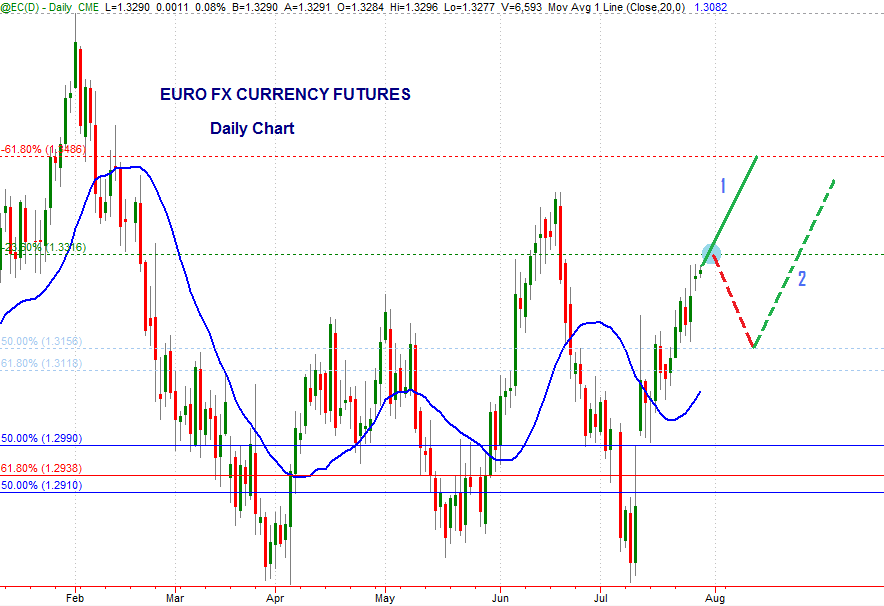

The market moved higher in the daily chart following traditional movements, modeled by our framework. The 1.3310 area is going to be 1st target for the long entry identified last week in the 1.2990 area. The second target of that long setup would be the 1.3480 area.

Picture: "Euro FX currency futures continuous contract daily timeframe, July 28th 2013"

I see two potential scenarios at the moment (refer to above picture):

Scenario 1. price of Euro could just continue higher into the 1.3480 area without pause. This is the preferred and most probable scenario.

Scenario 2. after reaching the 1.3310 area we could witness some profit taking bringing price at the the next support area starting at the 1.3160 area. There it is possible that a bounce could take place followed by a continuation higher.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.