The price increase has been accompanied by a rise in trading volume, which increased 32% week-on-week to 2.61 million BTC. This rise in volume was led by activity on Huobi, OKCoin and BTC-e.

Although OKCoin reported this week that it would calculate its futures trading volume in a new way that would double its figures, this did not affect its volume numbers in its market for spot BTC prices, it said. Read more on this issue below.

The markets like dark web busts

This week's big news came courtesy of the long arm of the law, as agencies on two continents swept through the dark web, seizing a number of markets trading in illicit goods.Code-named 'Operation Onymous', the FBI and its counterparts in the European Union and the United Kingdom arrested at least 17 individuals, shut down Silk Road 2.0 and other dark markets, and seized hundreds of Tor hidden services. Bitcoin, of course, is the de facto currency of the global dark markets.

Where did the price of bitcoin go? Perhaps counterintuitively, it went up. The price closed down just 2% as word of Onymous got out on 7th November, then rebounded by closing up a point at $344.03. In other words, the bitcoin price was higher by about $3 after the market digested the impactful news.

Intra-day prices told much the same story. The price opened at $348.23 before the operation went public, dropped to a low of $340.19 the same day, then closed the following day up, at $344.03.

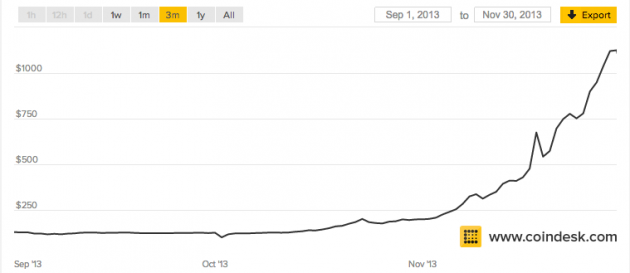

Operation Onymous, of course, comes almost exactly a year on from the FBI takedown of Silk Road, which took place on 2nd October, 2013. How did the bitcoin markets respond then?

The price had been trading in the $120s for weeks when the now infamous seizure notice appeared on Silk Road's Tor-hidden service. As one might expect, the price plunged, opening at $125.49 and hitting an intra-day low of $82. It closed 20% down on 2nd October compared to the day before.

Then something strange happened. Just as in the latest bust, the bitcoin price recovered. Last year, it rose by 17% the day after the Silk Road seizure was announced, closing at $116.32.

After the Silk Road rebound, the price began its historic rally, hitting a high of $1,147 in early December. Is the market saying it welcomes the intervention of lawmen on the dark web? Dare we hope for a repeat of a climb to those dizzying heights?

Controversial volume inflation

OKCoin took to Reddit last week to explain why its futures trading volumes had suddenly doubled. They hadn't, but the exchange was now counting each trade twice, leading to an inflated figure. The Chinese exchange justified the move by saying its competitors, Huobi and 796, were doing it too.That may be the case, but such moves only serve to undermine bitcoin traders' perception of inflated trading volumes on the Chinese exchanges. This is despite the fact that OKCoin's spot-BTC trading volumes are not affected by the new double-counting method. The zero-fee model and automated trading mean that bitcoin investors often discount the volume figures reported by the Chinese exchanges.

One derivatives trader told CoinDesk:

"I know the market is pretty sceptical in general of exchange-reported volumes, this is pretty damning proof."

He was wrong about the damning proof, of course. He had misunderstood OKCoin's announcement, taking it to mean that it had been double-counting its spot-BTC trades all along.

His sentiment is real, however, and it's one shared by many market participants. It might be prudent for exchanges to open a new front in the battle for perception of liquidity, instead of inflating volume numbers meaninglessly.

Where are the transaction fees?

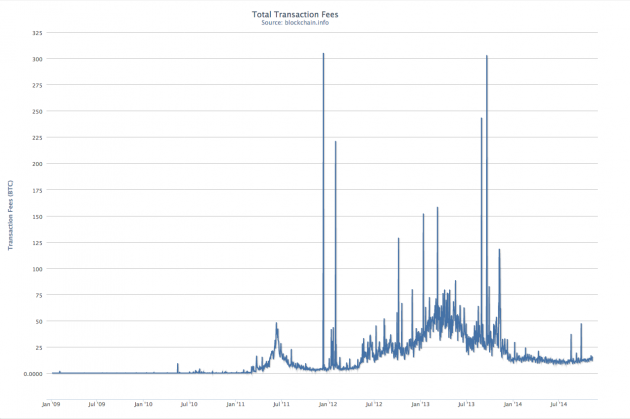

As a corollary to last week's Markets Weekly on the rising number of transactions, analyst Tim Swanson, who also works at altcoin exchange Melotic, contacted CoinDesk to highlight a few anomalies.He pointed out that, even though the number of transactions appears to have risen, he couldn't detect a corresponding increase in transaction fees or bitcoin days destroyed. Indeed, the all-time transaction fees graph as reported by Blockchain.info, is pretty flat.

This could suggest that the increased transactions aren't in the service of any real exchange in value for goods and services, Swanson said.

"Instead, it is likely a combination of advertisement spam, P2SH, mining payouts, mixing and Counterparty transactions," he said.

Swanson's guess is that transactions are rising because of non-commercial trades, meaning coin-mixing and various forms of 'blockchain 2.0' transactions.

If Swanson is right, it's hard to say how these transactions affect the bitcoin price, or what this development implies about the rate of bitcoin use and adoption in general. However, a blockchain at work is certainly a more positive signal than an idle one.

Recommended Content

Editors’ Picks

AUD/USD recovers to near 0.6450, shrugs off mixed Australian jobs data

AUD/USD is rebounding to near 0.6450 amid renewed US Dollar weakness in the Asian session on Thursday. The pair reverses mixed Australian employment data-led minor losses, as risk sentiment recovers.

USD/JPY bounces back toward 154.50 amid risk-recovery

USD/JPY bounces back toward 154.50 in Asian trading on Thursday, having tested 154.00 on the latest US Dollar pullback and Japan's FX intervention risks. A recovery in risk appetite is aiding the rebound in the pair.

Gold rebounds on market caution, aims to reach $2,400

Gold price recovers its recent losses, trading around $2,370 per troy ounce during the Asian session on Thursday. The safe-haven yellow metal gains ground as traders exercise caution amidst heightened geopolitical tensions in the Middle East.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.