The greenback was traded broadly higher ahead of FOMC minutes while euro experienced another range-bounded session with lack of direction. The sterling slumped against the G10 currencies as UK referendum looms and as services growth failed to meet estimations. RBA meeting on Tuesday continued to have a negative impact on the Australian dollar while gold enjoyed a winning day.In addition, the U.S. stocks closed the second consecutive day in the red.

U.S. Dollar is traded broadly lower ahead of FOMC Minutes

The greenback was traded broadly higher on Tuesday and early Wednesday while it depreciated versus the Swiss franc, Japanese yen and the New Zealand dollar. The Markit Purchasing Manager Index revealed that the services grew up to 51.3 in March, above expectations and last month’s figure of 51.0. The ISM Non-Manufacturing also outperformed in March, rising to 54.5 from 53.4 prior. The New Zealand dollar enjoyed some gains as the Global Dairy Trade Index, which indicates the change of dairy products prices, showed an increase of 2.1% following a decline of 2.9% in the previous auction. Today’s FOMC minutes will hog the limelight and will be the leading driver of the domestic currency.

Euro remains subdued as data is unable to determine the direction

Following last week’s rally, the shared currency continues to seek direction. The Retail Sales and the final Markit Services PMIs released yesterday were unable to determine euro’s direction. In Eurozone as a whole, the services sector in March expanded at a lower than expected pace at 53.1 from 54.0 expected while in Germany, the sector advanced at 55.1 also below market’s forecasts of 55.5. The German Factory Orders plunged by 1.2% mom in February, below expectations to grow just by 0.2% from an increase of 0.5% before. The Retail Sales in Eurozone outperformed and rose by 0.2% mom in February despite market consensus to have remained flat.

The EUR/USD pair has started the week with a slightly positive tone, however, the pair was little changed this morning, trading around 1.1370, leaving the points to watch pretty much unchanged. If we see another move higher, the next target, above Friday’s high, will be at 1.1500, however, I think it’s going to take at least 2-3 attempts before we see a break above here. On the other hand, support will be seen at 1.1300, which coincides with the 23.6% Fibonacci retracement level, from May 2014 high to March 2015 low. This is a significant level as it also coincides with the 50-SMA on the 4-hour chart.

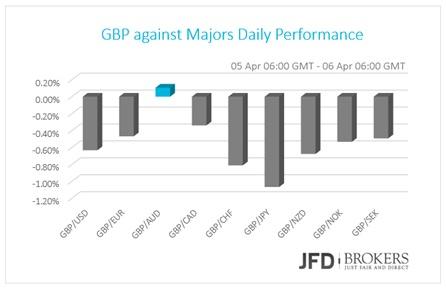

Pound continues to plunge as UK referendum looms

The sterling declined against all the majors as the Brexit continues to lower the confidence of investors and the data are not supporting the pound. The Markit Services for February came below expectations but higher than previous month’s 3-year low. The sector figure came in at 53.7 in March compared to an initial estimate of 54.0 and the 49.7 figure for February. The only loser against the British Pound during yesterday’s session was Australian dollar that continues being traded lower following RBA meeting early on Tuesday that left the cash rate unchanged at 2.0%.

GBP/USD rose 3.2% in March, its first monthly gain following four consecutive months of decline, with an early April rally that appeared to have triggered a considerable amount of long covering, following the failed attempt above 1.4460. As we said yesterday, on the daily chart, the pair has been fairly directionless as it remains in the symmetrical triangle, which started back in early March, and, therefore, it leaves the levels pretty much the same. The support and resistance levels are not reliable at the moment, therefore, short term traders should be very cautious.

AUD/USD – Technical Outlook

The AUD/USD is being traded lower this morning following the release of the RBA which left the cash rate unchanged at 2 percent. The pair fell for the second consecutive day and retraced all of the gains made the last six days. With the above in mind, I would expect the pair to come under further pressure and to test the 0.7550 level in the next couple of days. However, we do not have a clear direction following the failed attempt above the 0.7700 level, therefore, we should remain on the sidelines for today.

USD/JPY fell to 6-month low

The flash Japanese Leading Economic Index for February slumped to 99.8 from 101.8 before and the Coincident Index to 110.3 versus 113.5 in January. Contrary to the macroeconomic data, the USD/JPY fell to a 6-month low on Tuesday as investors trimmed bearish bets on the buck and locked in profits below the psychological level of 111.00, as well as around the key level at 110.50, two levels that we have suggested in the previous analysis. With the pair trading below the two aforementioned levels, a near-term pullback back to 111.00 is certainly in play heading into the first week of April, but as long as sellers step in to defend that level and the bottom of the channel the bears will remain in control. Beyond the psychologically significant levels that we have mentioned, the next support level to watch will be the 110.00.

Gold – Technical Outlook

The yellow metal surged yesterday, however, it continues to be confined within a descending triangle, which started back in mid-February. The metal is nearing the apex of the triangle and a breakout is expected anytime soon. To the upside, the levels to watch will be the $1,242 level, with a break above that to open the way towards $1,280. On the other hand, the $1,209 will be the first obstacle to the downside. Beyond there, we could see a run to $1,200 and even to $1,180, although this remains some way off. On the 4-hour chart, the stochastic and CCI indicators both look a lot more bullish and subsequently, I do believe we are likely to see some upside towards the aforementioned levels.

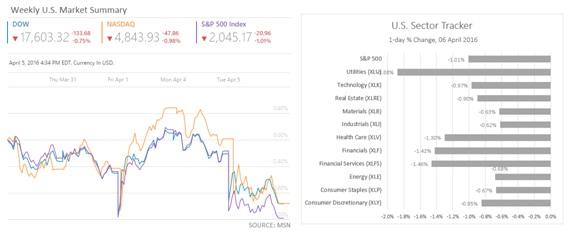

U.S. Indices closed negative for the second day

U.S stocks closed negative for the second day ahead of FOMC minutes. The Dow Jones Industrial Average dropped 133.68 points (0.75%) to 16,603. The broad-based S&P 500 dipped 20.96 (1.01%) to 2,045 while the tech-rich Nasdaq Composite Index gave 47.86 (0.98%) at 4,844.

It’s been another good week for the NASDAQ index, following eight consecutive winning weeks. The index does appear to have run into resistance 4500, a previous level of support. If the index fails to break and sustain any gains above this level, it could act as confirmation of last month’s break below that level, which would be very bearish for the pair, prompting a move back towards last week’s lows around 4320. Here, the index would find support from the 50-SMA. On the other hand, if the index overcomes the 4500 level, which the stochastic suggests that the index has more room to run t the upside, it should find further resistance around 4600.

The US500 is heading lower again today, after failing to close back above the critical level at 2100 over the last couple of days. If the index comes under further falling pressure the 100-SMA and the 200-SMA on the daily chart will be the first to provide some support to the index. This always made any push lower difficult, given the number of people who would either be looking to take profit or get long here. Therefore, following the aggressive rally the last couple of months, and following the gains we made the last couple of weeks on S&P 500, I will remain on the sidelines as I would like to see the final reaction of the index near 2050.

What to watch today

Today, the only notable macroeconomic update is the FOMC minutes that will be released on 18:00 GMT. The traders would like to decipher Fed’s tone on interest rates as Fed policymakers last week hinted a possible rate hike in April and more than two rate hikes in the year while Yellen denied that rumours with her dovish stance at her speech later in the week. Other news that is coming up is the ECB Non-monetary policy meeting, which is unlikely to stoke much interest among the investors and the UK Halifax House Prices in the European morning.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.