takes place in the second quarter in the rest of the OECD regions). Secondly, the biggest strike seen by US refineries in 35 years, affecting 12 refineries responsible for 15% of the country's oil refining capacity.

In short, the sharp increase in stocks is leading to doubts regarding the trend in oil prices in the short term. That is why we must be cautious in stating that the market has bottomed out and the possibility of further drops in price cannot be ruled out. Nonetheless, it is true that, in the medium term, the readjustment in the supply due to lower investment in the oil industry should help prices to recover.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold holds near $2,330 despite rising US yields

Gold stays in positive territory near $2,330 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, making it difficult for XAU/USD to extend its daily rally.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.