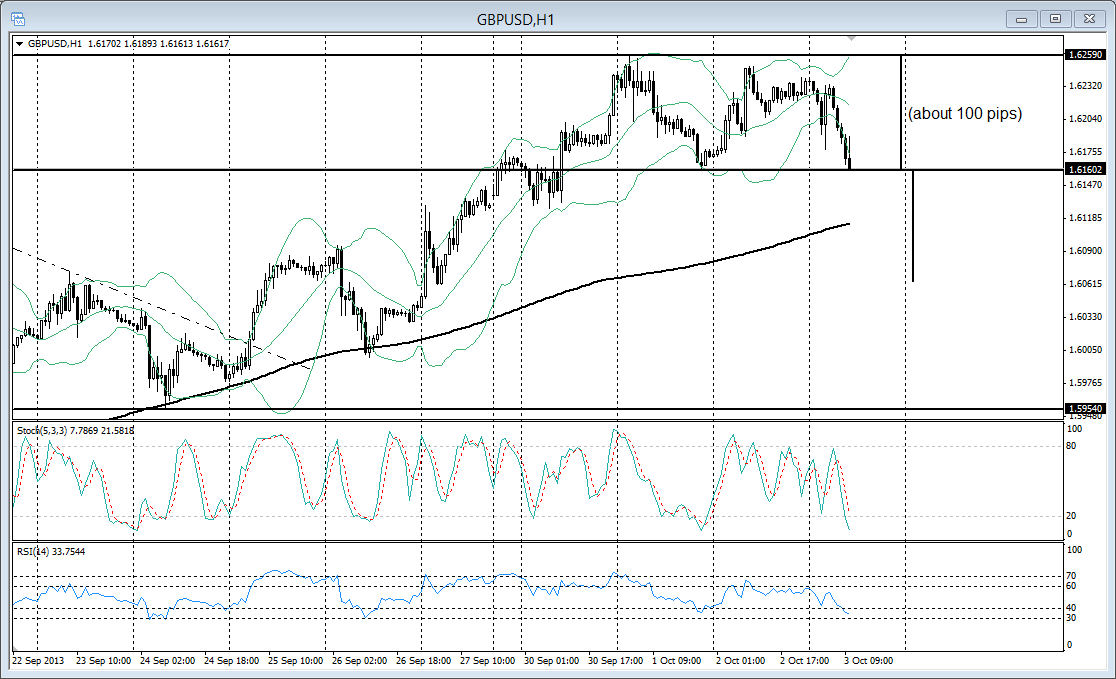

GBP/USD 1H chart 10/3/2013 10:40AM ET

Bullish: GBP/USD has been bullish since July’s and the 2013 low of 1.4812. The latest leg after a consolidation came from 1.5954 and has found resistance at 1.6259. The 1H chart shows strong bullish trend with price trading above a rising 200-hour SMA since early September. However, this bullish mode looks to be struggling at the moment.

Double top: The market failed to push above 1.6259 on 10/2 and is falling during the 10/3 session. A break below 1.6160 will complete a double top, which can suggest at least some short-term consolidation, possibly a bearish correction.

Bearish projections/supports: A conservative correction scenario would be a test of the 200-hour SMA, which has been providing support as seen during the 9/24-9/26 sessions. A breakout projection using the range of the double top targets 1.6160 – 100 = 1.6060.

The RSI is falling below 40 which shows lack of bullish momentum. Last couple of times it tagged 30, it found support and continued the bullish trend. Will this repeat if a bearish correction develops from the current double top? Or will cable start trading under the 200-hour SMA and open up the 1.5954 pivot.

The information used by ForexMinute.com including any opinions, charts, prices, news, data, Buy/Sell signals, research and analysis is provided as general market commentary and does not constitute any investment advice. ForexMnute.com is not liable for any damage or loss, including but not limited to, any loss of investment, which may be based either directly or indirectly on the use of or reliance on such information. Before deciding whether or not to take part in foreign exchange or financial markets or any other type of financial instrument, please carefully consider your investment objectives, level of experience and risk appetite. Do not invest more money than you can afford to lose.

Note that the high level of leverage in forex trading may work against you as well as for you. Please seek advice of an independent financial advisor if you are not fully aware about the risks associated with foreign exchange trading. Forex trading on margin involves considerable exposure to high risk, and may not be suitable for all investors. Global Invest does not endorse any companies, products or services which are represented on Forexminute.com The information on this website is subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.