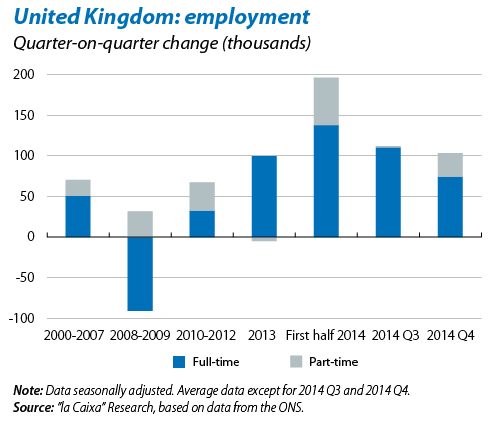

GDP has been growing by over 2% for more than a year now and the bulk of the evidence suggests that it will remain at similar levels in 2015 and 2016. The output gap (i.e. the difference between real and potential output, which reached –3% in 2012 according to the IMF) will almost be closed this year. Historically, such a situation increases pressure on prices and monetary policy therefore tends to react by tightening up financial conditions (or at least by becoming less accommodative). Another sign that spare productive capacity is already very limited are the good figures posted by the labour market. Unemployment fell to 5.9% in 2014 Q4, clearly below its historical average of 6.8%. Moreover a large part of this increase in employment corresponded to full-time contracts, indicating growing confidence that the expansionary cycle will continue for some time. Such changes in the labour market should lead to wage rises. In this respect, it is significant that the growth rate for wages was 1.7% year-on-year in 2014 Q4 (1.2% in Q3), breaking the downward slide starting in 2008.

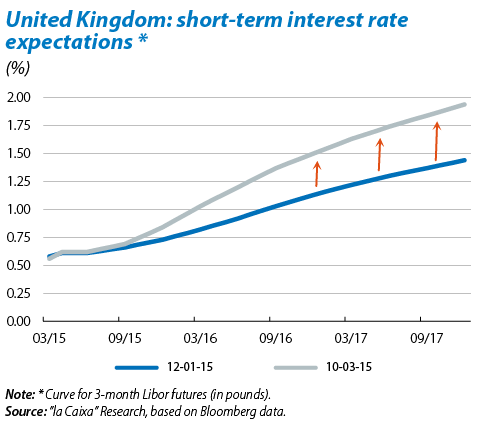

However, although data on economic activity have been surprisingly good in general, inflation has been surprisingly low in the last few quarters. The sharp drop in inflation, standing at 0.0% in February, has not been due merely to the fall in oil prices as core inflation has also shown a marked downward trend over the last few months. The pound's appreciation is playing an important role in this respect. Although inflation is likely to recover in the next few months, the absence of inflationary pressure introduces a large degree of uncertainty regarding the point when monetary policy should start to change its tune.

And as if the scenario were not complex enough already, the BoE must also bear in mind the effect of monetary policy on financial stability. The main concern in this area is the trend in house prices, up by 10% last year. The BoE is trying to contain the possible formation of another property bubble by limiting the amount of mortgage risk banks are allowed to take on.1 However, as Mark Carney has repeated on numerous occasions, the emergence of a new housing bubble is still one of the main threats to the United Kingdom's stability in the medium term.

In short, monetary policy will be the main focus of debate in the United Kingdom over the coming months. If inflation starts to pick up, as is expected, then discussion regarding the rate of interest rate hikes will also be lively. And if it does not pick up, forcing the BoE to maintain its current accommodative tone, then debate will focus on whether the pressure on house prices can be slowed up in such an environment.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.