The first Friday of the month is here and all the traders are tuned for the most important announcement of the Non-Farm Payrolls. While most of the other economic indicators show a weakness in the American economy, the U.S. jobs machine is well tuned and running. April’s employment report will also be an indication how well the economy will perform in the second quarter following the economic growth over a year the first quarter.

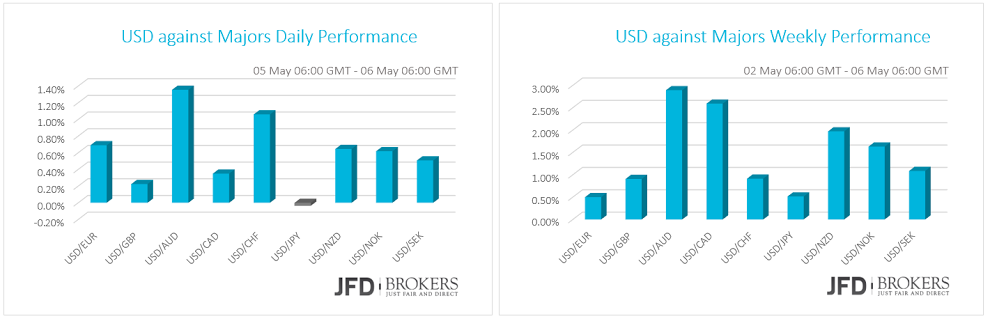

The greenback maintained this week's gains ahead of the today’s Non-Farm Payroll report and rose further against many of the major currencies on Thursday. For the U.S. dollar to extend its gains we have to see a job growth more than the forecasts of 200k or a decrease in the already low Unemployment Rate or a significant increase in the wages that has limited increase the last couple of months.

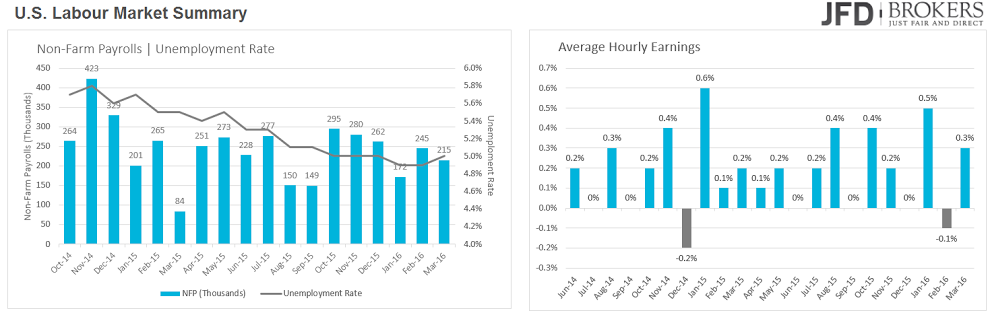

The U.S. economy has forecasted to have added 200k jobs in April, the lowest in three months. In March, the economy added 215k jobs and recorded the fifth above 200k figure in the last six months. It’s worth mention that ADP Employment Change, which shows the pace of hiring in the private sector, fell to the lowest level over the last nine months at 156k, missed by far the market expectations of 196k and added worries over today’s NFP number. The Initial Jobless Claims culminated to 5-week high while the Continuing Claims dropped to lowest level since November 2000. The Non-Manufacturing Production rose to 4-month high in April while the Manufacturing Production rose by 0.4%. The Unemployment Rate is expected to remain at the low level of 5% following a small rise in March from 4.9% before as well as the Average Hourly Earnings to keep the same pace of growth 0.3%.

Note that until the next FOMC meeting in June, there is one more Non-Farm Payrolls report expected and the two of them will be closely eyed by policymakers before any interest rate decision.

EUR/USD Forecast: Bears Coming Back!

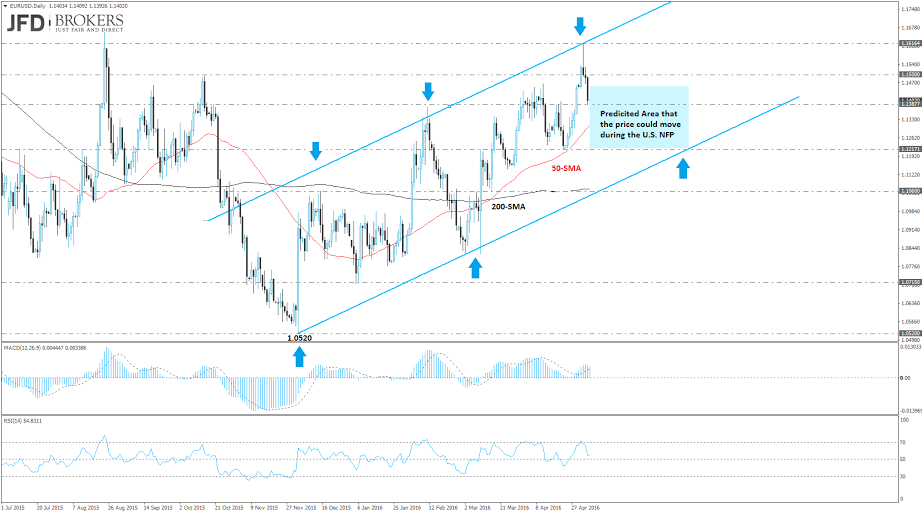

The euro came under pressure during the U.S. session against the dollar and plunged below the psychological level of 1.1500 ahead of today’s Non-Farm Payrolls report. The EUR/USD pair has been trading within an upward formation over the last 4 months, following the strong rebound from the important level at 1.0525. It is very significant that the bulls managed to maintain the price above the ascending trend line and the 50-SMA on the daily chart. However, following the failed attempt above the 1.1500 area, it seems that the pair has entered a correction phase – following yesterday’s fall – and of course with the U.S. NFP today might be the catalyst that EUR/USD needs.

An NFP with a headline print of +200k or more will indicate that the Federal Reserve does not need to worry too much about the U.S’s labor market conditions just yet. Therefore, for the greenback to rally on the NFP report, we need job growth to exceed markets forecast of 200k and it will be even better if it exceeds last month’s figure which is 215k. Furthermore, average hourly earnings will need to rise by more than 0.2% or at least 0.3% which is the consensus. If any part of this equation is off, investors will be reluctant to buy dollars. Note that a ‘big’ miss either side of expectations will only heighten market volatility.

Technically, the levels to watch today will be: to the upside the 1.1455 – 1.1465 zone and to the downside the 1.1300 level, which is my target for today. This is a significant level since it coincides with the 50-SMA on the daily chart, as well as with the 23.6% Fibonacci retracement level. From there, I would wait for a pullback before it continues south, towards 1.1215 – 1.1230, which includes the ascending trend line which started back in mid-December 2015.

Besides that, I wish you a good NFP trading and a safe weekend!

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD risks a deeper drop in the short term

AUD/USD rapidly left behind Wednesday’s decent advance and resumed its downward trend on the back of the intense buying pressure in the greenback, while mixed results from the domestic labour market report failed to lend support to AUD.

EUR/USD leaves the door open to a decline to 1.0600

A decent comeback in the Greenback lured sellers back into the market, motivating EUR/USD to give away the earlier advance to weekly tops around 1.0690 and shift its attention to a potential revisit of the 1.0600 neighbourhood instead.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Bitcoin price shows strength as IMF attests to spread and intensity of BTC transactions ahead of halving

Bitcoin (BTC) price is borderline strong and weak with the brunt of the weakness being felt by altcoins. Regarding strength, it continues to close above the $60,000 threshold for seven weeks in a row.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.