China’s “Black Monday” sent Commodity Currencies Lower; US Stocks Collapsed

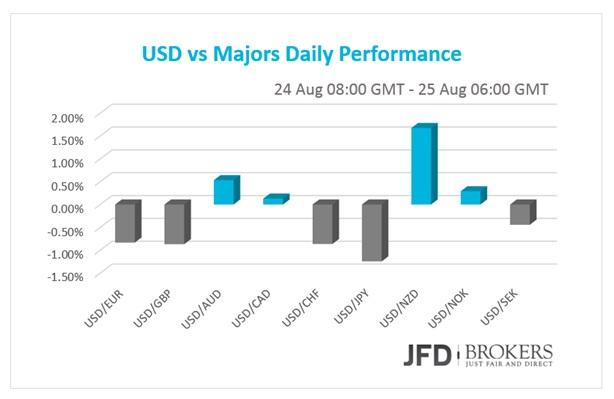

The Euro and British Pound rose against most of the other G10 currencies on the Chinese shares meltdown and dragged down all the other countries’ stocks and currencies. Especially the commodity currencies recorded severe losses against the US dollar on Monday.The NZD/USD pair dipped 2.21%, AUD/USD closed 1.31% down and the USD/CAD rose by 0.52%. The US shares suffered historical losses amid the sharp global sell-off and the Oil continues to decline sharply!

Euro appears to losing ground against the dollar this morning, following the sharp buy during yesterday’s session, where it enable the EUR/USD pair to close 2.14%, the best daily closing since March 18 (2.54%). The dollar traded mostly lower against its G10 peers as hopes for a rise in the benchmark interest rate by the Fed were diminished, following a dovish tone of the minutes of FOMC meeting for July as well as the problems in China are expected to have an adverse effect on the US dollar. On the medium-term picture, the euro confirmed the bullish bias against the dollar, following the break above some significant obstacles, including the 1.1400 and 1.1470 levels, as well as above both, the 50-SMA and 200-SMA on the daily chart.

The Australian dollar plunged on Monday, falling more than 1% against the US dollar, extending deep losses following a rout in world markets over China’s slowing growth. The AUD/USD pair has managed to break higher, following a record of a six-year low below the psychological level of 0.7100, yet a temporary pullback above the latter level has provided an opportunity for the bulls to recover and defend their levels. The 0.7050 barrier, as well as the 0.7100 key resistance level now, represents new support which brings about a likely reversal point. With the above in mind, I remain bullish in this pair, however, we could see some consolidation between 0.7260 and 0.7100, before the bears prevail again.

The safe haven Japanese yen was stronger against almost all currencies from its opening levels at early Monday to early this morning. The USD/JPY pair rose 2.72% on Monday, gaining from 123.30 where the pair closed the previous week. Given that we have already started showing signs of bearish strength coming back into play from very near to 119.00, I expect to see it push lower from here, with a move towards 119.00 and 118.50 likely.

Meanwhile, the USD/CHF fell during yesterday’s session as China slowdown fears drive investors into safe haven currencies. The pair fell for a second consecutive week and added more than 2.5% to its monthly losses, which stands at 3.48%. Going forward, the 200-SMA is providing a significant support, on the weekly chart, near the key level of 0.9230, where it failed to do so few days ago. I do not think it could hold for a long time and I would expect the dollar to drop further in the next few session and to test the next support level at 0.9150, a strong technical barrier. Alternatively, given how aggressive the rally has been over the last few days, we could see a brief period of consolidation, above 0.9230.

Gold is Rising amid Commodities Depreciation!

The precious metal bolted higher the previous week following the sharp depreciation of the US dollar as well as the aggressive sell-off in the commodity currencies. The yellow metal’s prices rose by more than 4% the previous week, to a fresh three-month high, benefiting from a safe bet in times of turmoil. Even though, the gold is trading lower the last couple of days (-0.85%), it remains in a positive ground as few days before the end of this month it’s recording a 5.25% gains. Going forward, on the upside the price is finding strong resistance at the $1,165 barrier, which coincides with the descending trend line which started back in mid-January. It is a significant development that the bulls managed to push the metal above the $1,142 - $1,146 zone, our medium-term suggested target. For now, I would expect the metal to consolidate above the aforementioned zone, before the bulls prevail again, prompting a more aggressive move towards the $1,185 level, which coincides with the 200-SMA on the daily chart.

Oil continues to be on aggressive sell-off

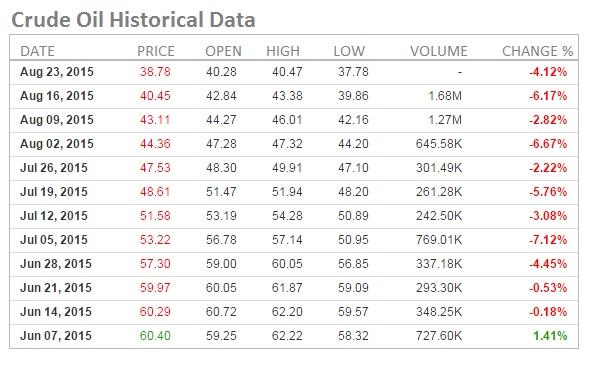

WTI slightly recovered on early Tuesday following the aggressive sell-off during Monday’s session, but it remained at 2009 level as commodity currencies kept tumbling. WTI was trading below the psychological level of $40.00 per barrel during early Monday, losing more than 4.5% for the day. It’s remarkable that WTI crude prices slipped for a ninth straight week, adding to the monthly losses of -18.30, followed by -20.92 in July. The longest stretch since 1986. It is clear that oil prices are still affected by the bearish sentiment on the back of economic worries over China, a key oil consumer.

Meanwhile, OPEC has continued to increase its production level, despite an oversupply, of 32 million barrels per day. Currently, the WTI is trading slightly below the key level of $39.00 and if the selling pressure continues to drive the crude prices lower, I would expect the shorts to challenge the next support level at $36.50.

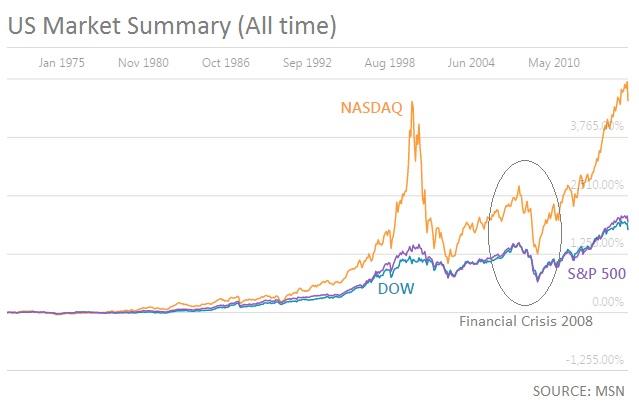

US Indices Plummeted! Trading Halted on Emergency of falling Stocks & Indices!

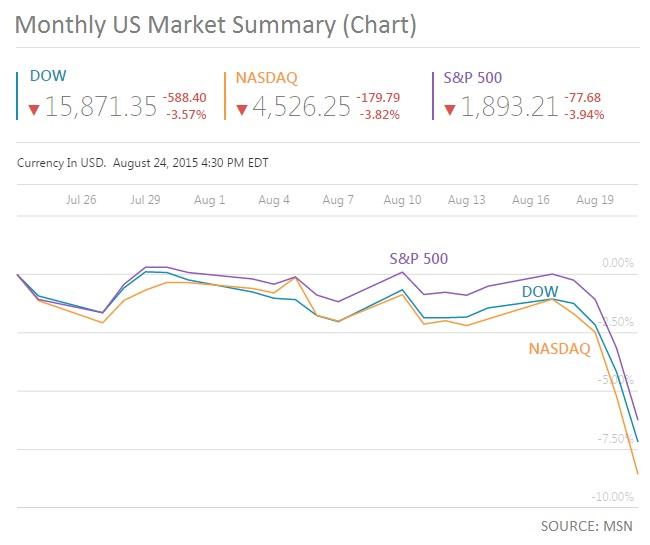

The three most popular indices in United States are in a correction territory for the first time since 2011 and created the most volatile days in history. Several stocks faced unprecedented emergency freezes on major losses.

The S&P 500 slumped near 1000 points after the opening of the Asian session but retreated some of its losses and closed 78 points down at 1,893. The pricing of the index stopped temporarily after the losses hit the 5% limit! The next limit on the downside was 7% but have not reached yet. Monday was the fifth consecutive day the index closed the trading session in the red and its losses totaled to -10.32%.

The Dow Jones industrial average fell 1090 points on the open, the biggest intraday swing in history. Moreover, it is noteworthy that it was extremely volatile through the days as it recorded 500 points swings multiple times. However US30 managed to close 588 points lower its opening level, 3.57% down. The Dow Jones rebounded strongly from a new-found support at 15233, which coincides with the 200-SMA on the weekly chart. Although the DJIA clawed back some gains, it is still flirting with the worst rates in 2 years. The JPMorgan Chase & Co (NYSE: JPM) was the major loser blue-chip stock which suffered losses more than 5.3%.

The Nasdaq Composite Index closed 3.82% down, also the fifth day in a row that faced declines. The last five trading sessions the index dropped 11.60% to 4,526.

Chinese Stocks meltdown

Chinese Stocks plummeted to the steepest four-day decline since 1996. The day called "Black Monday" as the fear spreaded worldwide on the start of Asian Session. The Shanghai Composite Index dived 5.73% on Monday and 49.17% since June 11! The CSI 300 dropped sharply 5.65% on the first trading day of the week and has in its records harsh losses of 50.28% since June 11!

Economic Indicators

The German IFO Survey will reveal the Business Climate, the Current Assessment and the Expectations levels. In UK, July’s BBA Mortgage Approvals and the Index of Services of the last three months to July will be released. In US, several economic indicators will be out but none of them is a game changer. In the housing sector, the Housing Price Index for June and the New Home Sales Change for July will attract limited attention. The Preliminary Markit Services and Composite PMIs for August will be eyed. The Consumer Confidence for August will be monitored by investors.

Later in the day, New Zealand’s Exports, Imports and Trade Balance will be announced. During the night, the Reserve Bank of Australia Governor Glenn Stevens will hold a speech.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.