Quiet day today, without heavyweight numbers to drive the market, while on Thursday the three major currencies, greenback, sterling, and euro were traded broadly range bounded. The U.S. Indices were virtually unchanged while the Bank of England policymakers worry about country’s slowdown due to EU referendum.

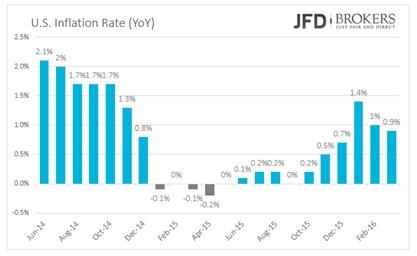

U.S. Inflation Rate falls from its strong levels

The U.S. dollar was traded range bounded on Thursday following its earlier gains while the economic indicators released disappointed again. The Inflation Rate came out at 0.9% in March, missing market’s expectations to rise up to 1.2% year-over-year. The data revealed a weakness in the consumer prices pick up, after January’s strong figure of 1.4% that raised hopes inflation rate was getting close to central bank’s 2% target.

Eurozone’s inflation rate at zero! Better than expected

Eurozone’s consumer prices remained unchanged in March, compared to the year before, despite market forecasts that Eurozone will remain in deflation for the second consecutive month. The month before, in January, the inflation rate of the 19-nation union was -0.2%.

The euro remains under pressure against the dollar on Thursday, reaching 1.1250 following the failed attempt above the significant zone of 1.1438 – 1.1455. Volatility compared to just a few days back is very mild, as the euro made a so-called fake breakup above the aforementioned zone and fell sharply. Lots of late longs are probably caught as a result the price to plunge below 1.1325 and 1.1300. Technically, the Euro has so far pulled down just short of the support at 1.1220. If that does get taken out, there is then not too much to stop it heading on to the previous area of support at 1.1150. To the upside, the first obstacle for the bulls will be the significant level of 1.1300, which I think will come in play today. Beyond there could head on to 1.1325.

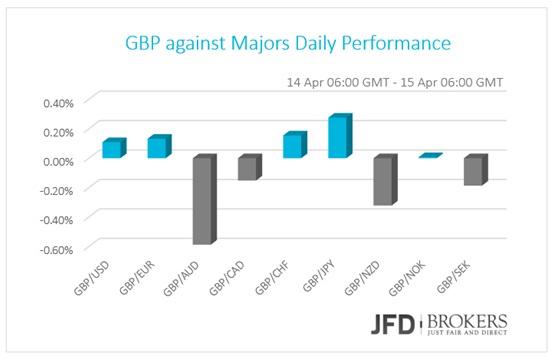

BoE Policymakers worry for slowdown due to EU Referendum

Not much volatility in the pound cross pairs on Thursday and early Friday. The Bank of England left its interest rate unchanged at the record low level of 0.5% that has been for over seven years and warned for the consequences of the EU referendum. The BoE minutes underlined that market’s uncertainty over EU referendum may cause a softer GDP growth in the first half of this year that “There are some signs that uncertainty relating to the EU referendum has begun to weigh on certain areas of activity, as some decisions, including on capital expenditure and commercial property transactions, are being postponed pending the outcome of the vote".

The GBP/USD pair has been choppy and fairly directionless since March with 1.4460 and 1.4515 capping any moves to the upside and 1.4000 propping it up. Technically, we have seen further selling in the pound the last couple of days following a strong rally off the last few weeks. On the upside, the pair is expected to face a hurdle near 1.4180 and then at 1.4200, which includes the 50-SMA on the 4-hour. The bias will, however, remain bearish as far as the 1.4200 resistance area is intact. To the downside, the initial support will arrive at the month’s low at 1.4020, below which there is not too much to prevent it heading back towards 1.3900, although without any significant market news today it currently seems some way off.

USD/CAD: Second Target Locked

The USD/CAD pair surged following the BoC policy meeting on Wednesday which left its benchmark interest rate unchanged at 0.50%. Meanwhile, the Canadian economy added 40,600 new jobs in March beating forecasts of 10,400 and driving the unemployment rate lower to 7.1%.

Following our analysis (USD/CAD upward correction underway) on Wednesday, the pair surged above the first target at 1.2856 and moved close to the second target at 1.2900 before retracing back towards the suggested area of 1.2800 – 1.2813. Technically, the points to watch remain unchanged and the momentum indicators look rather mixed. The dailies still point higher, so if the U.S. dollar can find the legs it could then head back towards 1.2900. Otherwise, we could see the pair trading between 1.2750 and 1.2900 ahead of a quiet session.

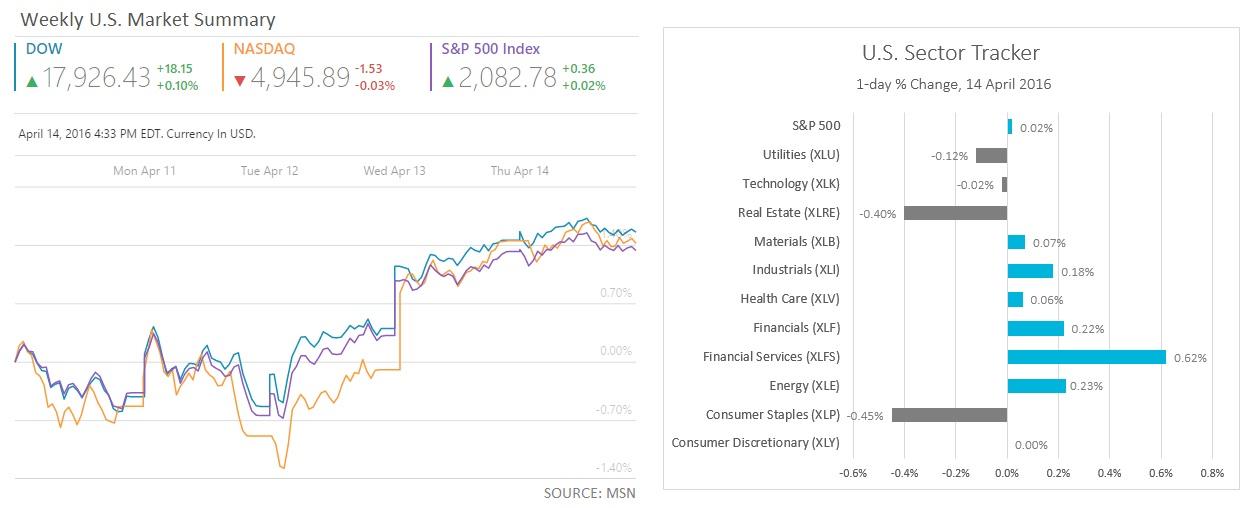

U.S. Indices Marginally Changed; Financial Services Dominated Again

The three most popular U.S. indices ended Thursday’s session marginally changed after two record winning sessions. The NASDAQ Composite Index edged slightly lower 1.52 points, or -0.03% on Thursday and is moving above the 4,500 again. The Dow Jones Industrial Average surged 1.15 points, or +0.10% during yesterday’s session and is now looking at the 18,000 level. Among the top winner stocks were the J.P. Morgan Chase & Co (NYSE: JPM, +1.29%), Visa Corporation (NYSE: V, +0.78%) and Exxon Mobil Corporation (NYSE: XOM, +0.71%), slightly below the two banks that boosted yesterday’s gains follow, Goldman Sachs Group (NYSE: GS, +0.66%) and American Express Company (NYSE: AXP, +0.56%). The S&P 500 gained 0.02%, closing slightly above the 2,080 level. For the second consecutive day, the S&P500 Financial Services sector outperformed, gaining a total of +0.62%, while the Consumer Staples sector and Real Estate ended negative at -0.45% and -0.40% respectively.

What to watch today

Early on Friday, the Japanese Industrial Production and Capacity Utilization, both for February will be released. The two-day IMF Meeting starts. Later on Friday morning, Eurozone’s Trade Balance for February is expected to come out. Shifting to U.S., the Industrial Production and Capacity Utilization for March will be released.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.