Euro Rose on Strong Labour Data; U.S. Indices Declined More Than 2.8% on China's Soft Data

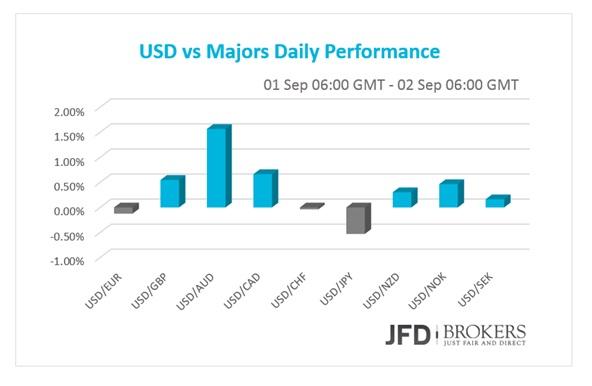

The US dollar was being traded higher against most of its major peers on Tuesday and early Wednesday on a stable increase in Construction Spending in July and despite the sign of weakness in manufacturing sector. The ISM Manufacturing PMI witnessed a more than expected fall back in August.

Euro picked up on Strong Labour Data

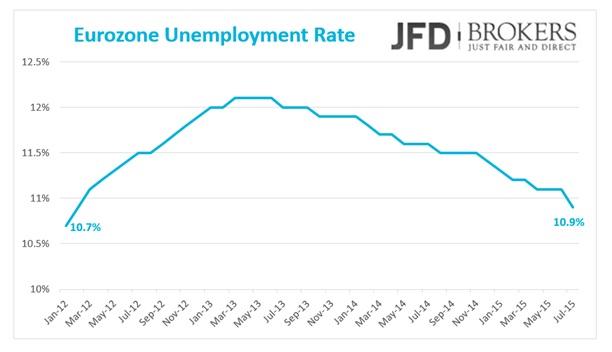

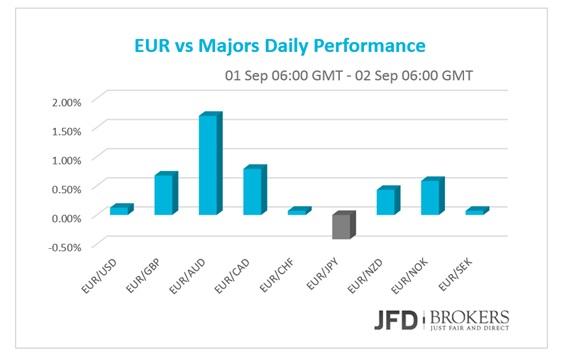

The shared currency picked up against almost all of its G10 counterparts after the stronger than expected data from the labour market. Following Eurozone’s Inflation rate that missed economists’ expectation to slow down and remained stable in August, the Unemployment rate for July completed the bright picture, strengthening hopes that recovery in Eurozone is gaining momentum. The people actively looking for a job in the Eurozone decreased to 10.9% of the total labour force, recording the lower figure in the last two years!

In Germany, even though the unemployment rate remained stable at 6.4% in August, the Unemployment Change came out better than anticipated at -7k (negative figures indicate that the unemployed people are reduced), going back in the negative territory after a 14-month high in June. Germany’s Manufacturing Growth was on slightly steeper pace than expected in August according to the Markit PMI Survey while in Eurozone eased marginally, however, the number was easily overshadowed by the upbeat labour data mentioned above.

EUR/USD is Moving Higher

The EUR/USD pair is moving higher, following a failed attempt to break lower few days ago. Furthermore, the bulls are currently struggling to break above a significant level around 1.1330, where the 50-SMA is providing a strong resistance to the pair. The psychological level of 1.1400 appears to be the next likely resistance level to hit, however, the bulls need to go through the 1.1330 barrier as well as the 50-SMA on the 4-hour chart before they reach that level. A move back below the 1.1215 would be needed to negate my bearish view, prompting a more aggressive move towards the 1.1080, which coincides with the 4-hour 200-SMA.

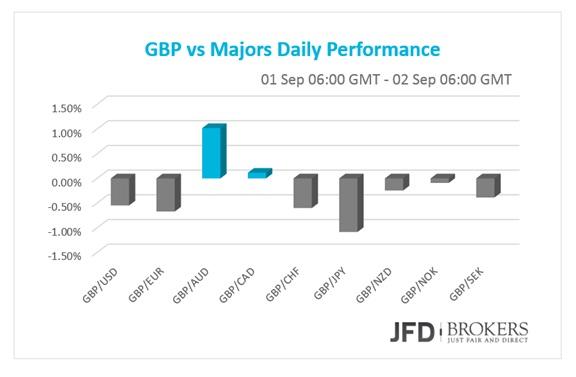

Sterling Slipped on Ease Manufacturing Growth

The sterling slipped against its major peers on Tuesday and early Wednesday on the back of the soft Manufacturing Growth in UK. The UK PMI indicated that the activity in the Manufacturing sector expanded at a slower than expected pace in August, showing sign of weakness in the third quarter.

GBP/USD below 1.5330

The GBP/USD pair saw a break below the key support level of 1.5330 yesterday, bringing with it the expectations of even further pressure which has seen 2.5% of its value lost over the last few months. The sell-off which started from 1.5800 doesn’t seem to be over yet, with the bulls to lose control the last few days. The 1.5250 level appears to be the next likely support level to hit, yet overall I believe we are set for a strong move lower ahead of the BoE policy meeting.

AUD Ticked Higher Despite the Unexpected Soft GDP

The AUD/USD moved slightly higher on Wednesday morning, 0.20%, despite the under performed GDP growth, following three negative daily candles that total more than 2% depreciation. After Tuesday’s announcement that the Reserve Bank of Australia kept interest rates unchanged at a record low of 2%, the GDP growth showed that the economy struggled to gain momentum in Q2 even with the two rate cuts in February and May.

AUD/USD fell below the psychological level of 0.7000 during the Asian session, however, the bulls managed to lift the price above that level in early European trade. As long as the pair remains below the 0.7200 – 0.7210 zone I remain strong bearish with the next level of support to be the 0.6935 and then the psychological level of 0.6900.

GOLD Failed to Sustain Gains

The precious metal moved lower, following a failed attempt above the key resistance level of $1,146. The metal plunged more than 0.2% during the US session as the inability for the bulls to build momentum past this point favors a move back towards the $1,130. A key way to recognize this lack of momentum is to see whether the 4-hour MACD can sustain above zero, as well as above its trigger line. On the upside the 50-SMA is providing a strong resistance around the $1,140 level while on the downside the $1,130 and $1,120 barriers appears to be the next likely support levels to hit, with the 200-SMA hovering around the $1,112 region.

U.S. Indices Closed Down More Than 2.8%

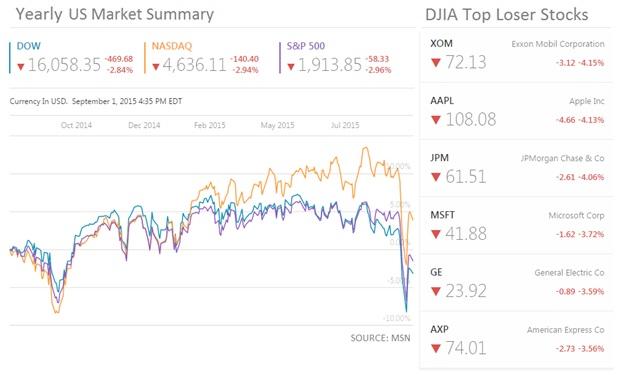

All three major indices in the US stock market closed down more than 2.8% today on China’s weak data. The Chinese Manufacturing PMI fell to a three-year low in August triggering stock sell-off across Asia, US and Europe.

The Dow Jones suffered a triple-digit loss of 470 points down to 16,058. The top loser blue stock was the Exxon Mobil Corporation (NYSE: XOM) with losses of 4.15% followed by Apple Inc. (NASDAQ: AAPL) which posted a decline of 4.13%. Both the Nasdaq Composite Index and the S&P 500 plunged almost 3.0% on Tuesday’s trading session, summing up losses near 4% since Monday.

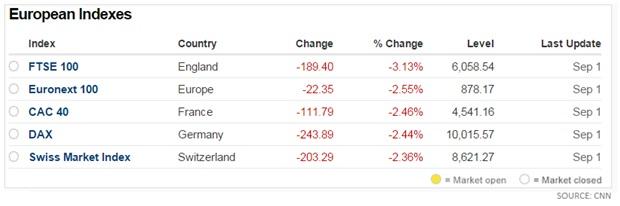

European Indices on Sharp Sell-Off

Shares in the UK and across Europe have fallen sharply during yesterday’s session with the UK’s FTSE 100index to record a 3% drop. The FTSE 100 index closed down 189.40 points to 6,058.54 while Germany's DAX index and France's CAC 40 both closed 2.4% lower. On Monday, the DAX fell by 4.7%, its lowest level in seven months.

Even though the UK’s FTSE 100 fell the last couple of days, I would expect the index to pick up some momentum and to test the 6150 level. The MACD and Stochastic indicators, support this notion since both are moving upwards – MACD above its trigger - indicating that the price may have further room to run before continuing south.

Economic Indicators

Today the economic calendar is looking a little quieter in the markets, especially compares with yesterday’s one. In the morning, the UK PMI Construction is forecasted to show an improvement in the sector. A while later, July’s Producer Price Index for Eurozone is scheduled for release.

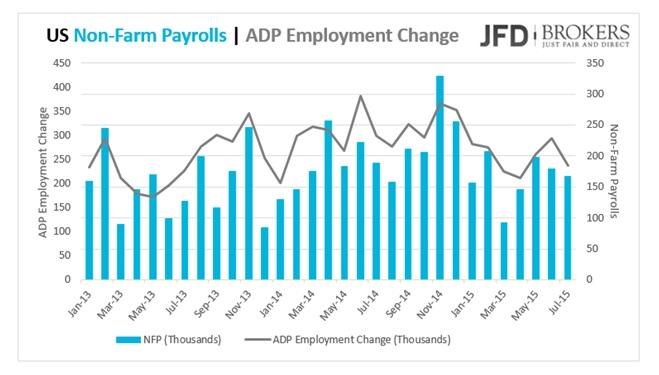

The highlight of the day is the ADP Employment Change from US. The ADP Survey is expected to show that the pace of hiring the private sector increased to 201,000 in August from 185,000 the month prior. Such a number could rise up the greenback as it prognosticates a strong NFP report that will support the optimistic economists who believe that Fed will raise interest rates on the FOMC meeting, on September 17.

The Factory Orders for July and the Fed’s Beige Book, a summary of economic conditions across the 12 Federal Districts will be published. Going forward, in Australia the AiG Performance of Services Index for August will be announced.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.