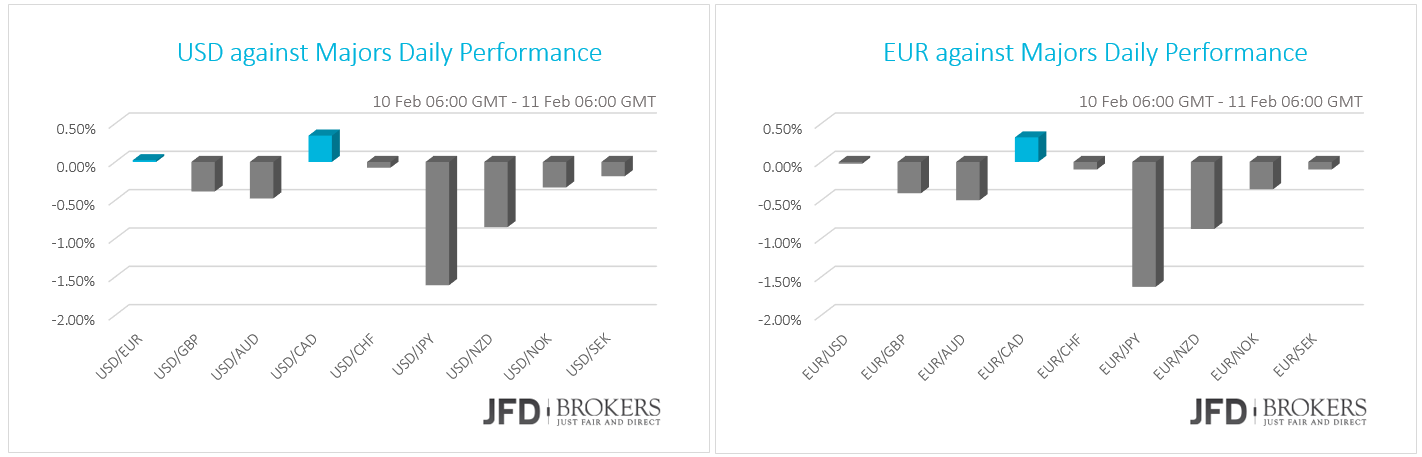

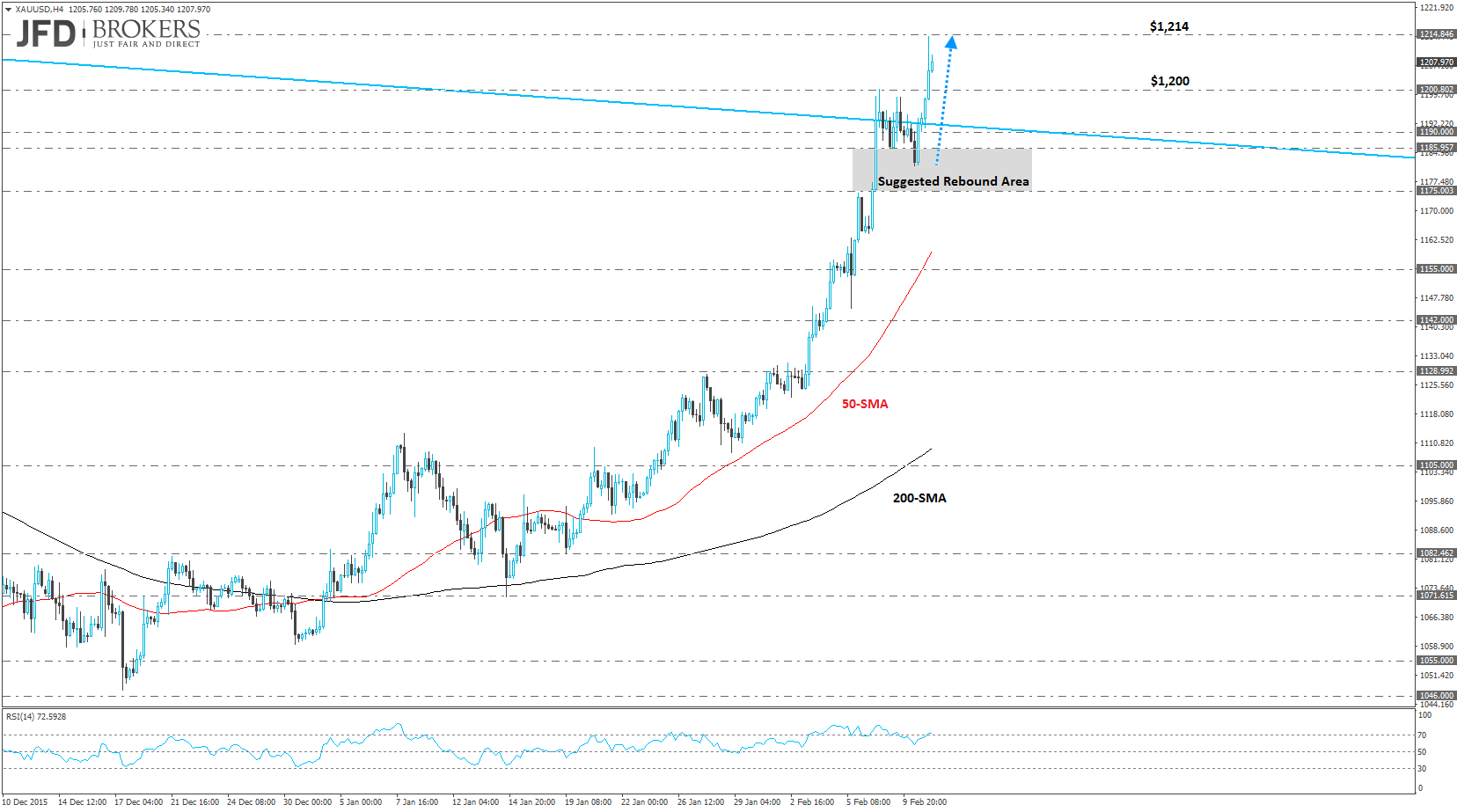

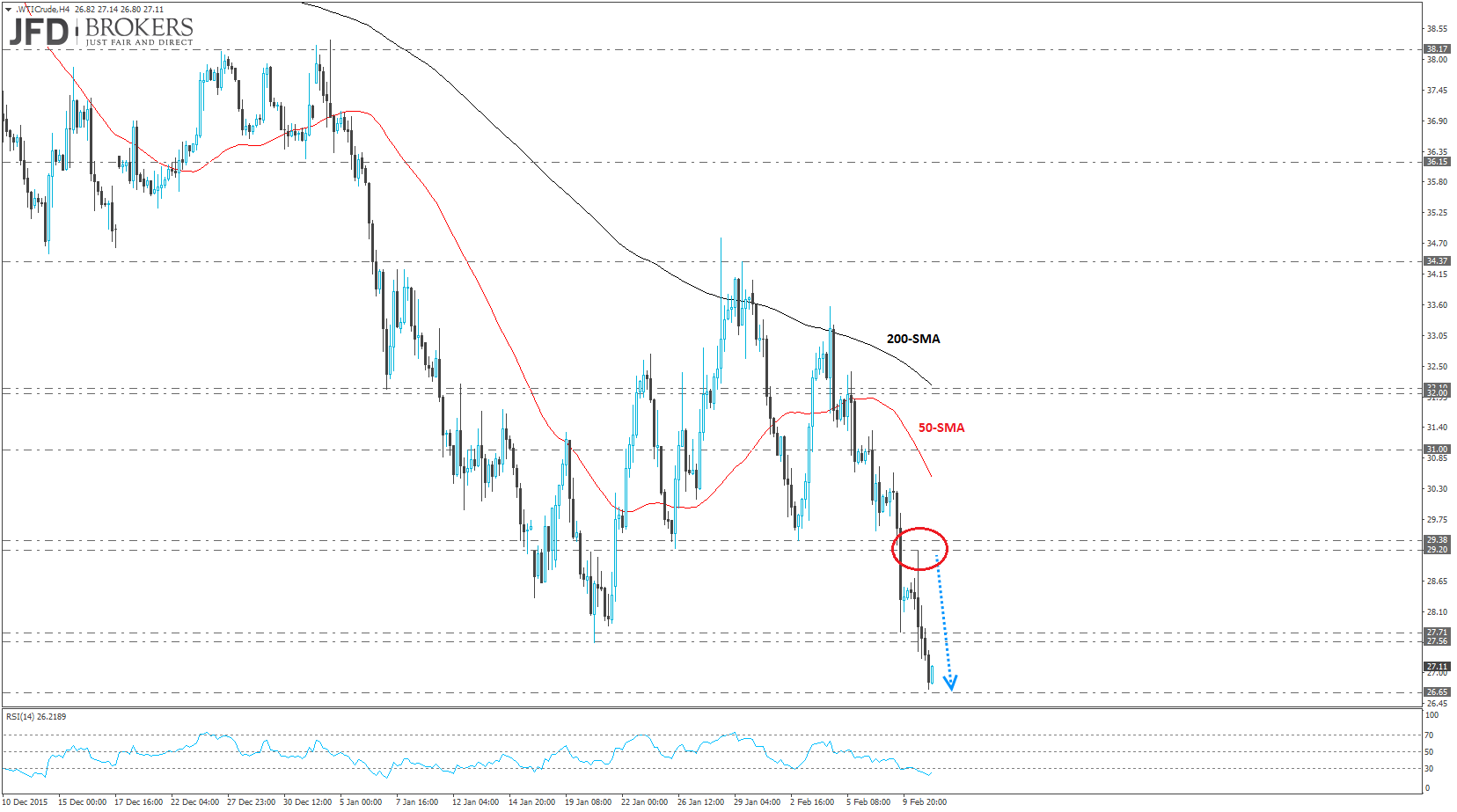

The greenback ended lower against the other major currencies on Wednesday, particularly versus the currencies with high demand as the Japanese Yen and hold steady against the commodity currencies after Yellen's testimony amid the global economic headwinds. The Fed Chairwoman didn’t abandon its plans for further gradual rate hikes if the data is suitable but she worries about the global economic slowdown that affects the U.S. economy. Gold rallied upwards and reached the psychological level of $1,200 as we suggested locking profit as well as WTI after a heavy sell-off that closed below the $27.00 level as it was suggested.

Yellen does not abandon rate hike plan but will delay it

Yellen continues to hint further rises however on a slower pace than before. Even though she didn’t abandon the idea of March’s rate hike, the odds for are decreased sharply and I would expect one or two rate hike during this year instead of three to four the central bank was planning prior. Fed Chairwoman expects the economy to continue to pick up in the current quarter while was very optimistic about the strength of the labour market. However, she underlined the downside risks from China and the plunge of the oil prices as well as the vulnerable global economic conditions which are not ready for another rate hike for the time being.

European Stocks enjoyed a profit session

The European stocks had a better luck than the euro after Yellen less hawkish testimony. The German DAX ended positive by 1.55%, CAC 40 added 1.59% at its value while Euro Stoxx 50 rose by 1.69%. The euro was traded weak against the other currencies especially against the Japanese yen despite the absence of macroeconomic updated in the Eurozone.

The EUR/USD pair attempted to bounce following Janet Yellen’s testimony and reached 1.1156 before turning sharply higher again, breaking up through the critical level of 1.1235, and currently trading slightly above the psychological level of 1.1300. The latter level is a significant since it coincides with the ascending trend line which started back in March. On the downside, support will be seen at 1.1235 and then again at 1.1156. On the other hand, a decisive break above 1.1300 will have larger bullish implications and would target the next resistance level, around 1.1385.

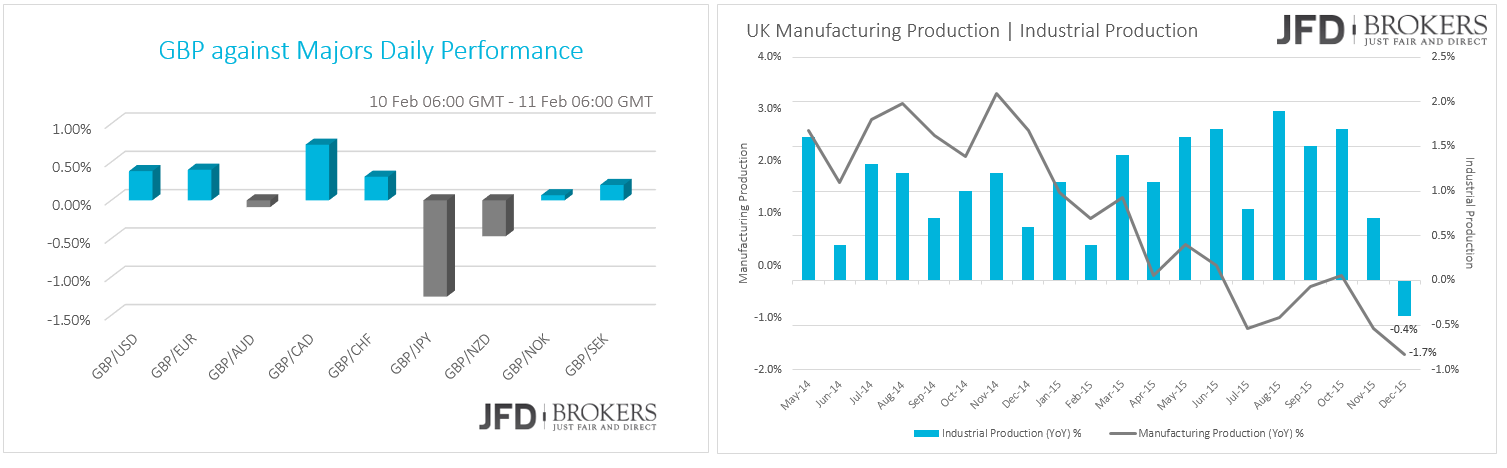

Pound Slightly Up despite the Worst Industrial Output in 3 years

The British Pound was traded subdued against the other majors on Wednesday but without severe losses despite the weak fundamental news, expect against the Japanese Yen. The Industrial Output shrank by 1.1% month-over-month and by 0.4% year-over-year much worse than the markets expected. The Manufacturing production also dropped by 0.2% month-over-month and 1.7% year-over-year, both indicators turning negative and posted the worst numbers since September 2013 on a yearly basis. On the top of that, the GDP growth estimate for the three months to January declined to 0.4% from 0.6% the three months from October to December. I wouldn’t expect the sterling to gain momentum in the next weeks as the risk of Brexit in collaboration with the global turmoil setting it as a less attractive currency.

Technically there is not too much change to the GBP/USD pair as it has moved quietly the last couple of days, however, the dollar failed to maintain its gains against the pound after it tested the key level of 1.4350. The pair managed to escape from the both the 50-SMA and the 200-SMA on the 4-hour chart and it seems now the new round of a bullish pressure could be seen. Therefore, the next level to watch will be the 1.4635, February high.

USD/JPY – Technical Outlook

USD/JPY extended is losing streak to eight days on Thursday and in the process broke and closed below what had been a key support region, around 116.00. The pair fell more than 7% so far this month and it seems that the retracement is just started. Naturally, adding a Fibonacci retracement to the chart can give an idea about where the pair will retrace to, with the next support being the 38.2% Fibonacci level around 108.00. Therefore, we remain bearish on this pair.

Profits booked on Gold!

Gold is being supported by safe-haven buying flows, as well as from a weaker dollar, reaching the psychological level of $1,200 on early Thursday, a level that we have suggested during yesterday’s report. The yellow metal rebounded from the $1,175 – $1,185 area, which we have suggested during yesterday’s report and surged above the psychological level of $1,200 recording a fresh nine-month high. The gold price is now up 14.10% so far in 2016 and has risen in 13 of the past 17 sessions, excluding today. Having in mind the above, the above target to watch will be the $1,235 barrier, June 17, 2015, high.

WTI and Brent – Profit Locked!

WTI turned aggressively downwards before testing the suggested level, at $29.20. WTI fell below the critical level of $27.56 and record a fresh low, closing below the $27.00 level, as suggested. The daily momentum indicators are pointing lower although the medium term MACD is showing a degree of bullish divergence so caution is warranted on the topside. Following 3 consecutive of winning suggestions, a cautious stance is required.

A similar picture prevailed in UK Brent as it tested the suggested zone of $32.00 – $32.10 before turning south. Currently, the Brent is trading around $30.65 and I would expect the selling pressure to continue, prompting a more aggressive move towards the $29.20 – $29.40 zone.

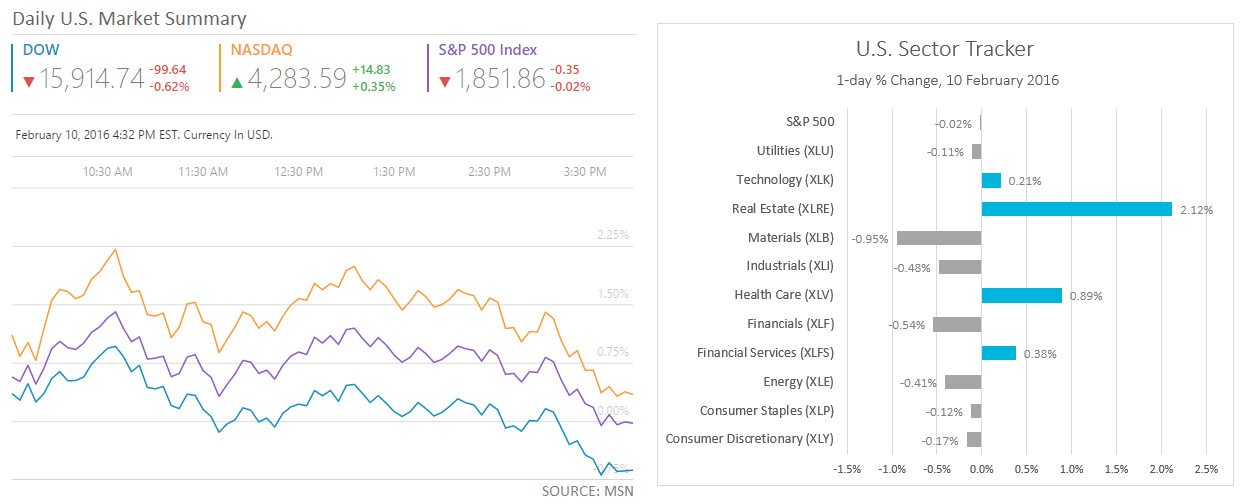

U.S. Indices Suffered another choppy session

The U.S. indices suffered another choppy session on Wednesday. Dow Jones and S&P 500 posted the fourth negative day in a row while Nasdaq posted slight gains of 0.35%. Since February, the Dow is down more than 3%, S&P500 more than 4% while the Nasdaq Composite plunged by 7%. The Bank of America (NYSE: BAC) was one of the most volatile stocks on Wednesday as the bank sector faces increased risks.

The Walt Disney (NYSE: DIS) was the worst performed stock of DJIA as it dropped by 3.76% followed by IBM (NYSE: IBM) and Caterpillar Inc. (NYSE: CAT) that slumped by 3.13% and 2.80% respectively. On the other hand, Nike (NYSE: NKE) and Visa (NYSE: V) were the first two top gainers with gains of 3.11% and 2.66% respectively.

Economic Indicators

Today, the calendar is relatively light as it is a public holiday in Japan and we have no major events or indicators coming out from the Eurozone and UK. In Eurozone, a Eurogroup meeting will take place. In the US, the Initial Jobless Claims for the week ended on February 05 are forecast at 290k vs 285k the previous week. That would bring the four-week moving average slightly up to 305k from 302k. Canada’s new housing price index is expected to continue posting slight gains. The index is forecast to rise 0.3% mom in December from 0.2% mom in November. Finally, Ministry of Japan releases the foreign bond investment report as well the foreign investment in Japan stocks (Feb 05) report.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.