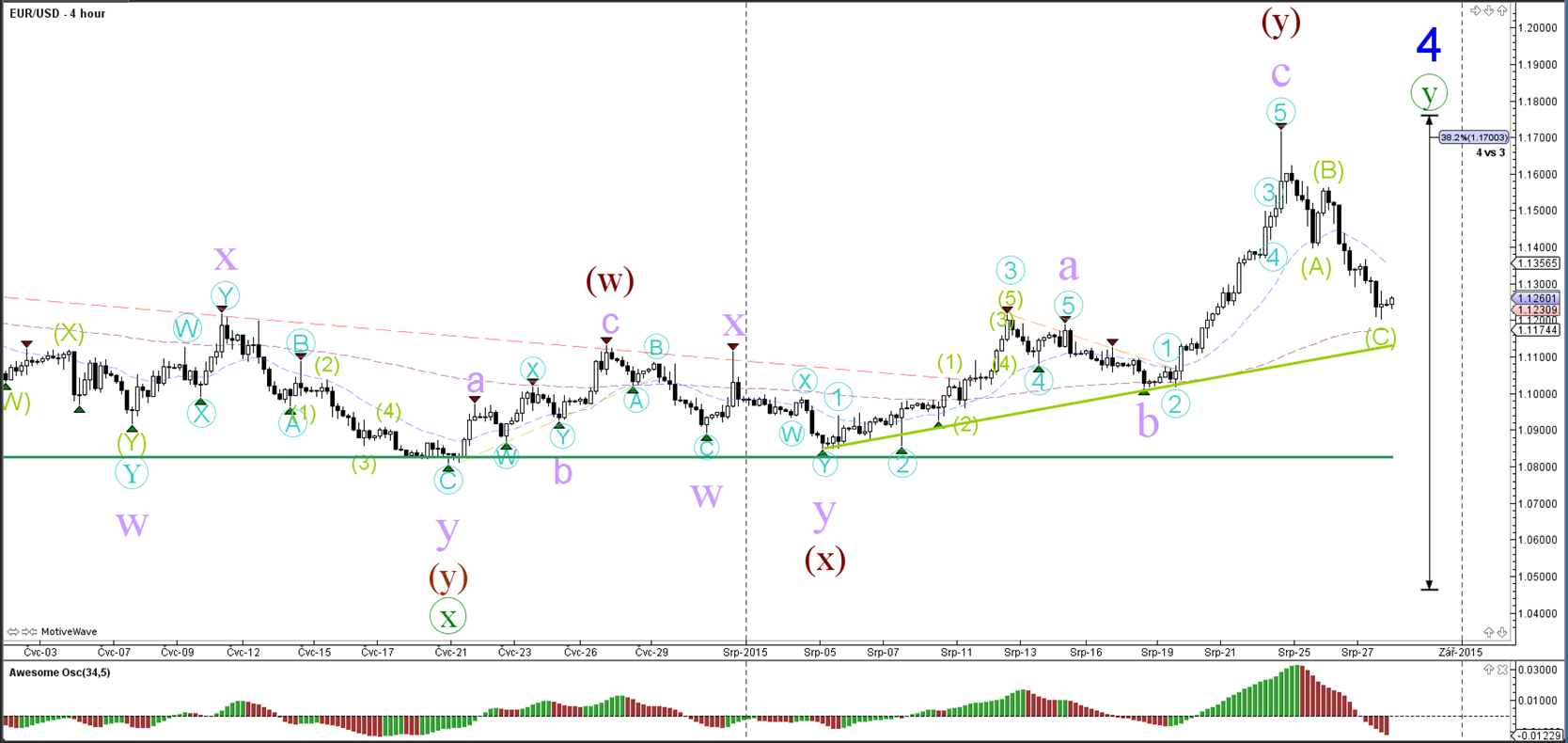

EUR/USD

4 hour

The EUR/USD bearish movement has retraced very deep which therefore favors a completed wave 5 (blue) of wave C (green) of Y (brown). Price could still expand the bullish price action after completing a potential ABC (green) zigzag pattern.

1 hour

Due to the weaker angle of price action in the 3rd leg of price movement, the bearish 3 wave pattern resembles an ABC more than a 123 pattern.

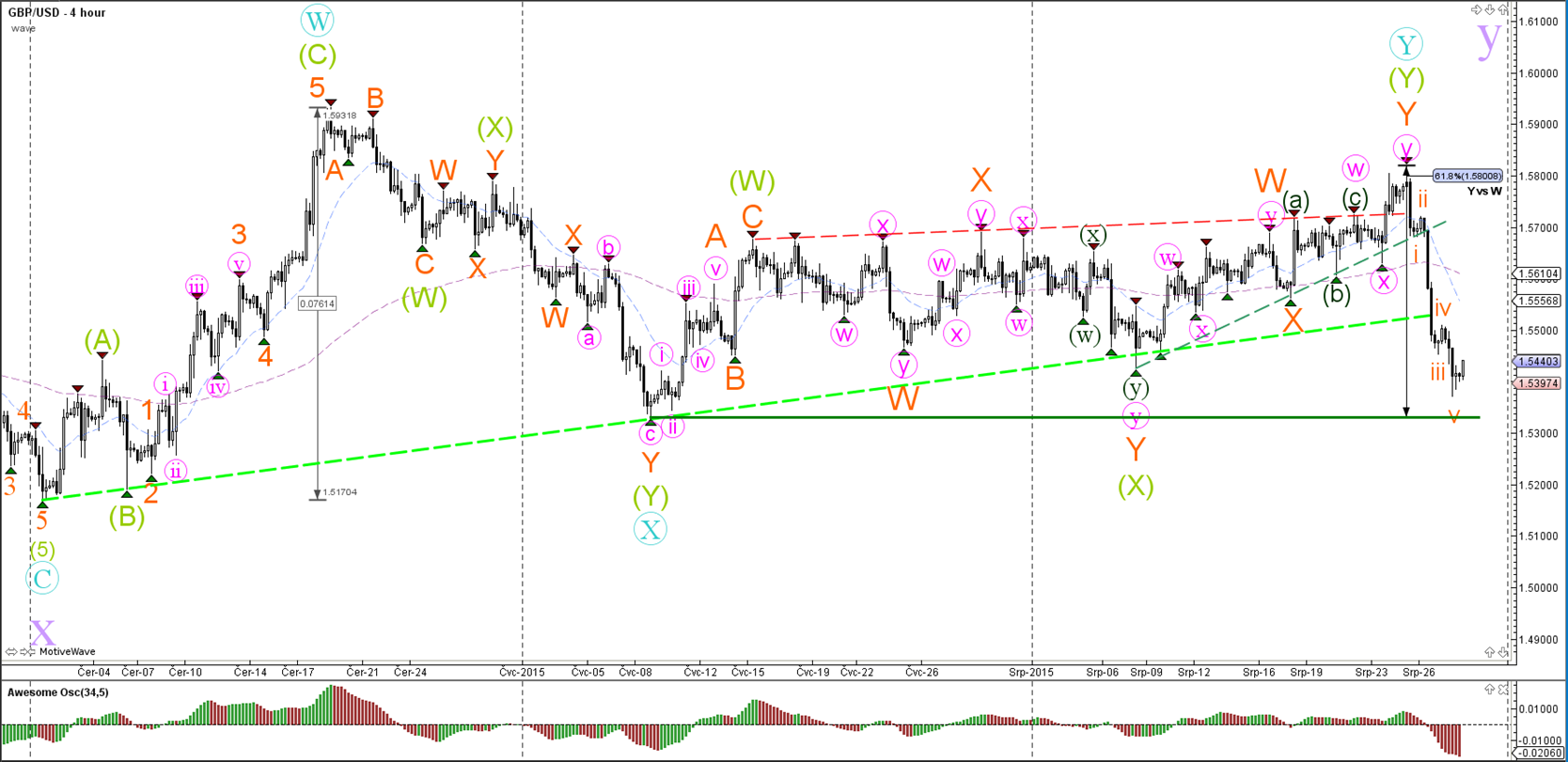

GBP/USD

4 hour

The GBP/USD broke both support trend lines (green) with a 5 wave bearish pattern (orange), which indicates that an ABC correction is now likely. A break below the bottom (green) would signal the completion of the wave Y (purple).

1 hour

Yesterday price completed a wave 4 (orange) at the 23.6% Fibonacci retracement level and made one more fall for wave 5. An ABC correction is the most likely scenario at the moment. If price does push below support then a wave extension is most likely taking place.

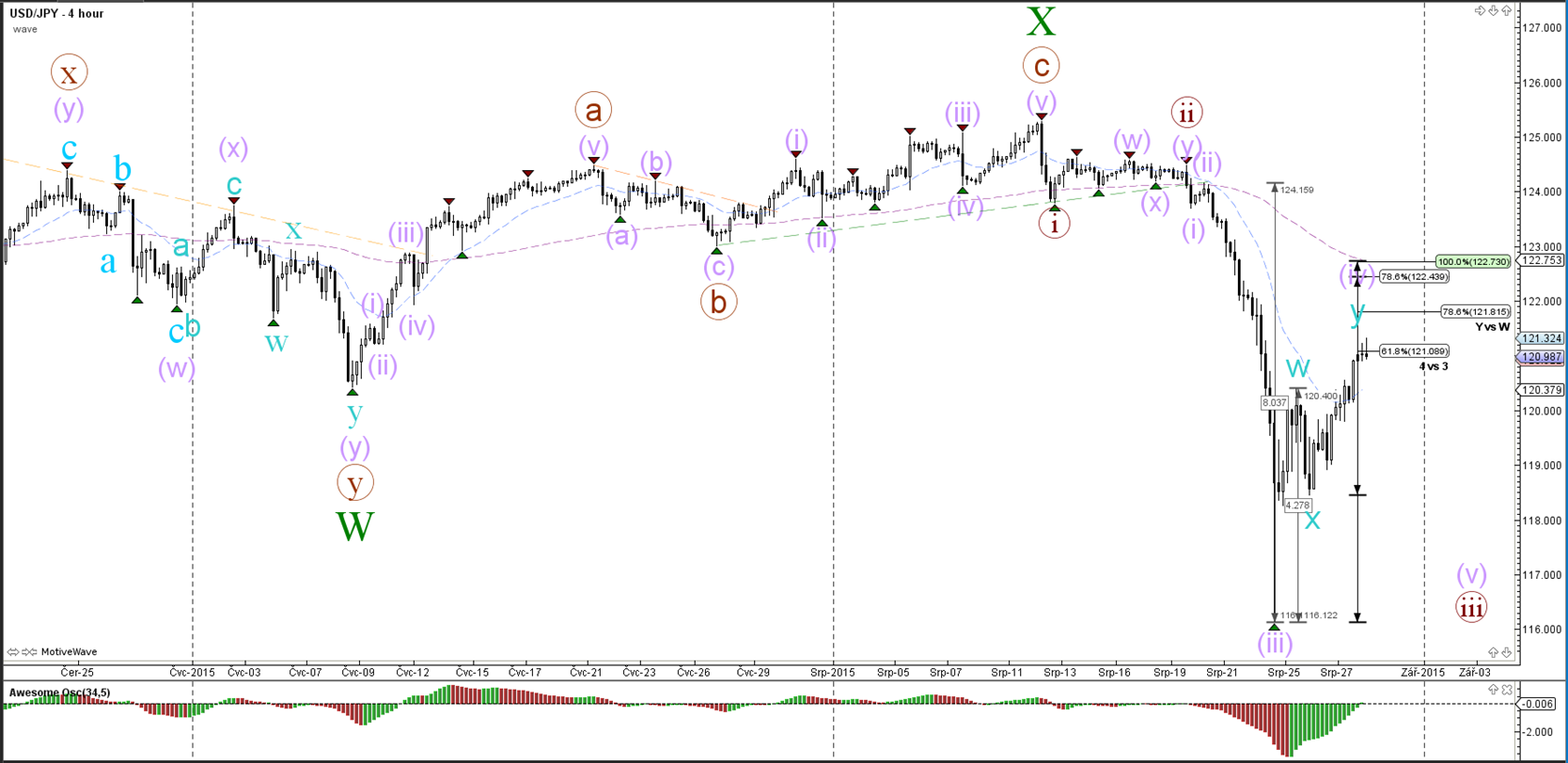

USD/JPY

4 hour

The USD/JPY’s wave count is indicating that the current retracement could be a wave 4 (purple). A deeper retracement than the 61.8% could require a wave count change.

1 hour

The USD/JPY is building a rising wedge chart pattern (green and orange) at the 61.8% Fibonacci level of a potential wave 4 (purple).

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.