USD Cautious Ahead of NFP; GBP Mutes Ahead of BoE Meeting; US Indices Plunged

The most traded currencies, US dollar, Euro and British Pound were traded mixed against its G10 counterparts at the start of the week in front of the market driver economic news scheduled in the week. The Crude Oil extended its losses pushing the US Manufacturing sector and the US indices overall lower. The Australian dollar picked up right after RBA published its decision to keep its interest rates unchanged.

USD slightly higher against on the mixed Economic Data

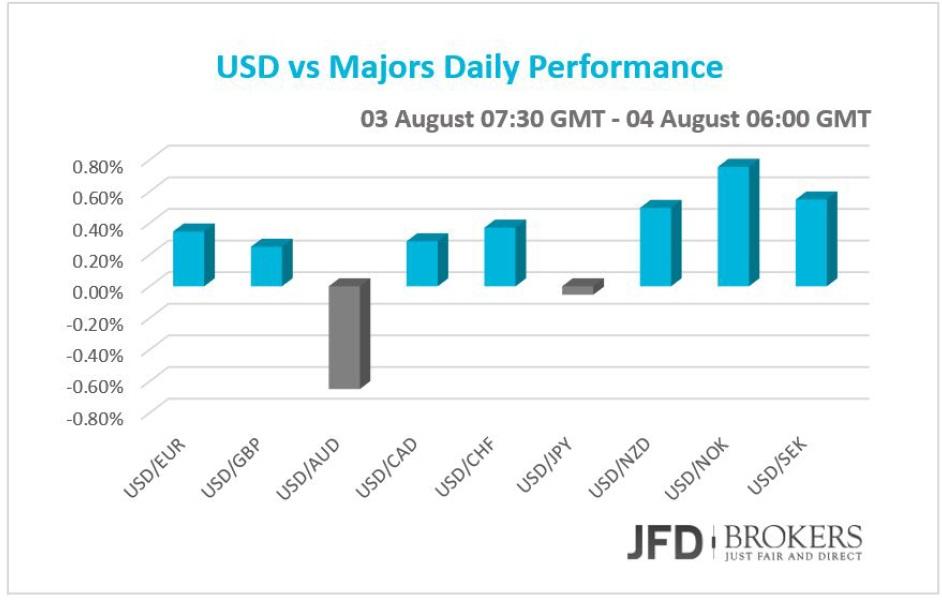

Most of the G10 currencies traded marginally lower than their opening levels against the dollar on Monday and early Tuesday as the dollar strengthened slightly on mixed fundamental data released at the start of the NFP week. The factory activity, according to Markit economics, met the initial forecasts at 53.8 in July but rebound from a 20‐month low registered in June. However, the factories eased pace according the Institute for Supply Management (ISM). The index regarding Manufacturing slipped to 52.7 missing market consensus to have been 53.5 as the previous estimate. The Personal Income accelerated at a steeper than expected pace in June by 0.4% vs 0.3% expected while the Consumer spending for the same month advanced at its slowest pace for the four months to June (0.2% vs 0.7% before). The Construction sector slowed down its spending pace at 0.1% missing forecasts of dipping to 0.6% from 1.8% before.

Euro mixed after the Athens Stock Exchange reopened

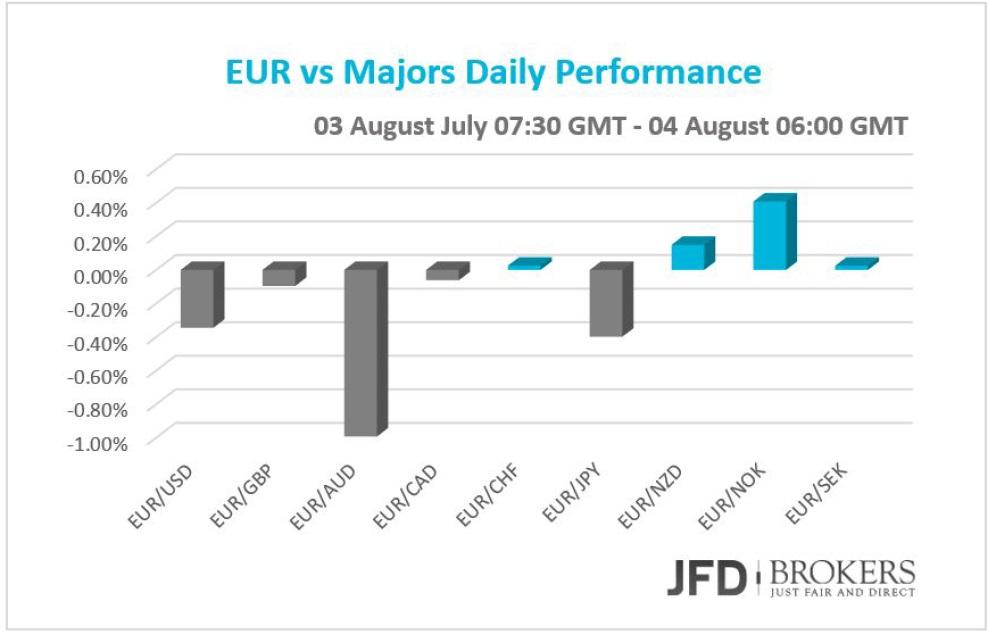

The euro slipped against the Australian dollar and the Japanese Yen while it rose against the Norwegian Krone and remained virtually unchanged versus the other G10 currencies on Monday and early Tuesday. The shared currency fell significantly against the buck on the reopening of the Athens Stock Exchange after five weeks. The main Athens stock index closed more than 16% down and the nation’s top four bank‐lenders declined 30%, the maximum allowed. In other news, on Monday, July’s Markit Manufacturing PMIs for Eurozone, Germany and Italy surpassed expectations while the French PMI met the forecasts. The better than expected figures confirmed the strong expansion the Eurozone Factories for the last months.

The greenback remained firmed against the single currency at the start of this month and the range looks set to continue ahead of Friday’s Non‐Farm Payroll report for July. This US jobs report and September 4 NFP report will likely confirm Federal Reserve’s interest rate decision. Non‐farm payrolls for July are expected to have risen by 222k, marginally lower than the rise in June of 223k. Today should be relatively quiet in the US and Europe, with not too much to go on.

The EUR/USD pair remained weak following the break below the psychological level of 1.1000, which coincides with both, the 50‐ and the 200‐SMAs on the 1‐hour and 4‐hour chats. As it is, I think we need to see further confirmation before determining that the bias in the market has changed from bullish to bearish. There is a clear battle going on between the psychological level of 1.0800 and around the 1.1100 – 1.1150 zone, however, it is not clear at this stage who has the upper hand, the bulls or the bears. The 50‐period SMA on the daily chart and the descending trendline which started back in mid‐May are continuing to provide resistance to the price action, while the 1.0850 level – a previous level of resistance – is providing significant support below. If we see a close outside of this range, it should give us a big clue about what the bias in the market actually is. There is little real change to the outlook and for the time being, with the short term charts giving a little hint in either direction, a neutral stance is required.

Pound mixed ahead of the BoE meeting and Quarterly Inflation Report in the week

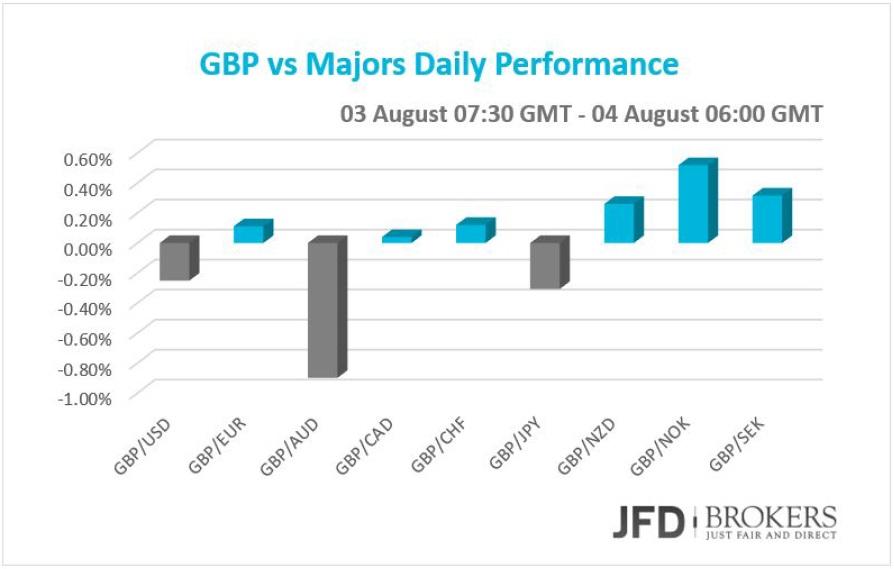

The GBP/USD pair remains locked in a sideways trend of several days and continues to negotiate around the psychological level of 1.5600 ahead of the BoE monetary policy meeting on Thursday. At the same time, the BoE will release the minutes and its Quarterly Inflation Report. Shortly afterward, Governor Carney will hold a press conference. The UK manufacturing growth picked up in July, the index rose to 51.9 from 51.4 in June; a figure above 50 indicates expansion. The pound has hardly reacted to the news and continues to trade in a tight range between the 1.5660 – 1.5700 zone and the 1.5550 level. Going forward, the 200‐SMA on the daily chart is continuing to provide support to the price action while the 50‐SMA is providing significant resistance near the 1.5600 level. Technically there is not too much change and with virtually no economic data due from either the UK or US today could be a rather range‐bound affair.

The EUR/GBP did not make any significant moves in yesterday’s trading session apart from a false break out the previous week below the 0.6985, a strong support level. Following that the price rose and trapped again in a tight range, roughly around the psychological level of 0.70. Going forward, the pair is biased to the downside as it continues to decline and to form lower peaks. In such a case, its key support zone at the 0.6985 level will be targeted initially. A break of this should then prompt a move back towards the 0.6940 level. On the upside, the pair needs to clear resistance at 0.7100, before testing the significant level of 0.7160, which also coincides with the descending trendline that started back in mid‐May. All in all, for the moment the picture looks a shade more bearish than bullish, with daily RSI still negative.

AUD lifted‐off after the RBA Announcement

The Australian dollar lifted‐off against the US dollar early on Tuesday’s morning after the Reserve Bank of Australia announced its Interest Rate decision to keep its interest rate unchanged at 2.0%, as expected, as it stills want to judge the impact of the two last rate cuts. The thought behind policy easing is that low interest rates support borrowing and spending. Credit is already on a gradual growth keeping the housing sector steady. The Rate statement encloses for another one time the officials believe that a lower foreign exchange rate is both likely and necessary on the back of the plunging commodity currencies.

The AUD/USD rose by 0.8% immediately after the RBA announcement following the strong rebound from the 0.7235 level few days ago, a 6‐year low, and more recently from the 0.7260 level. However, following the sharp move upwards the picture remains finely‐poised between the two market forces (the bulls and bears) as it continues trading within a tight range. The key level for me will be the 0.7400 – a previous level of support. If this level is broken it would suggest that the market has turned more bullish, opening up a move towards 0.7480. This also coincides with the 23.6% Fibo level of the move from May highs to July lows.

Crude Oil extends its losses

Crude oil plunged 4.36% below the strong support level of $46.00 a barrel. Brent fell below the psychological level of $50 a barrel for the first time since January 08. Brent crude prices slipped for a third straight session and eighth straight week. It is clear that oil prices are still affected by the bearish sentiment on the back of the melting situation in China.

U.S. Indices ended lower

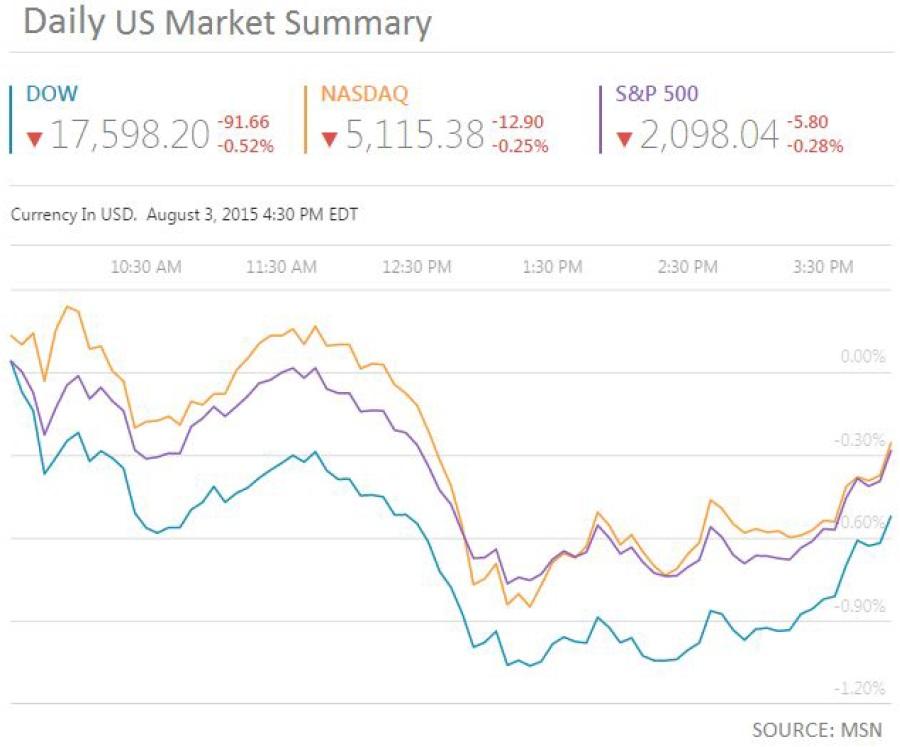

The US indices ended lower on the first trading day of August on both the indications that June was a weak month for the Manufacturing Sector and the falling commodity prices.

Dow Jones Industrial Average fell hard on Monday’s trading session by 0.52%, 91.56 points and closed below 17,600 as it came under pressure from a weak commodities. Copper fell for a fourth consecutive day adding to the previous weekly losses of 0.76%. At the same time, both the Brent Crude oil and the WTI lost more than 4% on the first day of trade for August. On the upside, the index is expected to face a hurdle near 17810, the high of Friday. Slightly above here, both the 50‐ and the 200‐SMAs are ready to provide a significant resistance to the index in case of a pullback. The bias will however remain bearish as far as the 1800 psychological resistance area is intact. On the downside the DJIA could find support in the area between 17395 and 17445. The top loser stocks of the index were the Chevron Corp, Apple Inc. and the IBM. The Chevron Corp (NYSE: CVX) was down more than 3.20% while the IBM (NYSE: IBM) recorded losses more than 2%.

Apple stock (NASDAQ: AAPL) fell below the 200‐SMA on the daily chart and is now trading below the psychological level of $119.00. At this point it’s worth noting that the stock is trading below the ascending trend line which started back in mid‐October 2014. In addition, the stock has been firmly capped below $135.00, having made several failed attempts at breaching that critical level.

The S&P 500 closed slightly below 2,100 with losses of 0.28%. Tyson Foods Inc. (NYSE:TSN) and the Michael Kors Holding Ltd (NYSE:KORS) were among the top negative performed stocks with declines of 9.90% and 7.80% respectively. The technology index, Nasdaq Composite slipped slightly by 0.25%, closing the trading session at 5,115.

Economic Indicators

Today begins with Eurozone’s Producer Price Index for June. In US, the IBD/TIPP Economic Optimism for August as well as and the Factory Orders for June. In Canada, the Ivey Purchasing Managers Index for July will attract considerable attention. Later in the day, the RICS Housing Price Balance for July will be out.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.