The market was more volatile than expected on Monday. The greenback plunged on the soft figures came out regarding the manufacturing sector and the construction spending. The euro picked up as ECB President defended the lower interest rates once more and the manufacturing sector rose more than anticipated raising optimism.

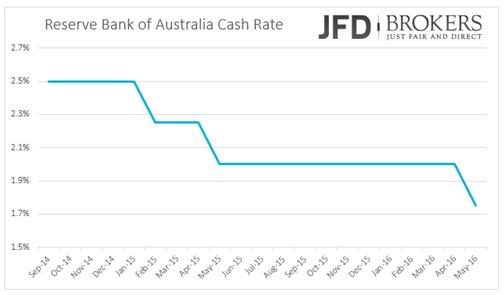

On the other hand, the pound suffered some losses following a poll that revealed the lower business confidence in four years due to worries over the EU referendum and the China’s slowdown. The RBA surprised the market early in the morning with a non-expected rate cut to boost growth and encourage low exchange rate.

U.S. Weak Manufacturing Data Drops the Dollar

The U.S. dollar plunged further due to the weak manufacturing expansion adding to the losses recorded the week just past. The ISM Manufacturing PMI showed a weak expansion of 50.8 in April below expectations of 51.4 and below March’s expansion of 51.8. The final Markit Manufacturing PMI for April showed a soft growth as well of 50.8 versus 51.0 expected. Below this weakness may be the Construction Spending that barely rose by 0.3% in March from 1.0% before. During the week, the traders will eye the Non-Farm Payrolls report coming out on Friday and any other related to it, like the ADP Employment Change on Wednesday and the Jobless Claims on Thursday. The market forecasted that the U.S. economy will add 200K jobs in April and that the wages rose by 0.3% for the second consecutive month. The final Markit Services PMI for April will be also eyed.

Euro Rises as Draghi Defends Low Interest Rates

The single currency enjoyed a winning session against the other major currencies while it recorded marginal gains against most of them. The ECB President Mario Draghi defended the interest rate low policy against the German Finance Minister and the other top officials in Berlin at the annual meeting f the Asian Development Bank in Frankfurt. Eurozone’s manufacturing sector expanded more than anticipated in April by 51.7 according to the final Markit PMI. Later today, the European Commission Releases Economic Growth Forecasts will be published and will attract the attention.

EUR/USD – Technical Outlook

The EUR/USD has been trading within a broadening formation over the last couple of months or so, following a strong start to 2016. It is very significant that the bulls managed to maintain the pair above the ascending trend line and the 50-SMA on the daily chart. In addition to the first support level at 1.1300 the 100-SMA and the 200-SMA are both ready to provide a significant support to the bulls in a case of a pullback. Given this short-term trend to the upside, the pair has come back into focus given that a major support level is currently being challenged following the aggressive rally to the upside. Thus, we should see the pair either finally break-out of this formation or reversing back towards the downside, prompting a more aggressive move towards the 1.1400 area. On the daily chart, the Relative Strength Index is certainly bullish and this could point towards a more bullish development that could lead to the move above 1.1550 and in a later stage above 1.1600 that I am looking for.

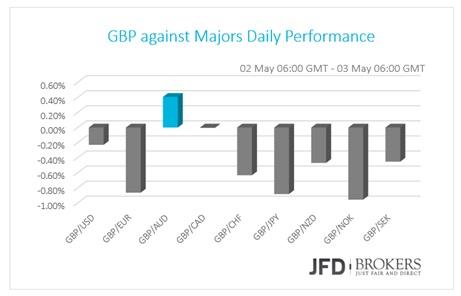

Pound plunged as a Poll Revealed a Four-Year Low Business Confidence

The British Pound slumped against all the majors in Monday, with only exception the Australian dollar, despite the absence of any indicators or speeches due to a public holiday. However, a poll of 1,000 chartered accountants showed that worries over EU-referendum and China’s slowdown dropped UK business confidence at a four-year low. No major news are coming later in the week for the UK, however, the Markit PMIs for Manufacturing, Construction, and Services coming out later in the week will be closely eyed, as well as the Halifax House Prices.

GBP/USD – Technical Outlook

The British pound has risen for a third consecutive day against the dollar advancing above the 200-daily moving average. Over the last couple of months, the pair has established and traded within a trading range roughly around the key level of 1.4300. However, following the aggressive move above the 1.4300 level, the bias clearly changed from negative to positive. Over the last couple of weeks or so the pound has moved very strongly pushing through resistance levels at 1.4520 and more recently the 1.4660. The latter level is quite significant as it had been looming large over the last month or so and a few days ago it moved through, reaching a new year high. On the upside, the 1.4800 is a key significant level and possible the next target. The medium-term outlook remains bullish, but MACD suggests that we may not be able to push much higher, above the latter level from where we are right now as it crossed below its trigger line and is approaching the zero line.

Australian dollar Tumbled After RBA Surprise Rate cut

The Reserve Bank of Australia cut its cash rate by 25 basis points to 1.75%, surprising the market, to improve growth prospects and encourage a lower Australian dollar. The first market reaction was indeed a lower exchange rate as the Australian dollar plunged nearly 1% versus the U.S. dollar. The RBA Governor Glenn Stevens underlined that the economic is growing at a slower than expected pace.

AUD/USD – Technical Outlook

The AUD/USD pair has been in an uptrend since early January gaining almost 15%. After the announcement of the rate cut, the pair topped at 0.7830 and fell towards 0.7550. The pair is currently finding support on the 50-SMA on the daily chart, however, a further move to the downside is expected. The next level to watch to the downside is 0.7380 – 0.7420 support zone. The MACD oscillator is traded below its trigger line and keeps falling encouraging our bearish perspective.

Economic Indicators

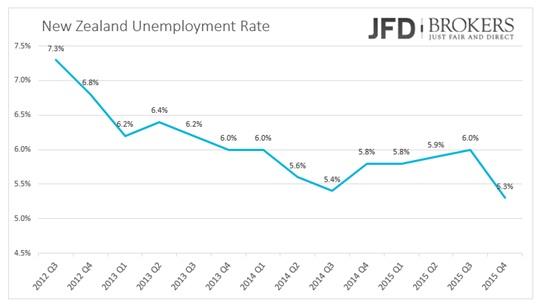

A quiet day in Eurozone regarding economic indicators but important fundamental news are coming out from other countries. Eurozone’s Producer Price Index will be released and after that attention will turn to Australia where the Annual Budget Report is coming out following the surprise rate cut earlier in the morning! In New Zealand, the Fonterra Dairy action will take place. The GDP Price Index posted two increases in a row at the last two auctions at 3.8%. In U.S., the economic calendar has a smattering low-level data out that will not attract too much attention. Later in the second half of the trading session, New Zealand’s Employment Report will reveal the level of unemployment rate the first quarter of the year and the employment change.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

Gold price remains depressed near $2,370 amid bullish USD, lacks follow-through selling

Gold price (XAU/USD) attracts some sellers during the early part of the European session on Tuesday and reverses a major part of the overnight recovery gains from the $2,325-2,324 area, or a multi-day low.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

Canada CPI Preview: Inflation expected to accelerate in March, snapping two-month downtrend

The Canadian Consumer Price Index is seen gathering some upside traction in March. The BoC deems risks to the inflation outlook to be balanced. The Canadian Dollar navigates five-month lows against the US Dollar.