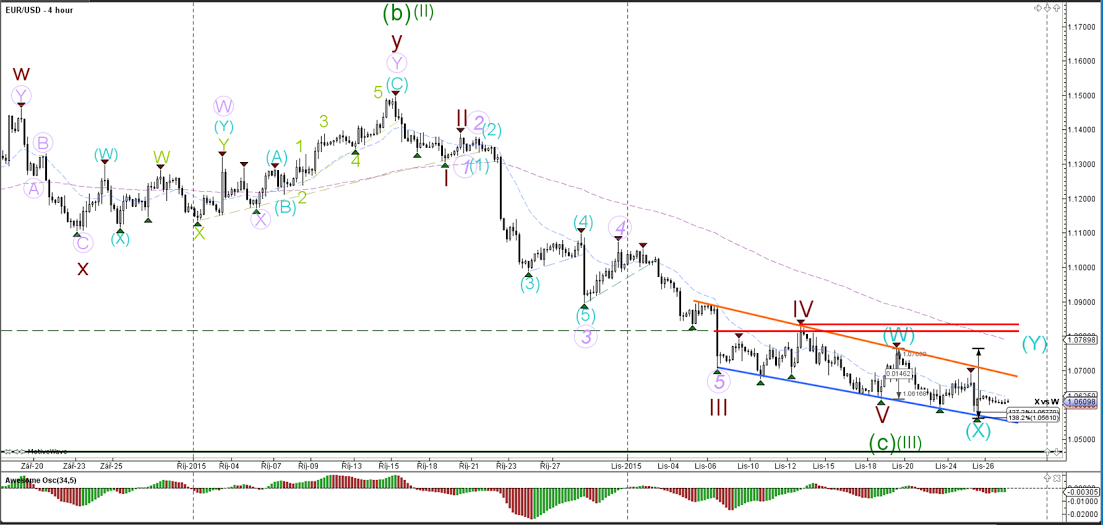

EUR/USD

4 hour

The EUR/USD remains ingrained in a downtrend channel which is indicated by the orange and blue trend lines. Price is near the year low (green) of 1.0460 which could act as a strong support level.

1 hour

The EUR/USD price action has moved sideways yesterday representing a consolidation zone. The zone could be part of a wave B (green) correction.

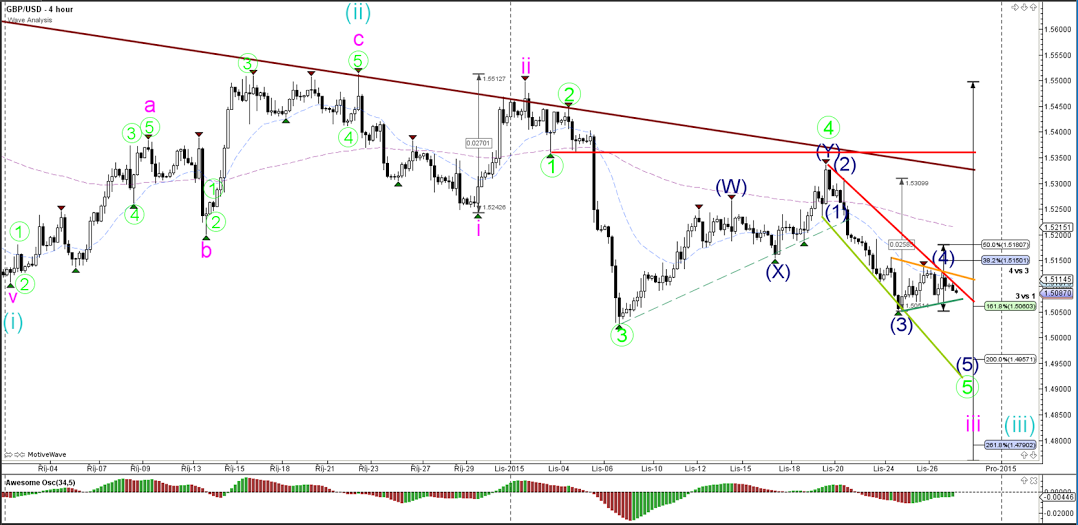

GBP/USD

4 hour

The GBP/USD is in a downtrend channel which is indicated by the support (green) and resistance (red). Price is most likely in a wave 4 (blue) correction.

1 hour

The GBP/USD is building a contracting triangle, which is indicated by the support (green) and resistance (orange/red). A break below support could see price move down towards the Fib targets. A break above the resistance trend line could see price struggle with the resistance Fibs.

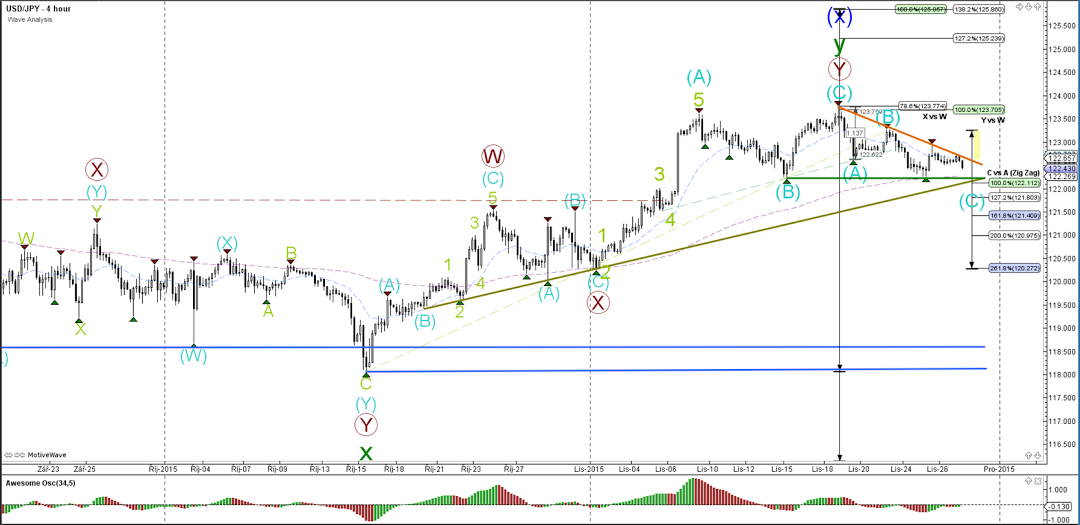

USD/JPY

4 hour

The USD/JPY turned at the 78.6% Fibonacci resistance level. A break above resistance (orange) could see price move up toward the next confluence zone of Fibs. A break below support (green) could see price move towards the Fibonacci targets of wave C (blue).

1 hour

The USD/JPY could have completed a wave 4 (green) retracement. Price broke the mini support trend line (dotted green) but a bigger bottom remains intact (solid green).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD turns south toward 0.6400 after mixed Australian jobs data

AUD/USD has come under renewed selling pressure and turned south toward 0.6400 after Australian employment data pointed to loosening labor market conditions, fanning RBA rate cut expectations and weighing on the Aussie Dollar.

USD/JPY remains below 154.50 amid weaker US Dollar

USD/JPY keeps losses for the second successive session, trading below 154.50 in Asian trading on Thursday. The pair is undermined by the latest US Dollar pullback, Japan's FX intervention risks and a softer risk tone.

Gold retreats as lower US yields offset the impact of hawkish Powell speech

Gold prices retreated from close to weekly highs during the North American session on Wednesday amid an improvement in risk appetite. The bullish impulse arrived despite hawkish commentary by US Federal Reserve officials.

OMNI post nearly 50% loss after airdrop and exchange listing

Omni network lost nearly 50% of its value on Wednesday after investors dumped the token following its listing on top crypto exchanges. A potential reason for the crash may be due to the wider crypto market slump.

US stock continue to stumble as traders rethink rates

US stocks grappled with uncertainty on Wednesday in the wake of a cautious string of commentary from the US Federal Reserve officials. The S&P 500 is currently experiencing its longest non-bullish streak in months.