EUR and GBP Plunged; US Indices on 4% Recovery; China's Stock Exchange Stabilized

China’s Stock Exchange chaos started to fade as the Shanghai Composite Index stabilized at 2,976 the last hours which means that the latest ease in monetary policy worked. However, the concerns among the investors are not diminished yet.

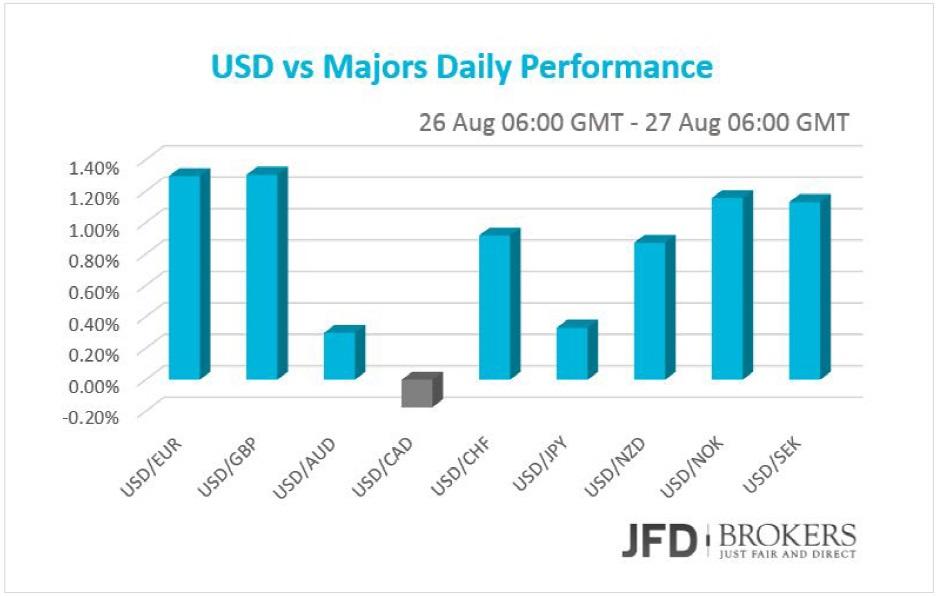

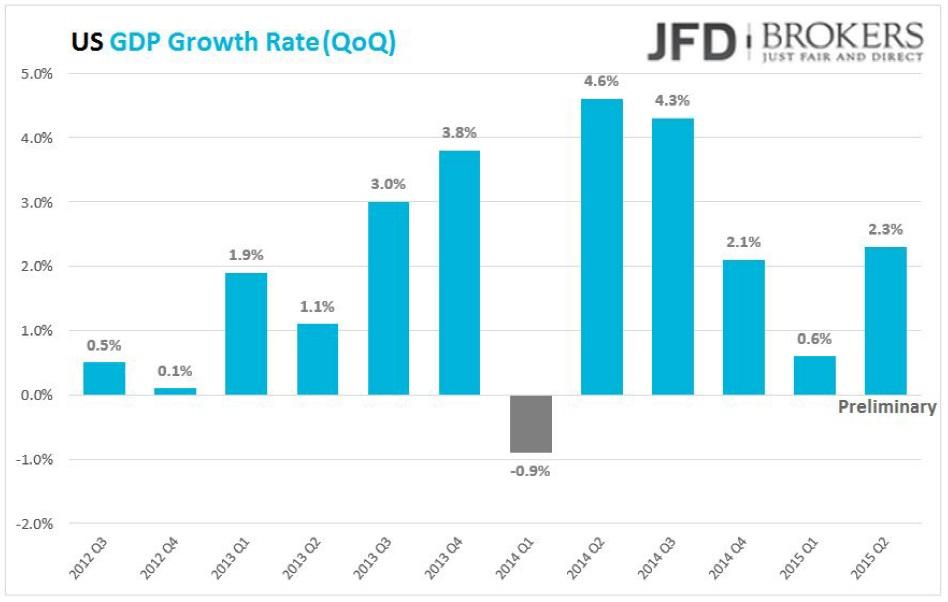

The US dollar rose against the other G10 currencies on Wednesday and early Thursday on the back of the upbeat Durable Goods Orders released and the awaited preliminary GDP, however, I would anticipate gains to be limited as Fed will not raise interest rates sooner than the first quarter of 2016. The Durable Goods Orders increased by 2.0% in July while were expected to slow down by ‐ 0.4%. The Durable Good ex‐Transportation surpassed expectations as well, rising by 0.6% missing market forecast of 0.4%. Today, the three‐day Jackson Hole Symposium begins while the market expected the second estimate for the GDP growth and the flash Personal Consumption Expenditures in Q2.

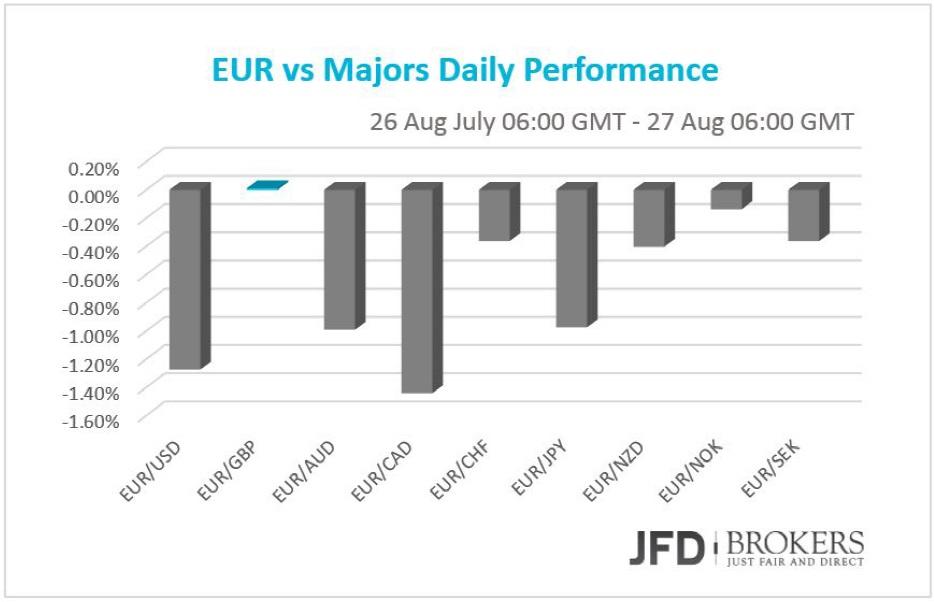

Euro lost ground against the majors

The euro lost ground against all the major currencies on Wednesday and early Thursday and remained flat against the sterling. The EUR/USD has fallen for the second day in a row and retreated from its 8‐month high reached earlier this week, as market sentiment continues to stabilize, despite the ongoing concerns in China. The pair came back to the same range that was trading the last few months after it failed to sustain the momentum above the key resistance level of 1.1470. On the topside, which a move above the 1.1470 is looking less likely according to the short term indicators, buyers will find a resistance at 1.1400 and then at 1.1560. On the other hand, the 200‐SMA on the 1‐ hour chart and the 50‐SMA on the 4‐hour chart both are ready to provide a significant support to the price action near 1.1265, in case of a further fall.

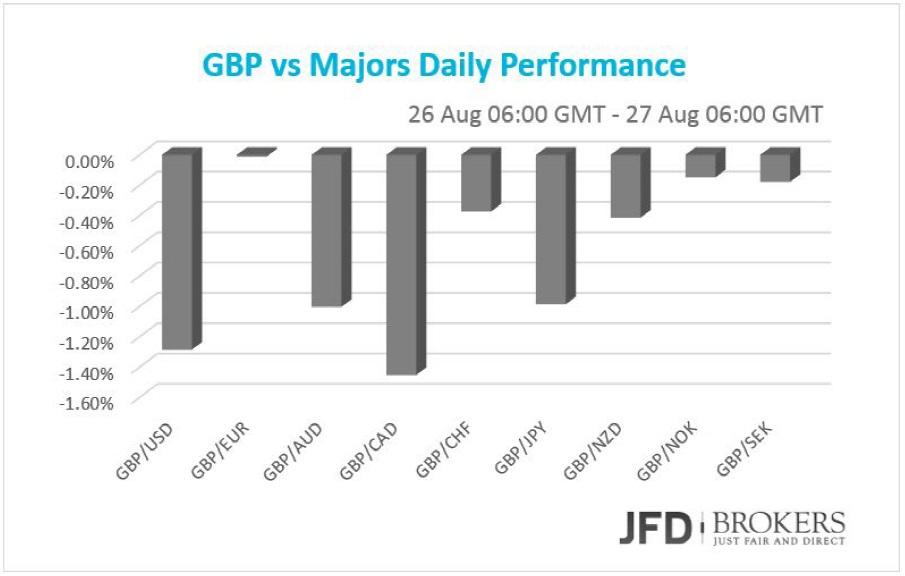

British Pound Collapsed!

The pound collapsed during yesterday’s session closing the day negative at ‐1.46% versus the dollar and adding to the monthly losses of 0.79%, few days before the end of August. The GBP/USD plunged below some significant levels ‐ including the 1.5677 which coincides with the 50‐SMA, 1.5600 which includes the 200‐SMA and the 1.5543 barrier ‐ in the absence of any marketaffecting news. The pair fell more than 200 pips to reach a fresh weekly low at 1.5450. As it stands, I would expect the price to be underpinned by the 1.5450 support level and a move towards 1.5543 seems likely in today’s session. Bear in mind that the dollar has been rising significantly, particularly against the euro. Alternatively, if we see a break lower, the pair should find support around 1.5420.

USD/JPY struggles at 120.40

The USD/JPY had another choppy session pretty much confined to the recent range, following the sharp sell‐off few days ago, and there is no change in view. The pair came back to test the 120.40 as suggested in yesterday’s session, however, the pair remained struggled at that level, which coincides with the 50‐SMA on the 1‐hour chart. I would be fairly neutral though on any directional move and we could yet see the yen come under further pressure, with much depending on the lead coming from China.

WTI ready to test $40

WTI was flat at $39.50 per barrel on early‐Thursday, after falling the previous day and closing negative following the close below the key support level of $38.00. Given how far the commodity has run in the past few weeks, unambiguously positive data is needed to drive the crude oil higher. At the moment, the commodity remained struggled at the $39.90 level, which coincides with the 50‐ SMA, however, I would expect the WTI to gain some momentum and to move above the psychological $40 level, since in lower timeframes the technical indicators started to exit their oversold territories.

Brent Stabilizes below $45

Not much movement in Brent Crude with prices trading within a tight range in the past 4 hours. Technically, the commodity remains unable to set a clear direction with the 4‐hour chart. The $42.70 level remains a key support while the $44.50 barrier is the key to watch for the upside.

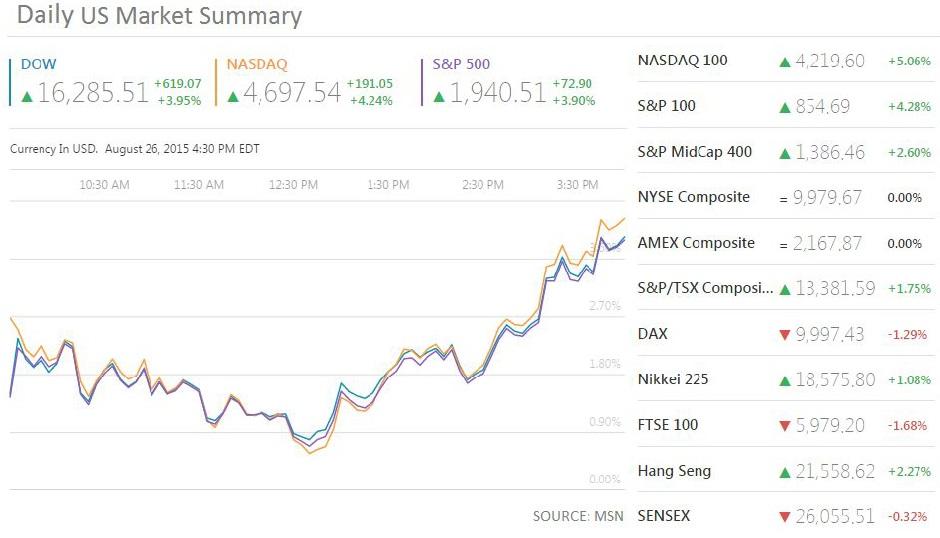

U.S. Indices on 4% Recovery

The US stocks rebounded with 4% recovery after six days of declines boosting the traders believe the stocks’ slowdown is just a correction and not a new financial crisis. The Dow Jones Industrial Average edged higher +3.95%, about 620 points higher to 16,286 making the sharp fall a correction of 24%. The DJIA made a sharp move upwards, following the aggressive sell‐off few days ago and confirmed our recommendations for long positions at 15970 ‐ buy stop ‐ to 16377 (target) DJIA analysis: http://bit.ly/1U7HDrk. All the Blue‐chip stocks of the index closed Wednesday’s trading session positive with Merck & Co Inc. (NYSE: MRK), Visa Inc. (NYSE: V) and Apple Inc. (NASDAQ: AAPL) the top gainer stocks that added more than 5.8% at their values. The high‐tech index surged 4.24%, near 190 points up and closed the trading session at 4,698 while the S&P 500 picked up by +3.90% at 1,940.

Economic Indicators

Today, the three days Jackson Hole Symposium sponsored by Fed of Kansas City will start. The central bankers, policy experts and academics will meet in Jackson Hole to discuss global financial issues. The symposium usually has an impact on the currency and stock markets. Going forward, the second preliminary figure for the US economic growth in Q2 will be closely monitored as it is an important parameter for Fed’s interest rate hike.

In addition, the flash Personal Consumption Expenditures will also draw markets’ attention. In UK, the Gfk Consumer Sentiment for August will be posted. Later in the second half of the day, in Japan, the National Consumer Price Index and the Unemployment rate for July are expected to have a significant impact on the JPY cross pairs.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.