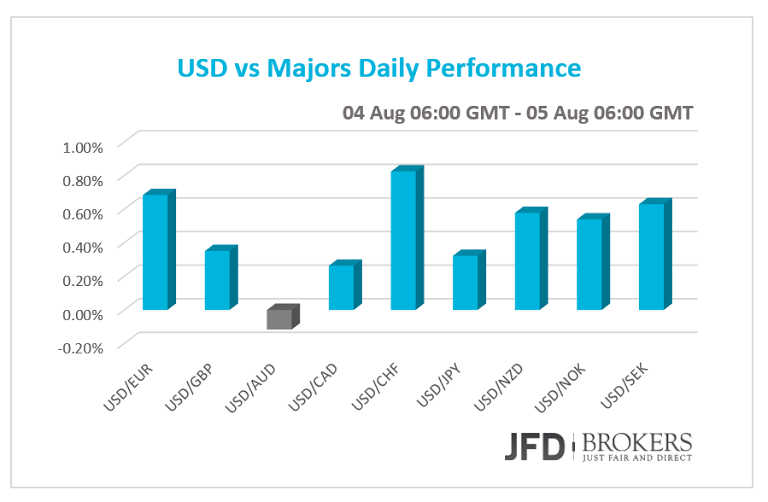

The US dollar was indifferent from the news came out on Tuesday and rose versus almost all of its major peers, as traders keep its interest on the labor data coming out through the week with climax the NFP Report on Friday. The euro fell on negative economic data while Sterling traders wait the BoE meeting to take decisions for their positions. AUD extended its gains after the RBA meeting and the New Zealand Labour Report pushed it lower even lower. Oil is slightly recovering, but Gold remains headed to the downside.

Euro on Weak Economic Data; USD ahead of the ADP and the NFP

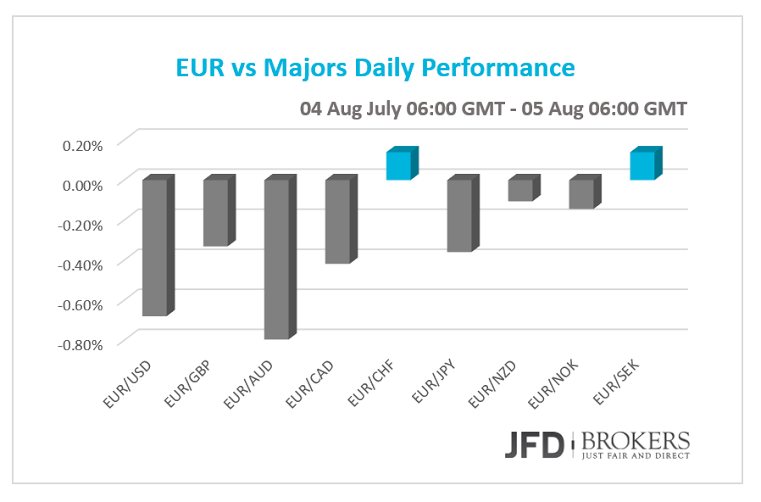

Euro suffered from severe depreciation against most of the G10 currencies on Tuesday and early Wednesday and aggressive sell-off on the downbeat data release yesterday and the soft forecasts for the economic indicators scheduled to be released today. The Producer Price Index eased more than anticipated in June. The Markit Services PMIs for many countries in Eurozone will come out today. The services sector in all these countries is predicted to have slowed down or remained unchanged in the month just past. Meanwhile, Greek Bank shares continue to fall after the Athens Stock Exchange reopened. The Athens General Index plunged 16.23% on Monday and 1.22% on Tuesday while major banks reached the maximum allowed decline in a day of 30% on Monday. Greece needs to repay 3.5 billion euros by August 20, thus the Bailout Package of 86 billion euros must be settled soon or another one Bridge Loan need to me agreed.

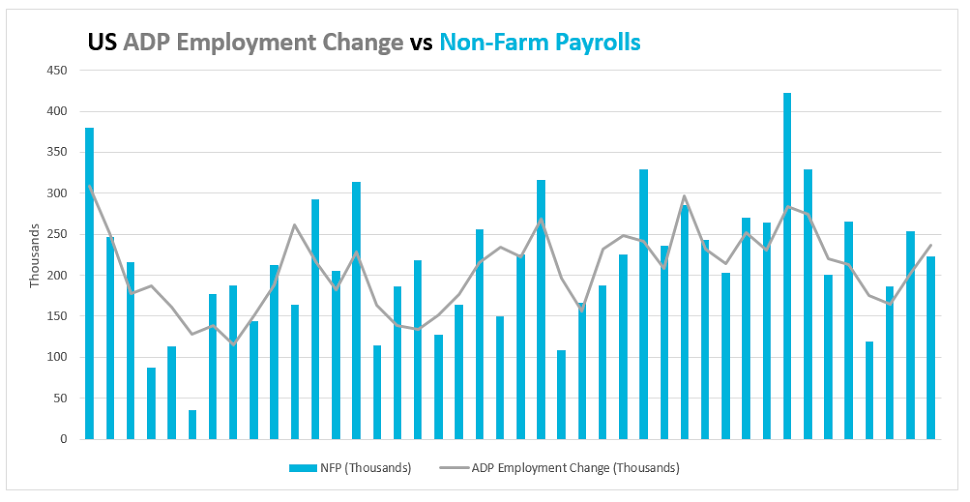

Even though on Monday the EUR/USD pair remained in a tight range, the dollar pared gains after the Factory Orders for June came in line with the expectations and better than the previous month. Orders for goods produced in US factories rose 1.8%. The dollar finished higher for a second consecutive day and is on track to record a third day of gains against the euro. However, markets continued to eye the release of U.S. Non-farm Payrolls on Friday. Monthly jobs gains above 200,000 are seen by economists as consistent with strong employment growth. July’s ADP Employment Change, scheduled to be published today, is forecasted to show a lower growth in private sector payrolls than in June, 215 k vs 237k before. The traders expect that ADP will fail to maintain the pace of extension seen the last few months than increased sharply for two straight months.

The EUR/USD pair fell below the strong support zone of 1.0890 – 1.0900 and it seems that is moving towards the key support level of 1.0810. However, it seems unlikely to be broken ahead of the all-important US Non-farm Payrolls coming up on Friday. A break of 1.0800 though would open the way towards the psychological level of 1.0700.

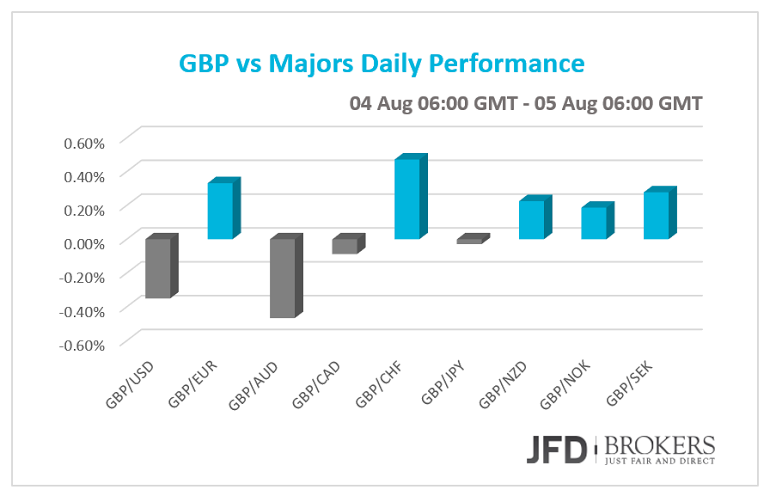

GBP continues its firmed motion ahead of the BoE

The British Pound continues its firmed motion against its G10 peers on Tuesday and early Wednesday as the market participants await the BoE Meeting along with the Quarterly Inflation Report on Wednesday. The Construction PMI fell short of the forecasts in July, falling to 57.1 from 58.4 expected. However, the report was unlikely to stoke sell-off or lower demand among the investors on the back of the modest increase of the Nationwide Housing Prices in July as anticipated. Today the GBP traders looking forward to the Markit Services PMI report to reveal that expansion in the Britain’s dominant services sector slowed down in July.

GBP/USD has been slightly down after it recorded a session low below the key level of 1.5550. We could be in for more choppy trade although the downside is mildly favoured, as both of the moving averages are providing a significant resistance since the pair penetrated the psychological level of 1.5600 few days ago. On the downside, the new found support over intraday basis at 1.5525 now seems to provide immediate support for the pair, however, the major support on the downside continues to remain near 1.5500.

AUD rose after the RBA meeting

The euro faced an aggressive sell-off versus the Australian dollar, as euro weakens on the disappointing economic data and the AUD picked up after the Reserve Bank of Australia left the interest rates unchanged. On the other hand, the US dollar moved higher against the Australia dollar, reversing earlier losses following the RBA policy meeting. The AUD/USD pair fell more than 70 pips after testing the 0.7430 and the 120 pips gained by the AUD against the USD immediately after the RBA meeting.

Kiwi plunging after New Zealand’s Labor Data

The New Zealand’s Employment Sector has badly underperformed pushing the kiwi on the seventh negative daily close. The Employment change came out 0.3% and failed to meet expectations of decreasing to 0.5% from 0.7% before. The Unemployment rate increased to 5.9% in the second quarter, as the market predicted while the participation rate decreased which means the lower employability is more perceivable.

The US dollar is pushing higher against the New Zealand dollar again this week after completing a sixth consecutive positive week on Friday. With the NZD being in heavy selling pressure the last 2 months, I would expect the downside pressure to continue and the bears to push the price further down and towards the key support level of 0.6500. If the negative momentum continues and the NZD/USD violates the latter barrier, it should then challenge the next support at 0.6440, a strong technical level. For the medium-term I remain bearish on this pair with the next target being the strong support and critical level of 0.6000.

Gold continues to suffer heavy losses

The precious metal suffered heavy losses in July (-6.60%) and started the first week of August by dipping below the psychological level of $1,100 per ounce. This is the lowest value in over five years. The move below the $1,140 came after comments from a Federal Reserve official backed expectations that the central bank would hike interest rates as early as next month. However, the big players preferred to remain on hold until seeing the next 2 NFP figures, given its importance of the US jobs on shaping the Fed’s monetary policy. The yellow metal plunged more than 0.7% during yesterday’s session and fell below the key support level of $1,090. XAU/USD slipped for a sixth straight week and it’s clear that gold prices are still affected by the strong dollar.

Brent and WTI Crude Oil Outlook – Technical Analysis

Brent crude oil surged above the psychological support level of $50.00 on early Wednesday, recovering from multi-month lows, as investors await U.S. oil inventories data to gauge supply. On Friday the commodity booked a seventh-consecutive week of declines. However, the commodity managed to recover some of its losses moving for a second positive session in a row. At the same time, stops were slowly being triggered, below the $50.00 level, forcing other traders out of the market. On the upside, the key for the commodity will be the $52.30 as I suspect that the majority of stops are sitting above that level. This is a significant level over intraday basis as it includes the 50-SMA on the 4-hour chart.

A similar picture prevails in WTI. The US crude plunged more than 20% in July, a huge losses since the second half of 2014, when the commodity fell for seven consecutive months losing more than 50% of its value. Going forward, the commodity found a strong support at the key support level of $45.10 and is now retracing above the psychological level of $46.00. As it stands, I would expect the WTI to test the strong resistance level of $46.70 before we see a more aggressive move in either direction.

U.S. Dollar Index is rising

The dollar index, which tracks the green currency’s movements versus a basket of major currencies, surged the last couple of days and is now approaching towards the psychological and historical level of $100.00 ahead of the release of the awaited nonfarm payrolls data on Friday. The dollar index found a strong support from the 200-SMA on the 4-hour chart and since then is moving one way. A break of the $100.00 level would suggest that the longer term bullish trend has resumed. Moreover, the dollar index to reach the latter level it need to go through the important level of $98.30. If the bulls fail to push the index above the later level, I would expect the sellers to take control and to push the price down towards the psychological level of $97.00, which coincides with the 50-SMA and the 100-SMA on the 4-hour chart.

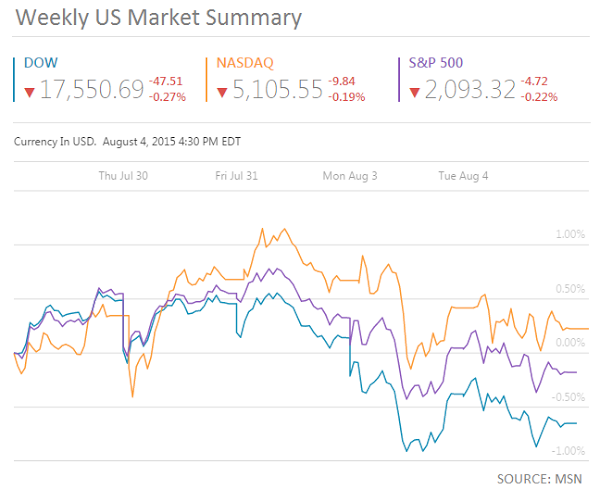

U.S. Indices marginally lower on Apple severe decline and Fed

The US Indices closed marginally negative for one more day as the market driver stock Apple Inc. plunged more than 3% on Tuesday and more than 12% the since July 19 amid of the slight recovery in the oil prices and the closely eyed Fed decisions for the timing of the first rate hike. Nasdaq Composite Index edged 0.19% lower and closed at 5,106.

The Dow Jones Industrial Average ticked lower 0.27%, 47.51 points and closed at 17,551. After the biggest loser stock Apple Inc. followed the blue chip stock Exon Mobil Corporation (NYSE: XOM) by 1.14% down. The only stock with gains more than 1% was the Microsoft Corp (NASDAQ: MSFT) which rose by 1.58%.

S&P 500 slipped 0.22% and ended at 2,093 with three of its stocks recording losses more than 10%. Mallinckrodt Plc (NYSE: MNK) fell by 14.07% and Allstate Corp (NYSE: ALL) 10.15%. The following negative performed stock was the NRG Energy Inc. (NYSE: NRG) which was down 10.01%.

Apple Inc. (NASDAQ: APPL) has had some hard times since the three failed attempts near the psychological level of $135.00. The shares of the company plunged during yesterday’s session and met our first target, for the short-term analysis, at $114.65. The Apple stock has been under pressure since week when the price fell below the 200-SMA on the daily chart as well as below the strong support level of $119.25. We remain bearish on this stock with the next target being the psychological and historical level of $100.00.

Economic Indicators

Today, US, Eurozone, Germany, UK, France, Italy and Spain will have their Markit Services PMIs for July and their weighted Markit Composite PMIs. Moreover, UK will release its Trade Balance. Eurozone’s Retail Sales will be eyed from investors. In US, the ADP Employment Change will be closely monitored, two days ahead of the Non-Farm Payrolls report. The ISM Non-Manufacturing report is also expected.

During the night, attention is turned to Australia. July’s labour report be published with information for Unemployment Rate, Employment Change, Participation Rate as well as Full-time and Part-time Employment.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns. Gold confirmed a symmetrical triangle breakdown on 4H but defends 50-SMA support.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.