DAILY USD/CHF TECHNICAL OUTLOOK

DAILY USD/CHF TECHNICAL OUTLOOK

Last Update At 13 Sep 2016 00:03GMT

Trend Daily Chart

Sideways

Daily Indicators

Neutral

21 HR EMA

0.9731

55 HR EMA

0.9734

Trend Hourly Chart

Sideways

Hourly Indicators

Falling

13 HR RSI

40

14 HR DMI

-ve

Daily Analysis

Choppy consolidation to continue

Resistance

0.9818 - Sep 02 high

0.9785 - Last Fri's high

0.9763 - Y'day's high

Support

0.9711 - Last Fri's low

0.9651 - Last week's (Thur) low

0.9631 - 26 Aug low

-

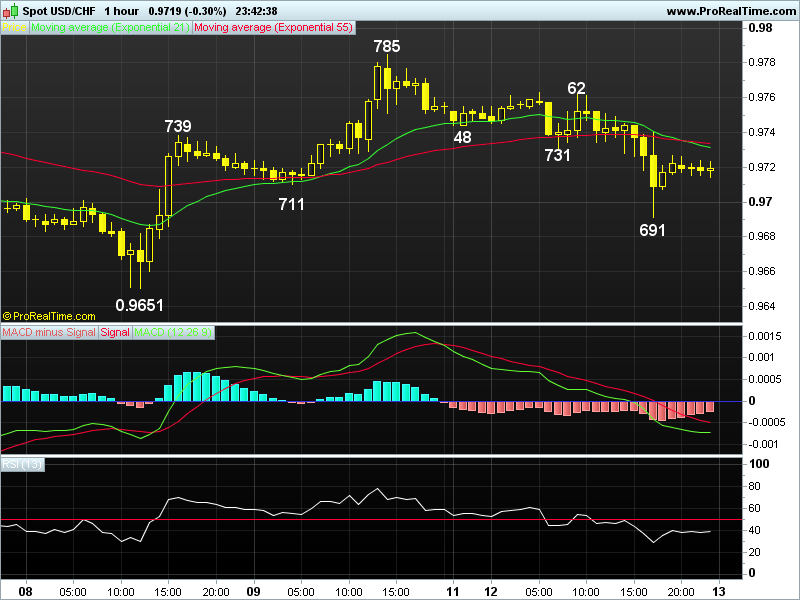

USD/CHF - 0.9719... The greenback remained under pressure on Mon partly on selling in eur/chf cross as global stocks fell. Price weakened to 0.9731 in Europe n recovered to 0.9762 but only to tumble to 0.9691 in NY b4 stabilising.

-

On the daily chart, despite dlr's early fall fm Jul's peak of 0.9951 to 0.9538 in Aug, subsequent strg rebound to 0.9885 at the start of Sep signals the 2-month long broad sideways price swings following the early rise fm 2016 bottom at 0.9444 (May) to 0.9956 would continue. Having said that, dlr's said decline fm 0.9885 to 0.9651 last Thur n then rebound to 0.9785 Fri suggests further vola tile sideways swings would continue this week, only below 0.9651 would yield weakness twd 0.9538 later this month. On the upside, a daily close abv 0.9818 res would bring re-test of 0.9951, then 0.9956.

-

Today, despite Mon's broad-based weakness in the usd on cross-selling in eur/chf to 0.9691 following Fed Brainard's dovish comments, subsequent minor rebound suggests consolidation is in store, abv 0.9762/63 res any time would sig nal pullback fm Fri's 0.9785 high has ended, then nr term rise fm 0.9651 would head to 0.9918. Only below 0.9691 may risk weakness to 0.9870 n possibly 0.9651.

Trendsetter does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Trendsetter does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Trendsetter shall not be responsible under any circumstances for the consequences of such activities. Trendsetter and its affiliates, in no event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.