The Day After Greek Banks Remained Shut; Euro Recovered all of its Losses

After the announcement that the Greek Banks and the Athens Stock Exchange remained closed the market opened with several gaps, but the market covered most of them. The US stock market recorded significant losses and USD turns to safe-haven currency.

The Greenback was broadly stable versus most of the major currencies on Monday and early Tuesday while it dropped significantly against the euro and the Swedish Krone. The macro economic indicators for the labor market that will be released on Thursday are highly important for the traders, as well as for the Fed. As Greece future is uncertain, the euro is deemed as risky currency and traders will close their euro positions and turn back to the dollar. The last NFP reports indicated a strong number of added jobs, this the Fed is now concentrated more on the Unemployment Rate and the Average Hourly Earnings to decide the date of the first interest rate hike.

Euro recovered all of its losses

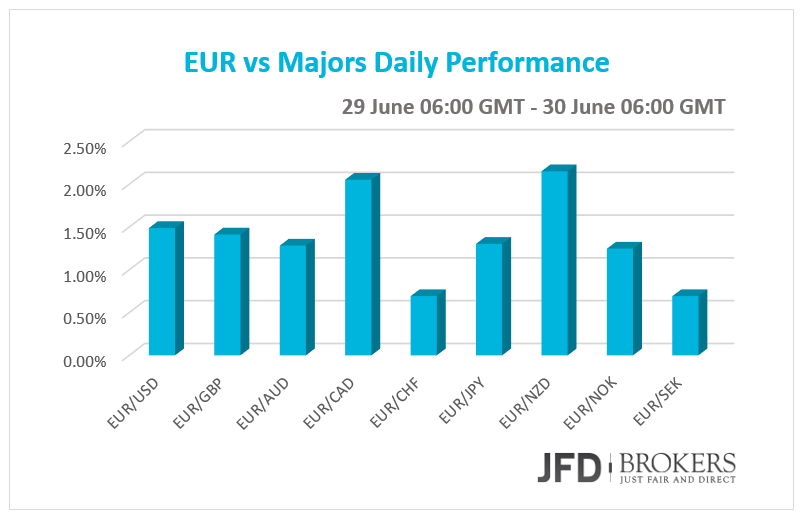

The shared currency recorded a strong reversal on late Monday, following the gap on early Monday, finishing almost 200 pips above its session low despite the catastrophic news that Greek banks will remain shut until next week. The euro gained ground against all of the other G10 currencies on Monday and early Tuesday, covering the gaps, as the EU leaders say that Eurozone is safe despite the Greece decision. TheGreek Prime Minister Alexis Tsipras on a television interview said that he will resign if the referendum result on Sunday is “Yes”. He will completely respect it, but he will not serve it, as he said. “Yes” means people accept the Creditors’ terms and austerity measures for more bailout funds. The Greek economy plunged more into uncertainty as today has to pay €1.55 billion euros debt repayment to IMF after EU leaders refused Tsipras request for a small extension on the rescue package that ends today. Greece does not have the money and will default on its payment without bailout funds.

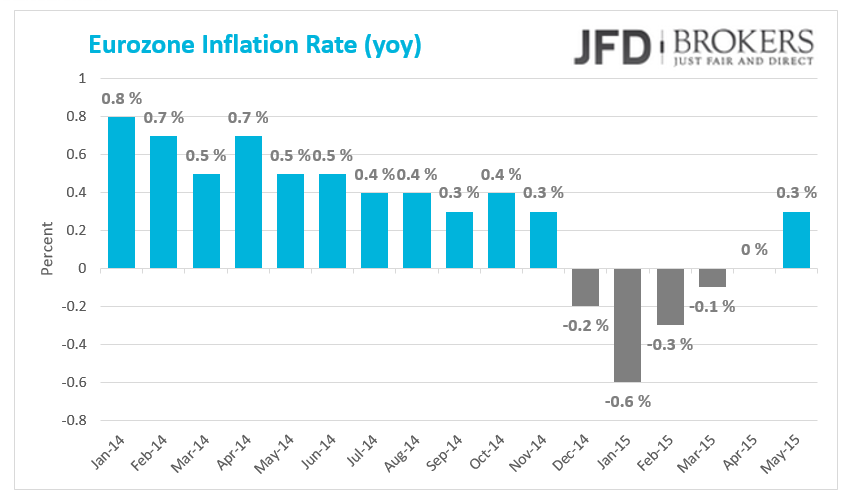

In other news, all the sentiment indicators released yesterday for Eurozone in June disappointed. Economic Sentiment declined to 103.5 from 1038 expected and Business Climate dipped to 0.14 from 0.28 before, the second straight month it drops. Consumer Confidence remained steady but negative and the Industrial Confidence dipped to -3.4 from the forecast of -3.0. In Germany, the Preliminary Harmonized Index of Consumer Prices came out below than anticipated at 0.1% on a yearly basis from 0.7% in May. The flashInflation rate reading showed that the country is on a slight deflation of -0.1% mom in June dragging the yoy rate to a four-month low of 0.3% after four consecutive months that accelerated gradually.

The EUR/USD has been trading lower this morning following the strong rebound slightly below the psychological level of 1.1000, however, the 1.1280 level is proving a struggle for the bulls. The 1.1280 is a significant level since it coincides with the 50-period SMA on the 4-hour chart as well as with the 200-period SMA on the 1-hour chart. The pair has been in an upward trend since mid-March and the bias is still to the upside, but the unpredictability of the Greek situation could trigger another sell-off anytime soon. An important level for the pair over the past three months has been the 1.1400 – 1.1470 zone while on the downside the key for the bears will be the 1.0820 barrier.

With the above in mind, any move lower will find support around the 1.1050 level which includes the short-term ascending trend line while the psychological level of 1.1400 is the first target to the upside.

Despite the growing threat for the Greek exit, the EUR/GBP filled the gap and is now trading above the key support level of 0.7050. The euro traded below the psychological level of 0.7000 early Monday, however, the euro gained aggressive momentum and surpassed both the 50-period SMA and the 200-period SMA on the 1-hour chart. Lots of late shorts are probably caught and eventual stop loss hunting will lead prices higher, well above the 0.7200 level. On the other hand, the short-term momentum indicators are overbought so we could yet see another strong sell-off towards 0.7050 and even 0.6950 in the upcoming sessions.

EUR/AUD remains in its downward sloping channel and alongside with the bearish cross of the moving averages as well the test of the upper boundary of the channel, they shift the odds for further downward movement. A decisive break below the 1.4550 would confirm my suspicions that yesterday’s rally was a correcting wave into the channel, which started after the strong rebound from the 1.4300 level, which coincides with the lower boundary of the channel. A move lower will target the next support level at 1.4500 which is where the 50-period SMA is found. Below this, support is provided at 1.4430.

UK Consumer Confidence on 15-year high in June

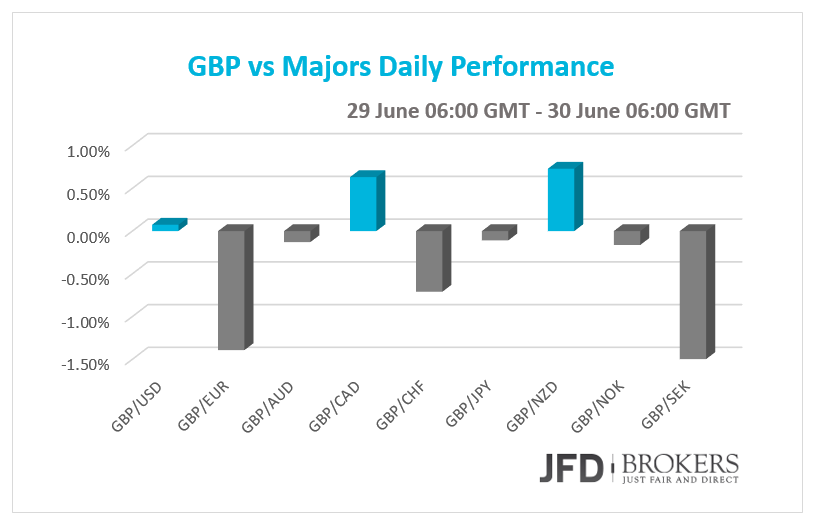

The pound was traded virtually unchanged against most of the other major currencies and recorded severe losses against the euro, the Swiss franc and the Swedish Krone on Monday and early Tuesday. The sterling recorded gains against the Canadian dollar and the New Zealand dollar. The Gfk index of Consumer Confidence surged more than anticipated, elevated to 7 in June from 1 the month before recording a 15-year high!

GBP/USD remained trapped in a tight range, roughly around the psychological level of 1.5700, whilst moving down to the key support of 1.5660 and up to 1.5800. Over the last couple of weeks, the pair has moved aggressively downwards, pushing through some significant obstacles, including the 50-period SMA, as well as below the psychological level of 1.5800. The pair has been in a strong upward trend since early-June and the bias will remain to the upside as long as the pair remains above the 200-period SMA near the 1.5550 barrier, which coincides with the 38.2% Fibo level and the ascending trend line which started back in mid-April. Therefore, the bears will need to go through these significant obstacles to turn the picture to negative. A break above the psychological level of 1.5900 should open the door for further pressure towards the 1.5900 level, then 1.5930 will be in sight.

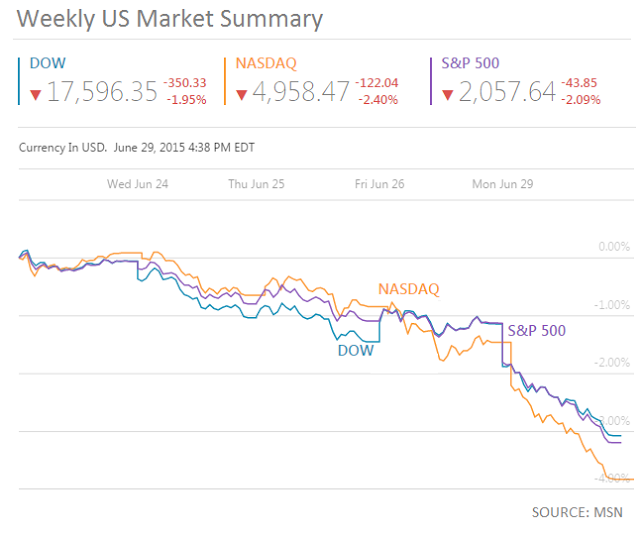

U.S. Indices Slumped on Greece Turmoil

The US Stocks suffered losses on Monday after the Greek turmoil culminate. Stocks extended its losses as the S&P downgraded Greece to “CCC-“ and the Greek officials said the Greece will not today’s repayment to IMF. The Dow Jones Industrial Average closed 350 points down, -1.95% with no one of its stocks closed with gains. The Visa Inc (NYSE: V) was the top loser company with losses of 2.98%. The Nasdaq Composite Index lost 122 points, 2.40% down and the S&P 500 edged 2.09% lower, -44 points.

Gold remains in range

The precious metal remains trapped within its broad $1,160 - $1,200 range. Going forward, if the Greek turmoil continues, beyond default, we might expect some safe-haven demand, which could sent the price for a test of $1,200 and possibly higher. The $1,170 and the medium-term ascending trend line which started back in November 2014, combined to provide a support to the bulls while the 50-period SMA and the 200-period SMA are providing a strong resistance to the upside near the psychological level of $1,200.

WTI consolidates below $60.00

WTI Crude oil remains stuck in a range between the strong resistance level of $56.50 and the key resistance zone of $61.70 – $62.55. Last week we saw a break attempt on the upside, but it failed highlighting the fact that the commodity is in a pause after the aggressive rally after falling to its lowest level in almost 6 years. On the daily chart, the 200-period SMA in moving slightly above the $56.50 area ready to provide a significant support while the 50-period SMA is moving slightly above the $60.00 level, inside the channel. Technically, WTI still remains strong, and could likely test $60.00 in the next few days.

Economic Indicators

Today, we have important news out. In Eurozone as a whole, the preliminary Inflation Rate and the Unemployment Rate for June will be out.

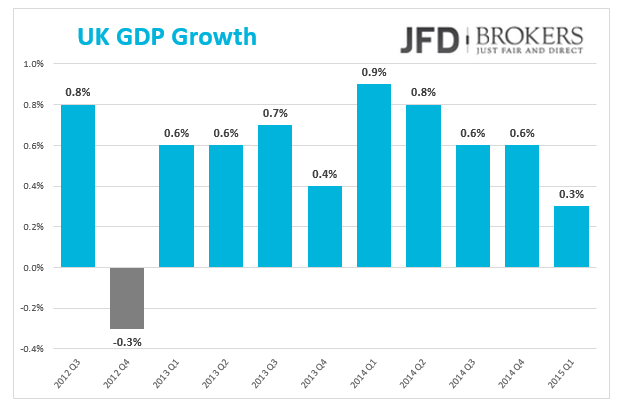

In Germany, the unemployment rate for June is expected. In Australia, the RBA Governor Glenn Stevenswill have a public speech. In UK, the final GDP and the Total Business Investment for the first quarter will be released.

The Canada’s GDP will also be released. In US, the Consumer Confidence, the Purchasing Managers’ index for June and the Case-Shiller Home Price Indices for April will be announced.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.