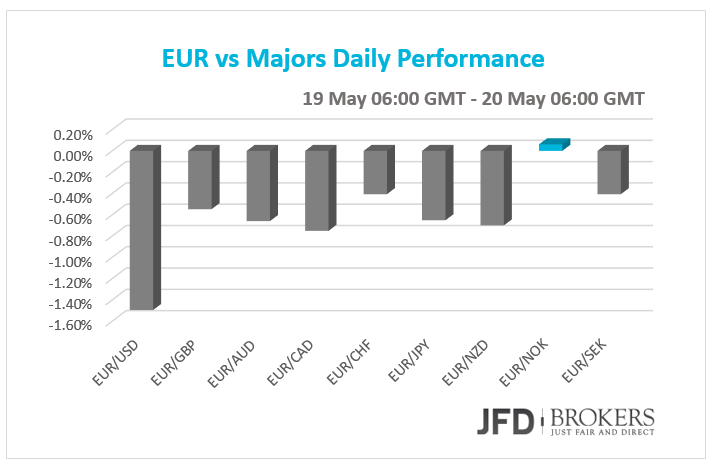

The shared currency declined sharply against it G10 counterparts during the morning European session on Tuesday as Greek officials haven’t reached a deal with its creditors yet. Greek concerns are increasing ahead of repayment deadlines that approaching and raising the probability of a default. However German Chancellor Angela Merkel and French President Francois Hollande gave Greece 12 days in order to reach a deal on its rescue package. Greek Prime Minister Alexis Tsipras is continuing to stick to his red lines even as the country is quickly running out of money. The euro also tumbled on the signals that ECB may speed up its bond-buying program in the next couple of months.

Moreover, the Eurozone’s CPI was released yesterday, showing that the year-over-year prices remained stable in April as expected while the month-over-month Inflation rate decreased sharply to 0.2% from 1.1%. The ZEW Survey showed that the Economic sentiment for May in the Eurozone decreased more than the market forecast at 61.2 vs 64.8 prior. In Germany, the results of ZEW Survey were also disappointing, as both the Current Situation and the Economic Sentiment declined more than anticipated. The Current Situation came out 65.7 in May versus 68.0 expected from 70.2 before. The Economic Sentiment fell to 65.7 below projections of 68.0.

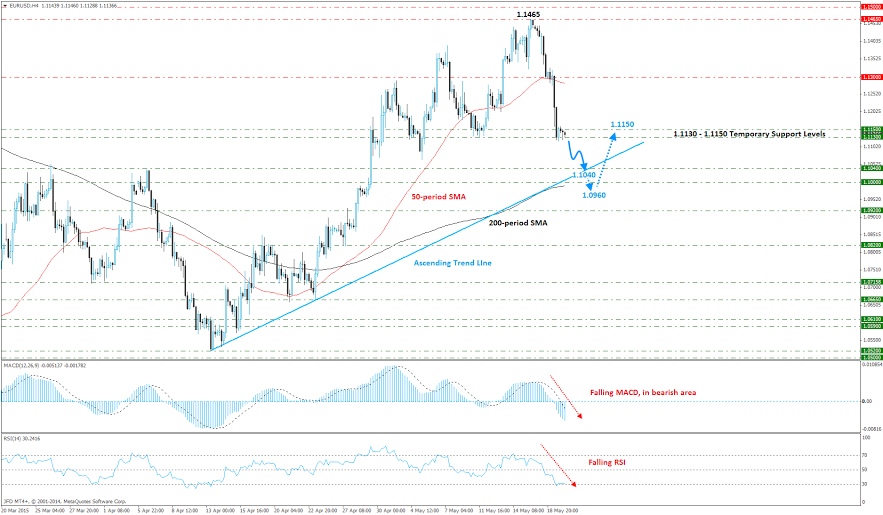

EUR/USD fell sharply after several unsuccessful attempts to break the strong resistance level at 1.1450. As a result the pair plunged below some significant obstacles including the psychological level of 1.1400 as well as the 1.1300 barrier, which includes the 50-period SMA on the 4-hour chart. However, the 4-hour charts show that the pair has been in a clear uptrend since mid-April. The short-term ascending trend line as well as the 200-period SMA, both are ready to provide a significant support to the price action in case of a further fall around the 1.1000 – 1.1040 zone.

On the upside, the euro could find resistance in the area around 1.1290 – 1.1300, which includes the 50-period SMA. The MACD lies below both its trigger and zero lines, while the Stochastic seems ready to cross below its 20 level, thus I would expect a further consolidation or a downward corrective wave before the bulls prevail again. All in all, the 4-hour chart certainly suggests we are due some dollar strength.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.