DAILY EUR/USD TECHNICAL OUTLOOK

DAILY EUR/USD TECHNICAL OUTLOOK

Last Update At 27 Sep 2016 00:08GMT

Trend Daily Chart

Sideways

Daily Indicators

Neutral

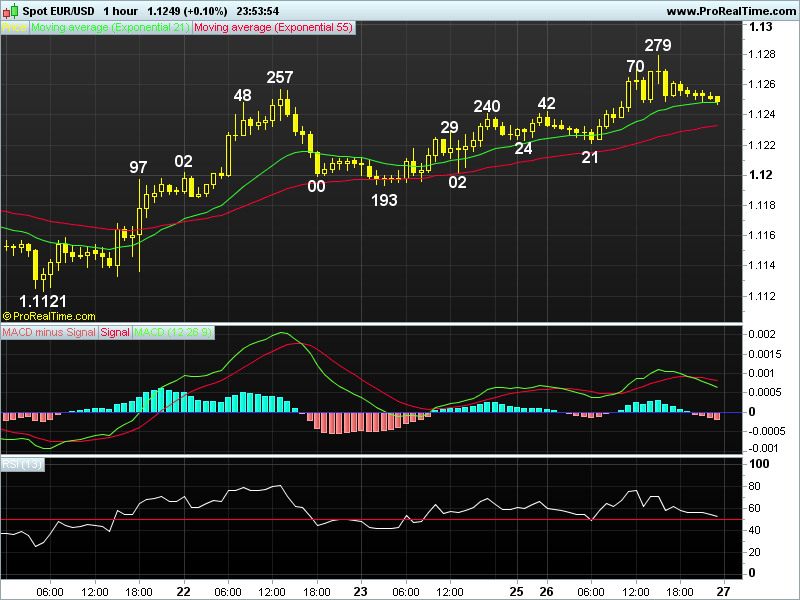

21 HR EMA

1.1248

55 HR EMA

1.1233

Trend Hourly Chart

Up

Hourly Indicators

Bearish divergences

13 HR RSI

52

14 HR DMI

+ve

Daily Analysis

Consolidation b4 one more rise

Resistance

1.1366

1.1327 - Sep's high (08)

1.1279 - Y'day's high

Support

1.1221 - Y'day's low

1.1193 - Last Fri's low

1.1149 - Sep 16 low

-

EUR/USD - 1.1250... Although euro retreated in Asia y'day after initial gain to 1.1242, renewed buying at 1.1221 lifted price, release of upbeat German Ifo sent price abv last week's 1.1257 high to 1.1279 in NY b4 retreating.

-

Looking at the daily chart, euro's erratic rise fm Jun's 3-month bottom at 1.0912 to 1.1366 in Aug confirms MT decline fm 2016 peak at 1.1617 (May) has ended there, however, the strg retreat to 1.1123 n then subsequent choppy side- ways swings suggest broad consolidation would continue. Having said, last week's rally fm 1.1121 to 1.1257 signals upside bias remains for gain to 1.1327 (Sep top), a daily close abv there would encourage for re-test of 1.1366 but break there needed to extend said MT rise fm 1.0912 to 1.1432 (Jun's high). On the downside, only below 1.1121 sup would risk stronger retracement to 1.1085 (61.8 % r), then 1.1046 b4 prospect of another rise in early Oct.

-

Today, despite euro's retreat fm 1.1279, as long as Fri's low at 1.1193 holds, outlook remains mildly bullish for last Wed's 5-week trough at 1.1121 to resume, abv 1.1284/85 would extend to 1.1300/10, as hourly indicators have dis- played 'bearish divergences', reckon 1.1327 (Sep's high) would cap upside.

Trendsetter does not warrant or guarantee the accuracy, timeliness or completeness to its service or information contained therein. Trendsetter does not give, whatsoever, warranties, expressed or implied, to the results to be obtained by using its services or information it provided. Users are trading on their own risk and Trendsetter shall not be responsible under any circumstances for the consequences of such activities. Trendsetter and its affiliates, in no event, be liable to users or any third parties for any consequential damages, however arising, including but not limited to damages caused by negligence whether such damages were foreseen or unforeseen.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.