EUR/USD above 1.0900; RBNZ: Low Oil Should not be Responded by Rate Cuts

The greenback, the single currency, and the pound rose against the G10 currencies due to positive data and remained virtually unchanged on the cross pairs of each other’s. Meanwhile, the Japanese yen and the New Zealand dollar were the biggest winners of Tuesday.

The two currencies enjoyed their gains on the BoJ meeting minutes and the New Zealand employment report that surprised the market positively. On the other hand, the sharp oil depreciation dragged down the Australian dollar and the Canadian dollar labeling them as the worst performed currencies of the day.

U.S. Economic Optimism on 7-month high

The only noteworthy indicator for U.S. released on Tuesday is the U.S. economic optimism. The index is at the better state has been the last seven months, as it edged up by 0.5 points to 47.8 in February from 47.3 in January, sending an optimistic signal for the U.S. economy. After a rate hike in December, a dovish message from Fed calmed the tightening pace down and started to spread worries if the rate hike was a right move from the beginning.

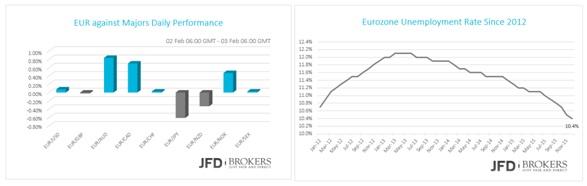

EU Unemployment rate lowest level since September 2011

The single currency favored from the record low December’s jobless rate! The euro closed the day mixed against the other major currencies. It recorded gains against the Australian and the Canadian dollar and lost ground against the Japanese yen and the New Zealand dollar. The unemployment rate in Eurozone decreased to the lowest level since September 2011, at 10.4%. It is worth mentioning that since March 2013 the rate has never edged up. It’s constantly decreasing at a moderate pace.

EUR/USD – Technical Outlook

The EUR/USD rebounded strongly at the start of last week, finishing just above its 1.0900 high. At the same time, stops were slowly being triggered above the latter level forcing other traders out of the market. With that move, the pair managed to record a second consecutive winning session placing the bulls to the driver’s seat. In the bigger picture, the pair remains trap inside the range which started back in December.

UK PMI Construction at 9-months low

The British pound ended Tuesday’s trading day and early Wednesday’s higher against most of the G10 currencies, marginally changed versus the U.S. dollar, the euro and the Swiss franc while it plunged against the Japanese yen and the New Zealand dollar. The fundamental data came out for UK were limited, with PMI Construction to capture the lights. The construction sector slowed down in January at its weakest level for nine months at 55.0 and missed market forecast to slow down slightly to 57.6 from 57.8 before.

GBP/USD – Technical Outlook

The pound is continuing to edge higher this morning against the dollar after finding resistance yesterday from the critical level of 1.4410. Above the 1.4415 – 1.4430 zone the GBP/USD pair can incline up to 1.4560, where the 200-SMA on the 4-hour chart is ready to provide a significant resistance while slightly below the 1.4330 hurdle the 50-SMA could provide some support to the bulls. Below here, the pair can come under further selling pressure, which I do not foresee for now, prompting a more aggressive move towards the 1.4225, whilst below this last, the 1.4100 region comes next.

EUR/GBP – Technical Outlook

The euro has been looking a little weak against the pound over the past couple of days, following the aggressive move above the significant level of 0.7000. In fact, the last few candles have been very bearish. The EUR/GBP pair has clearly lost some momentum, based on our momentum indicators, and could simply be going through another short-term consolidation period before a continuation of the move towards January highs, around 0.7700.

NZD boosted by RBNZ Wheeler Comments; Unemployment Rate Lowest since March 2009

Even though the Global dairy auction disappointed the New Zealand again, the employment report and the comments from the RBNZ Governor Graeme Wheeler shadowed the bad news and bolstered the domestic currency. The global dairy trade index revealed that the dairy prices decreased by 7.4%, the biggest decrease suffered since November 2015, that dropped by 7.9%. On the other side, the employment report for Q4 outperformed! The jobless rate fell to 5.3% from 6.0% the quarter before, at its lowest level since March 2009. The employment change climbed by 0.9% from a decline of -0.5% the three months to September. The RBNZ Governor tried to cool further easing expectations and stated that inflation rate does not need to be within 1%-3% bank’s target range at any cost. The global low oil prices should not be faced with decreasing further the Official Cash Rate (OCR), while he stated that the low New Zealand Dollar foreign exchange value was desirable.

GBP/NZD – Technical Outlook

The British pound is trading lower against the New Zealand dollar this morning, having found strong resistance around the psychological level of 2.2300. The range that the GBP/NZD pair is trading in has been getting smaller and smaller and it’s now getting to a point when a break of either direction could occur. This comes on the back of the strong downward rally which occurred in the second half of 2015, so probably the traders are waiting for a directional bias to enter this pair again. However, I don’t believe this (recent sideways move) changes the medium or longer term outlook for the pair, which as far as I’m concerned is still bearish. However, we could see a pullback and the pair to test the 2.2500, this year high but this is just a backup scenario for the bearish position we hold.

BoJ Governor: More Rate Cuts in the Negative Territory are Likely

The Japanese Yen ended the day higher against the majors following BoJ Governor Haruhiko Kuroda comments. Last week the Bank of Japan surprised the market by turning to negative interest rates policy to boost its economy. The BoJ Governor yesterday stated that the central bank will do whatever it takes to meet 2% inflation target. He also added that the central bank has more room for stimulus and is ready for further rate cuts in the negative territory and “there in not limit to measures for monetary easing”.

USD/JPY – Technical Outlook

The Japanese yen is making its way back towards the psychological level of 119.00, after finding resistance for a second time around the 121.50 barrier. Naturally, adding a Fibonacci retracement to the chart can give an idea about where the pair will retrace to, with the next support being the 190.30 level. In the longer picture, the USD/JPY remains trap in a range roughly between the psychological level of 116.00 and the critical level of 126.00, therefore, for the medium and long term, I remain on the sidelines. The intraday traders should watch to catch a rebound between 119.00 and 119.30, so buying the dips will be the most likely scenario for now.

AUD/USD – Technical Outlook

The Australian dollar is looking a bearish against the U.S. dollar the last couple of days following the failed attempt above the 0.7100 level. As it is, I think we need to see further confirmation before determining that the bias in the market has changed from bearish to bullish as I think the move above the 0. 6800 was just a retracement of the previous downtrend, as I personally see a further room for the Aussie bears to run. However, the key to understand this will be the significant level of 0.7000. If we see a close below of this level, it should give us a big clue about what the bias in the market actually is. Therefore, if we see a break lower, further support should be found around 0.6960, where the 100-SMA intersects the ascending trend line which dates back to 12 November.

EUR/AUD – Technical Outlook

EUR/AUD is continuing to look bullish, after finding strong support around 1. 5240 – where the ascending trend line dating back to 03 December lows intersected the 50 Fibonacci level – on Monday. The rally in this pair since breaking above 1.5000 has been very strong, adding almost 1000 pips in less than a month. However, a retracement was always likely to come, it was just a case of when. The pullback came few days ago when the pair failed to break above the key level of 1.6000.

For now, it will be interesting to see if this is in the early stages of a Dow pattern and the key to understand this will be a break above the 1.5600. On the other hand, I do not foresee any pullback for the short-term, therefore, I will remain bullish on this pair.

Economic Indicators

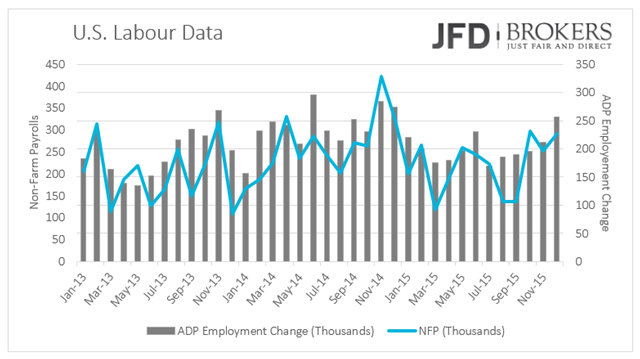

Today, the Markit Services PMI for January is expected to remain stable in most of the countries, like Eurozone, Germany and UK. The European Commission will release the economic growth forecasts.

A while later, the attention turns to U.S. The Markit services PMI will be out as well as the ISM Non-Manufacturing PMI. The services sector is forecasted to remain stable at 53.7 while the Non-Manufacturing to decline at 55.1 from 55.8 before. The ADP employment change for January is expected to come out at 220k from 257k before, two days ahead of the NFP report.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.