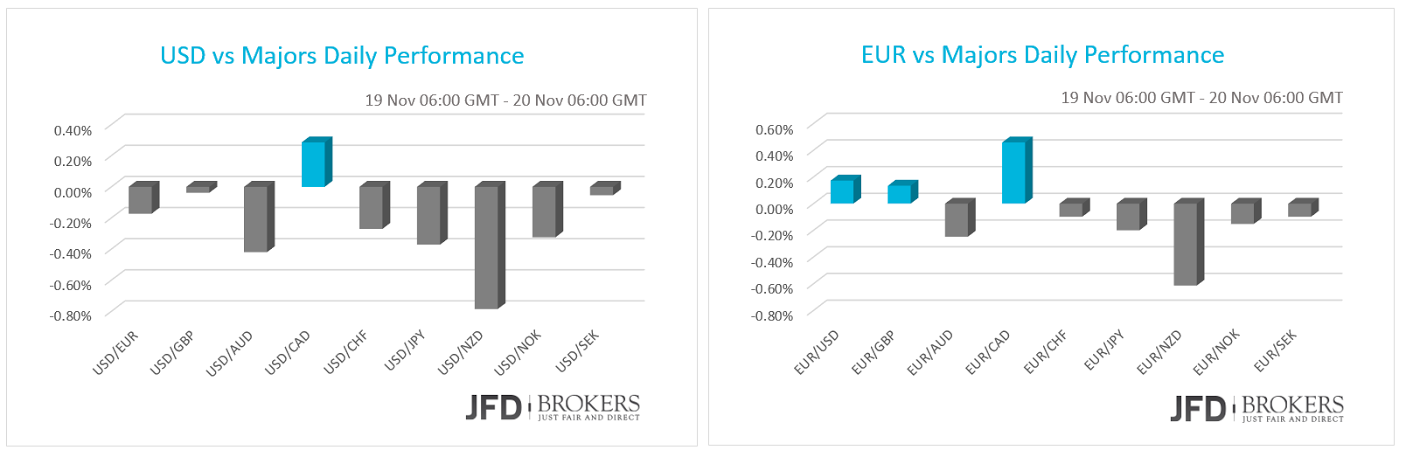

Quiet in the market despite the fundamental disturbances, with most of the major currencies remaining in a wide range. The traders are conservative to take positions on USD, GBP and EUR on the unstable and unbalanced economic situation, thereby, they turn to commodity currencies. The terror attacks continue to worry in countries with major currencies, like France and UK.

Furthermore, the ECB policymakers are likely to ease their monetary policy at the policy meeting on December 3rd, not necessarily by expanding or extending QE program but by cutting the overnight rate to negative, which is a considerable option. On the other hand, Fed sends repeatedly the hawk message that will raise interest rates at the policy meeting on December 16th if the fundamental does not turn to worse. The Aussie, New Zealand dollar and Canadian dollar are the best performers among major peers in the last two days.

US Jobless Claims dropped

Despite the strong upbeat data the keep coming up for the dollar, it was traded broadly lower against the major currencies on Thursday. The jobless claims number which are usually not particularly interesting by traders, except on major changes, were the headlines of the news on Thursday ahead of the crucial interest rate dependent Non-Farm Payrolls report. The number of Americans filing for first-time unemployment benefits fell by 5,000 last week.

Quiet day for Euro On Thursday, no market driver news for the euro were out keeping it marginally unchanged against the other G10 majors. Today we are seeing the EUR/USD pair reverse much of the gains made during yesterday’s session and it’s now attempting to break below the 200-SMA on the 1-hour chart. Having pushed through the 1.0750 support level, the pair has extended losses and now looks to be heading towards the psychological level of 1.0700. Slightly below the latter level the 50-SMA is ready to provide a significant support to the bulls. The Relative Strength Index and the MACD, are both moving near their mid-levels, thus I would expect further consolidation or a downward corrective wave before the bulls prevail again, prompting a move back towards 1.0760.

The European markets are near a three-month high despite the absence of any market-affecting news. The DAX 30 surged 1.64% to 10,139 and France’s CAC 40 advanced 0.82% to 4,947. Britain’s FTSE 100 rose 1.35% to 6,363 ignoring economic data showing U.K. retail sales plunged 0.6% in October. On Thursday, we saw the UK 100 breaking above the key level of 6330 and post its third consecutive positive week while is on track to record another straight day of gains, 0.80% so far.

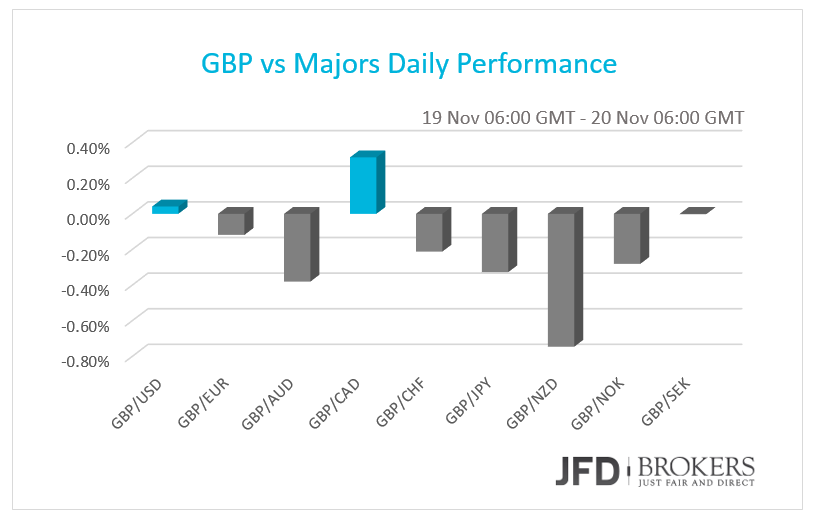

UK Retail Sales Contracted

The UK Retail Sales, in October, fell by most the last seven months, below the market expectations while the mortgage lending in October reached the highest level since 2008 and grow at the steepest pace over the last seven years. However, the retail sales overshadowed the other news and dropped the sterling.

The overnight rally in the GBP/USD pair has been reversed, putting the pair back below yesterday’s 1.5320 resistance level, which includes the 4-hour 200-SMA. The pair didn’t react much on the UK Retail Sales which dipped in October -0.6%, as sales at food stores fell at the fastest pace in 17 months. Support is possible around 1.5230, which includes both the 1-hour 50-SMA and 200-SMA, with more support around 1.5200. On the upside, 1.5320- 1.5330 zone remains the main obstacle for the bulls.

USD/JPY – Technical Outlook

The USD/JPY pair has been bullish since 2012 and we have not seen any significant bearish response seen. The latest bearish correction occurred during mid-August when the pair fell more than 5% in 4 days, but still the pullback is not considered significant. Following the aggressive buy from the bulls around the 116.00 level, the pair is now consolidate between the latter level and the 125.00 mark and in my opinion I think pretty soon the outlook will turn bullish again. However, for the pair to resume the bullish trend and exit the sideways channel, it will need to go through the 125.00 – 125.30 zone. As long as it remains below that zone then I would expect further consolidation between 116.00 and 125.00.

Commodity Currencies extend gains

Both the AUD and NZD extended their gains the last 2 days adding more than 1% to their values the last 2 days. The AUD/USD following the strong rebound from the 0.7060 level it managed to surge above the key level of 0.7160 and is now attempting to break above 0.7220, a key level for the short-term. Slightly below here, the 200-SMA is providing a strong support to the pair.

A similar story for the NZD/USD pair. The pair recovered all of its last week’s losses after new spending data revealed strong growth in credit card purchases last month in New Zealand. The credit card spending was up 7.8% year-on-year last month, following a 7.3% rise in spending in September. The bulls managed to surged the price above the both the 50-SMA and 200-SMA on the hourly chart, as well as above the key level of 0.6550. Note that the daily 50-SMA could provide a significant resistance to the pair, at least for now, however I would expect the buying pressure to continue and the pair to reach the 0.6630 barrier, which includes the 200-SMA. In contrast, USD/CAD ended the day virtually unchanged.

Economic Indicators

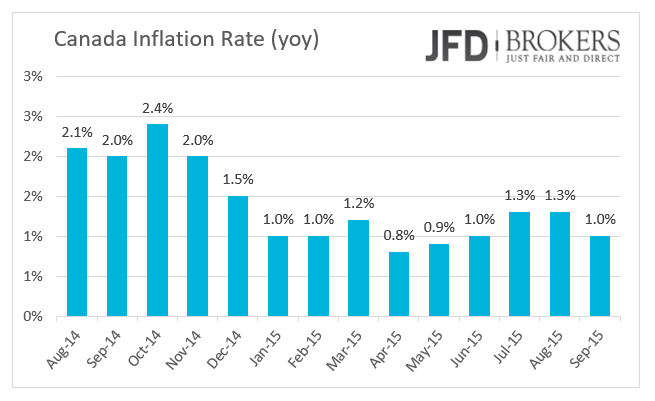

Today, the focus of attention will be on ECB President Mario Draghi speech. In his last meeting, Draghi said that economic risks to the region were “clearly visible,” suggesting that a more aggressive quantitative easing package could be on the way. Currently, the ECB is buying 60bn euros of mostly government bonds a month. From Canada, we have the release of CPI and Retail Sales. The main inflation rate is expected to have remained stable at 1.0% in October while the Retail Sales are predicted to have slowed down in September.

Finally, in Europe, Eurozone consumer confidence for November is expected to improve slightly to -7.5 vs –7.7 from the previous reading.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD favours extra retracements in the short term

AUD/USD kept the negative stance well in place and briefly broke below the key 0.6400 support to clinch a new low for the year on the back of the strong dollar and mixed results from the Chinese docket.

EUR/USD now shifts its attention to 1.0500

The ongoing upward momentum of the Greenback prompted EUR/USD to lose more ground, hitting new lows for 2024 around 1.0600, driven by the significant divergence in monetary policy between the Fed and the ECB.

Gold aiming to re-conquer the $2,400 level

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

Bitcoin price defends $60K as whales hold onto their BTC despite market dip

Bitcoin (BTC) price still has traders and investors at the edge of their seats as it slides further away from its all-time high (ATH) of $73,777. Some call it a shakeout meant to dispel the weak hands, while others see it as a buying opportunity.

Friday's Silver selloff may have actually been great news for silver bulls!

Silver endured a significant selloff last Friday. Was this another step forward in the bull market? This may seem counterintuitive, but GoldMoney founder James Turk thinks it was a positive sign for silver bulls.